RESPECTED EXPERT, PLEASE SOLVE BOTH THE QUESTIONS, THEY ARE VERY SHORT QUESTIONS.

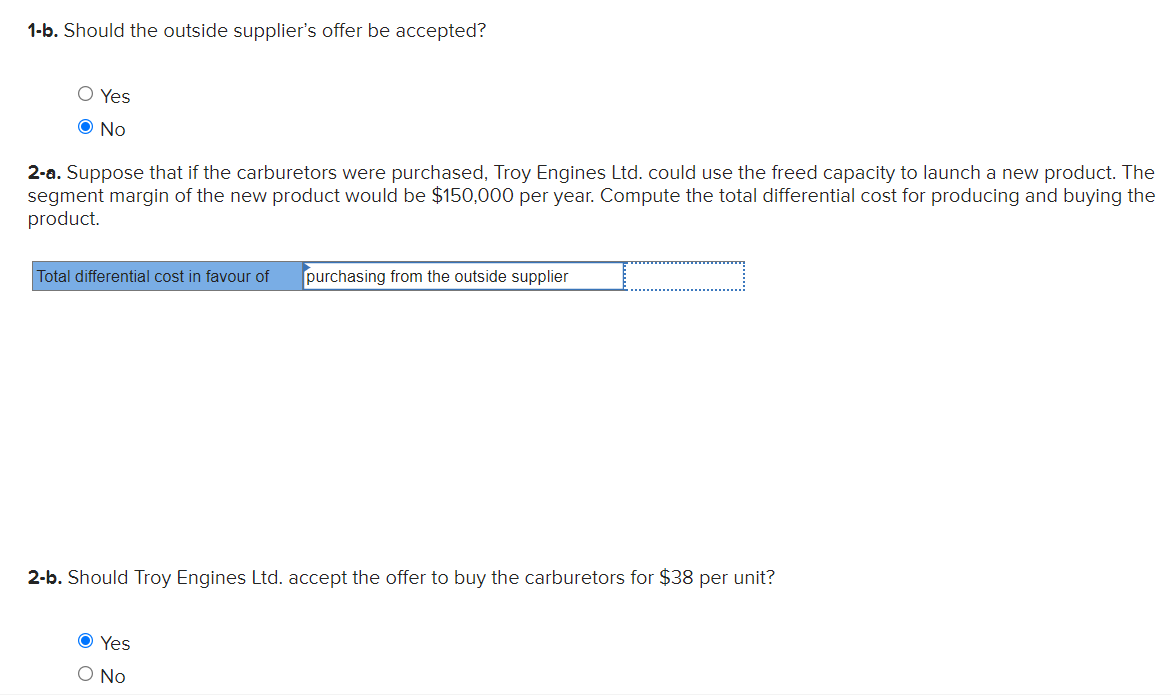

QUESTION 1 ( 1B AND 2B ARE SOLVED)

QUESTION 2

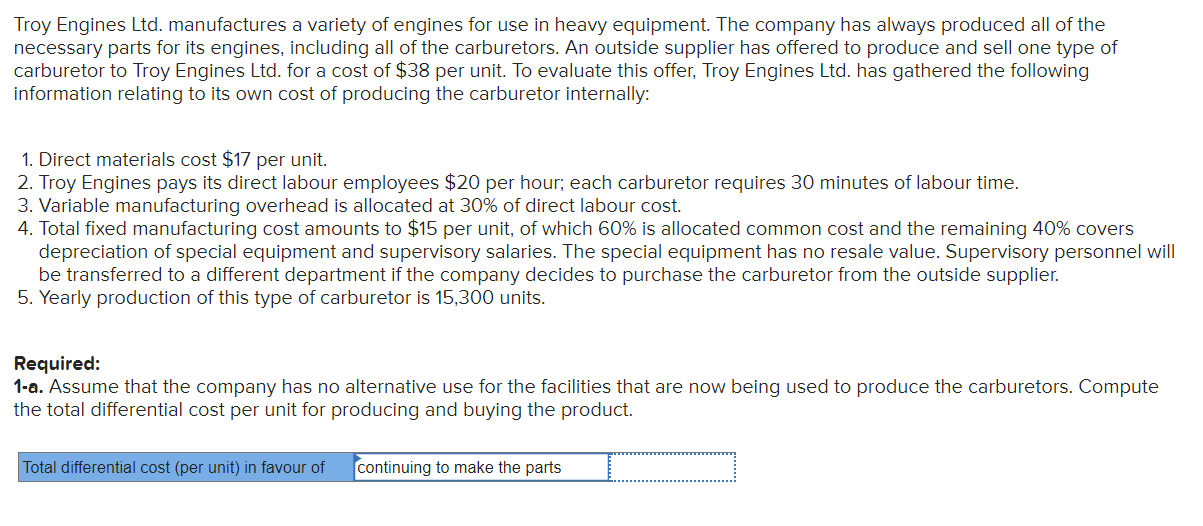

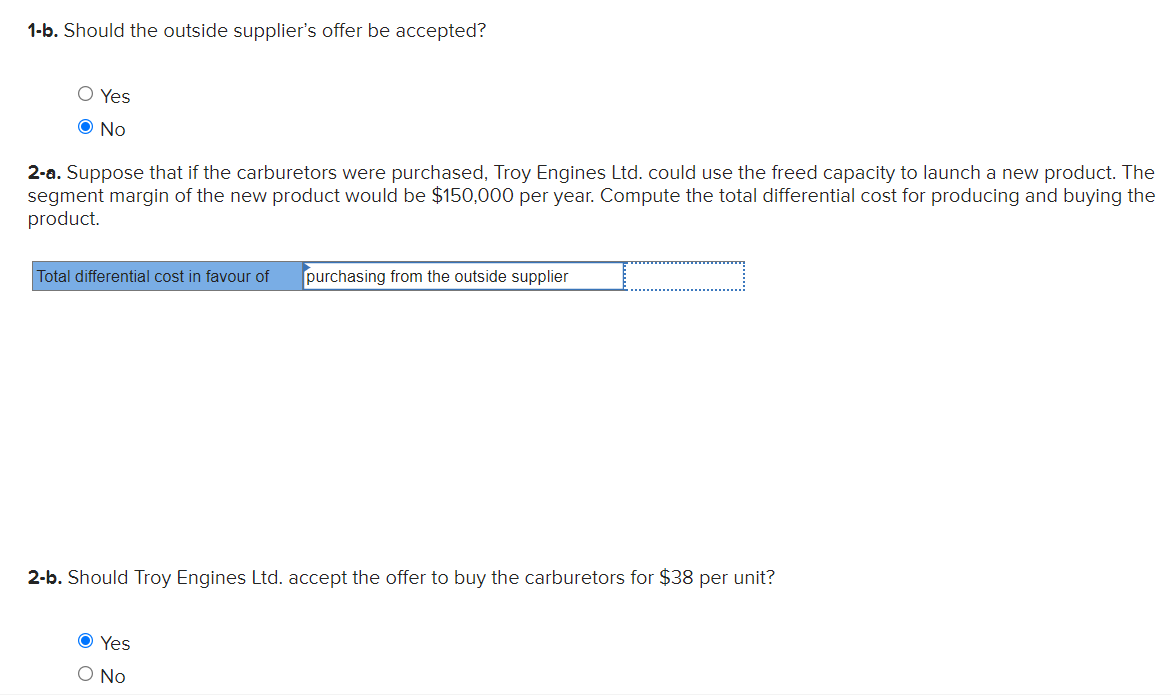

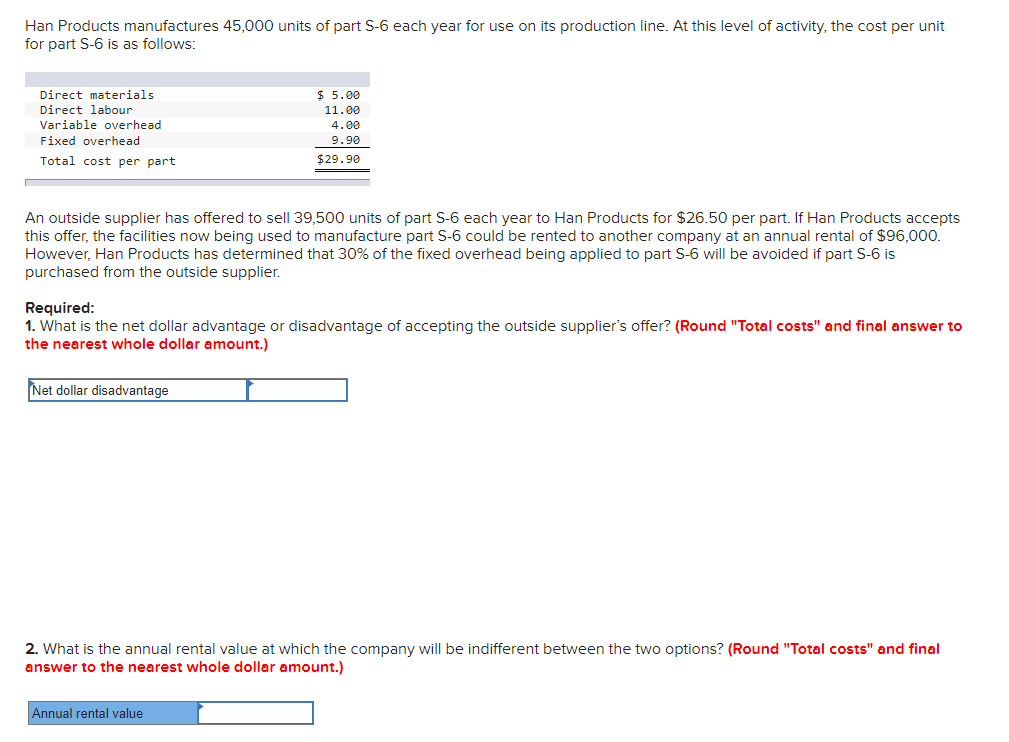

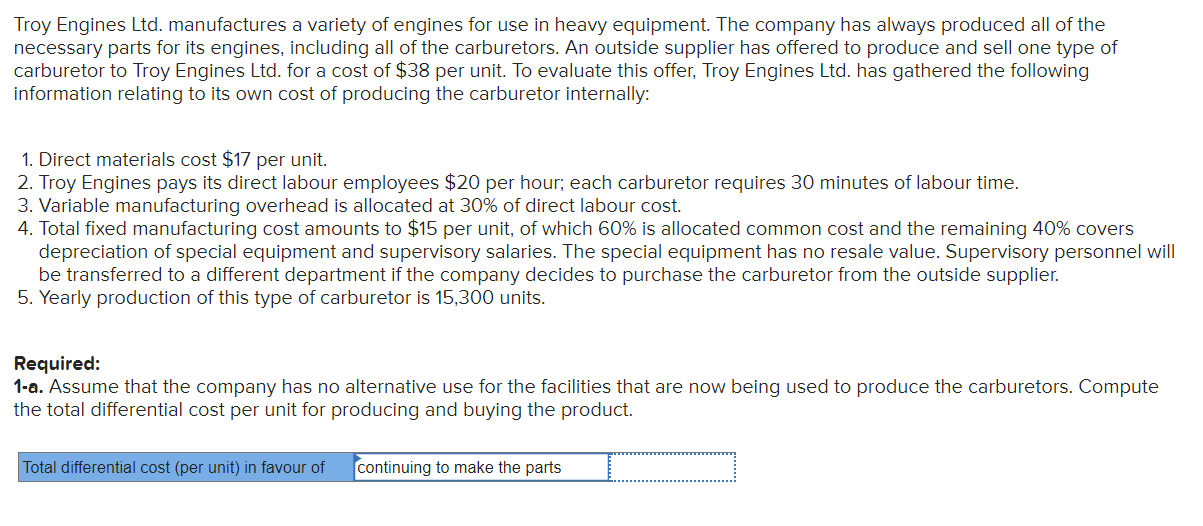

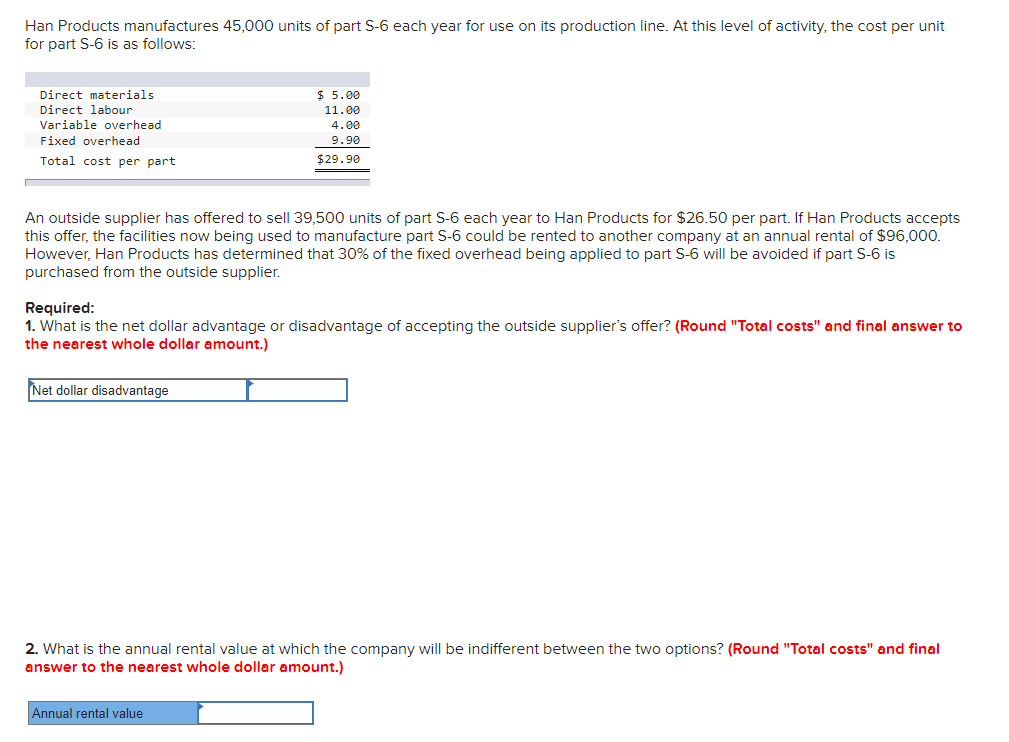

Troy Engines Ltd. manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to produce and sell one type of carburetor to Troy Engines Ltd. for a cost of $38 per unit. To evaluate this offer, Troy Engines Ltd. has gathered the following information relating to its own cost of producing the carburetor internally: 1. Direct materials cost $17 per unit. 2. Troy Engines pays its direct labour employees $20 per hour; each carburetor requires 30 minutes of labour time. 3. Variable manufacturing overhead is allocated at 30% of direct labour cost. 4. Total fixed manufacturing cost amounts to $15 per unit, of which 60% is allocated common cost and the remaining 40% covers depreciation of special equipment and supervisory salaries. The special equipment has no resale value. Supervisory personnel will be transferred to a different department if the company decides to purchase the carburetor from the outside supplier. 5. Yearly production of this type of carburetor is 15,300 units. Required: 1-a. Assume that the company has no alternative use for the facilities that are now being used to produce the carburetors. Compute the total differential cost per unit for producing and buying the product. 1-b. Should the outside supplier's offer be accepted? Yes No 2-a. Suppose that if the carburetors were purchased, Troy Engines Ltd. could use the freed capacity to launch a new product. The segment margin of the new product would be $150,000 per year. Compute the total differential cost for producing and buying the product. 2-b. Should Troy Engines Ltd. accept the offer to buy the carburetors for $38 per unit? Yes No Han Products manufactures 45,000 units of part S- 6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 is as follows: An outside supplier has offered to sell 39,500 units of part S-6 each year to Han Products for $26.50 per part. If Han Products accepts this offer, the facilities now being used to manufacture part S-6 could be rented to another company at an annual rental of $96,000. However, Han Products has determined that 30% of the fixed overhead being applied to part S-6 will be avoided if part S-6 is purchased from the outside supplier. Required: 1. What is the net dollar advantage or disadvantage of accepting the outside supplier's offer? (Round "Total costs" and final answer to the nearest whole dollar amount.) 2. What is the annual rental value at which the company will be indifferent between the two options? (Round "Total costs" and final answer to the nearest whole dollar amount.)