Answered step by step

Verified Expert Solution

Question

1 Approved Answer

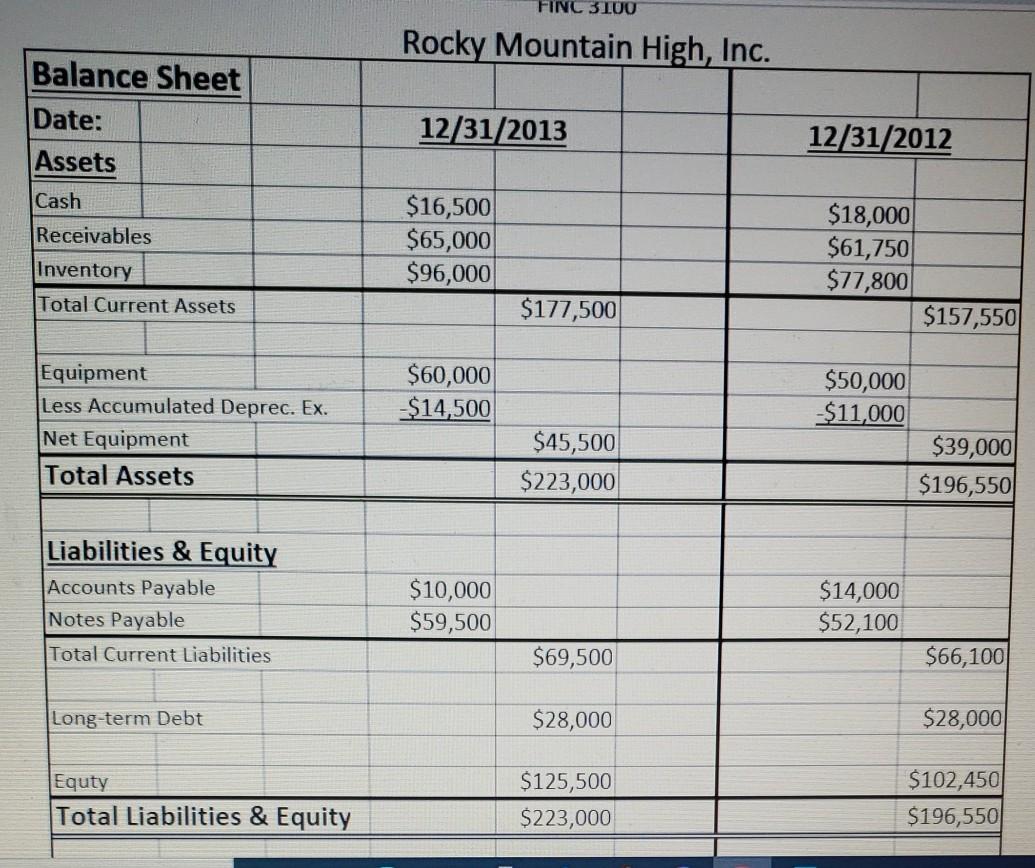

respond questions 1 to 5 FINC 3100 Rocky Mountain High, Inc. Balance Sheet Date: Assets 12/31/2013 12/31/2012 Cash Receivables Inventory Total Current Assets $16,500 $65,000

respond questions 1 to 5

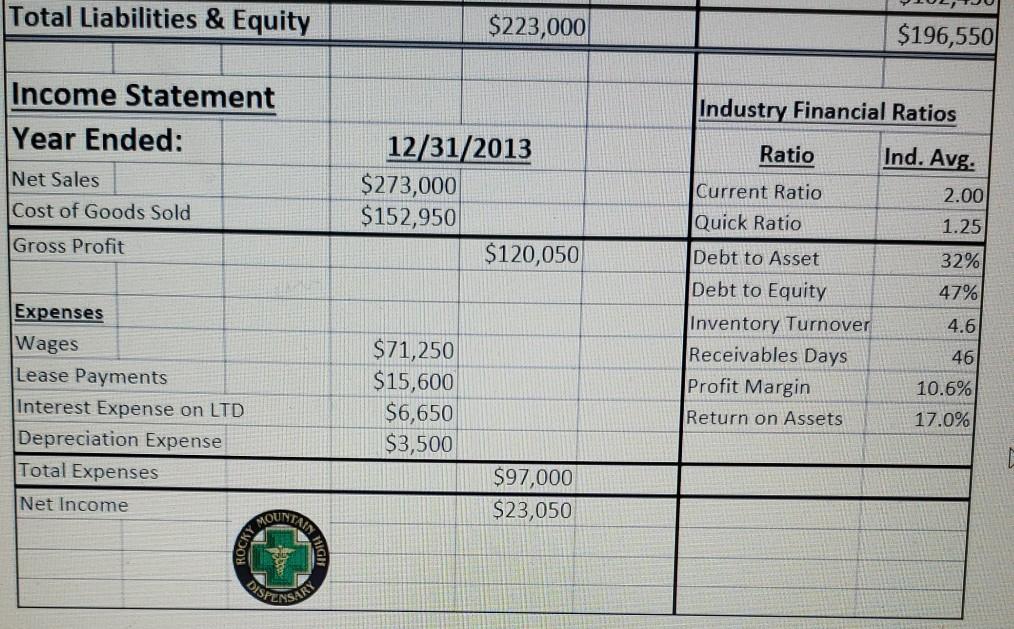

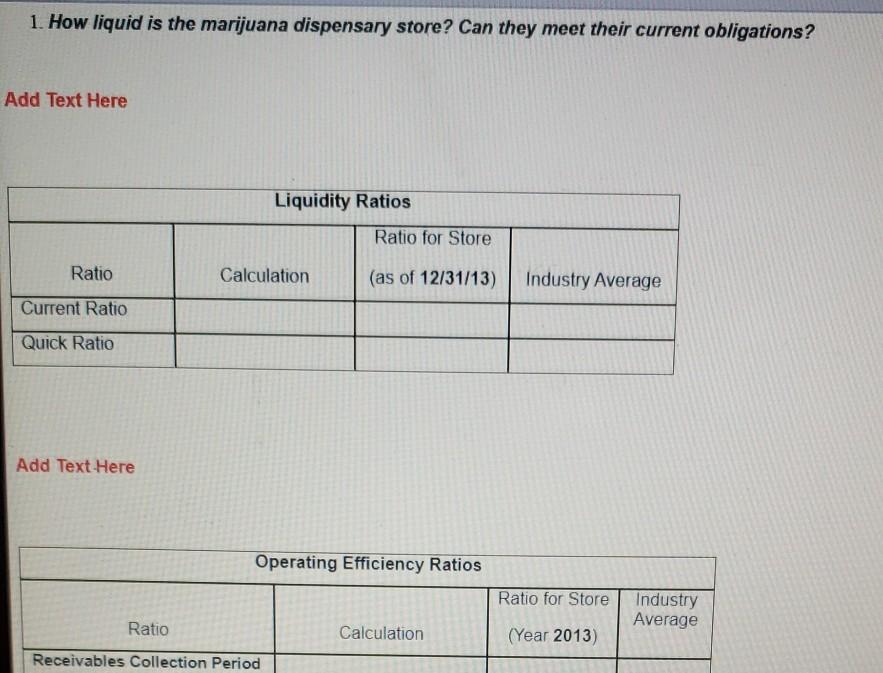

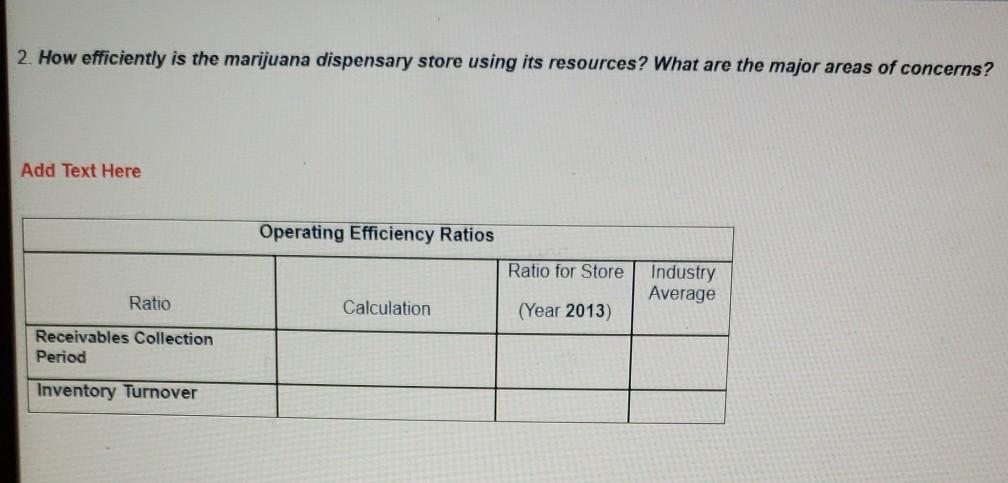

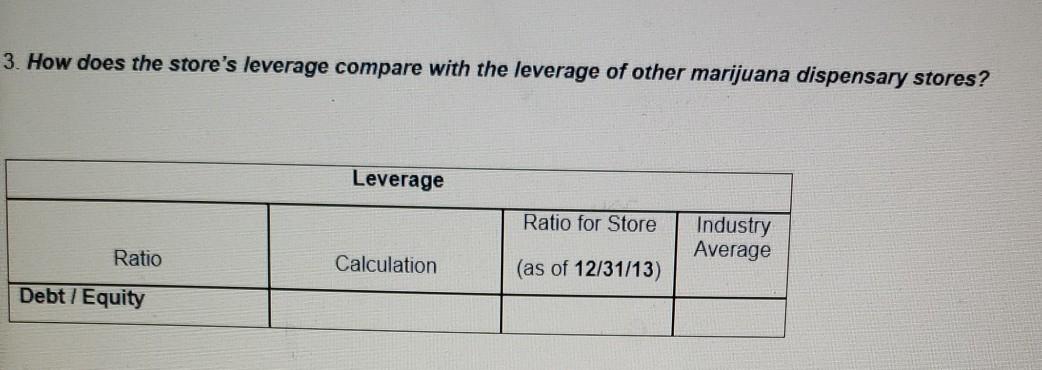

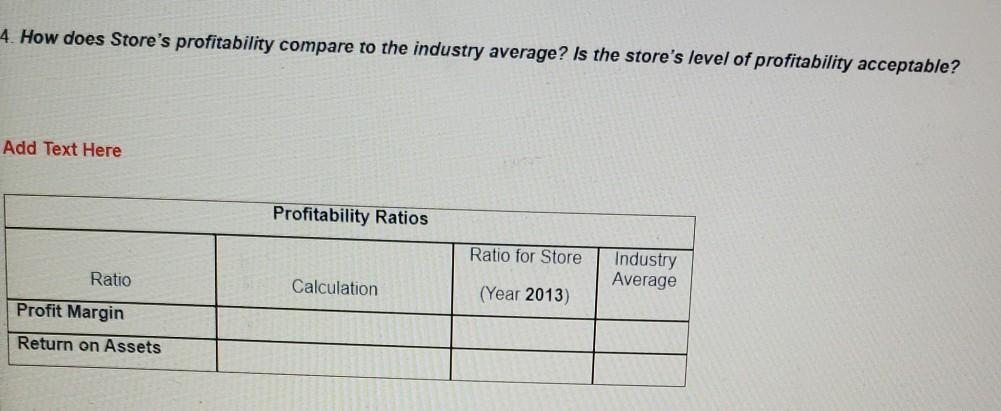

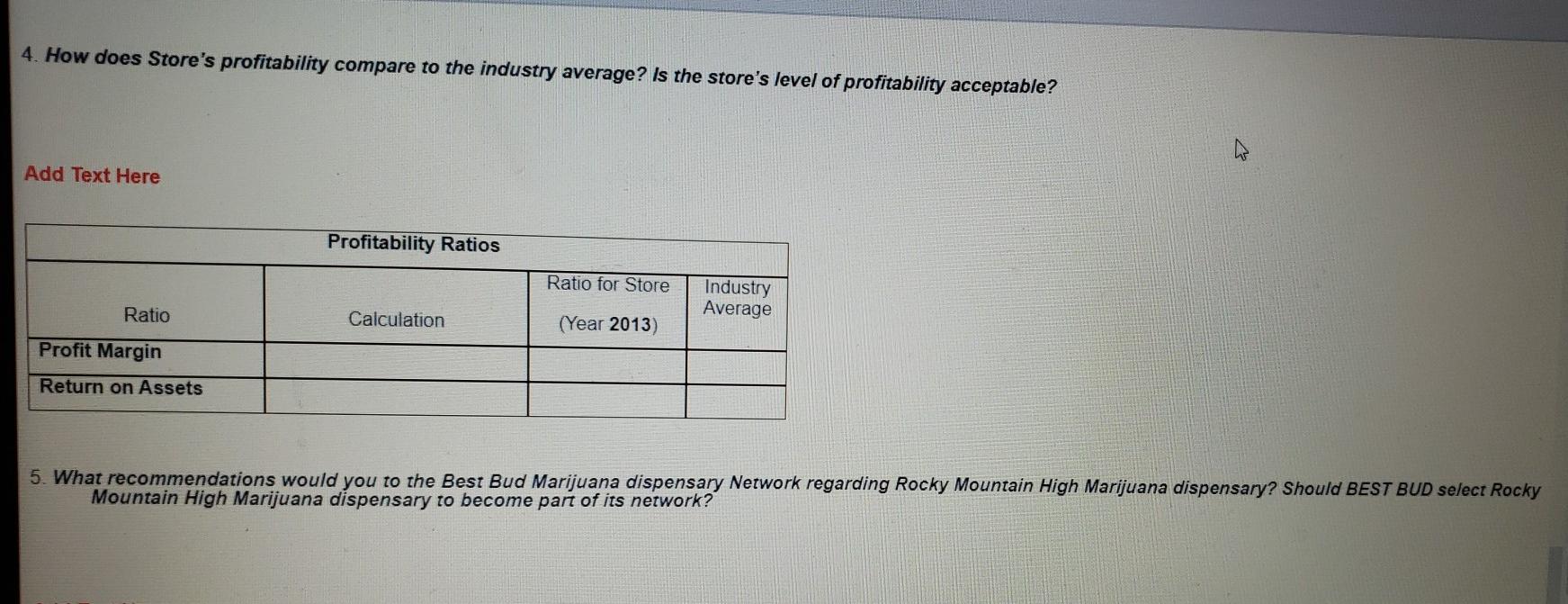

FINC 3100 Rocky Mountain High, Inc. Balance Sheet Date: Assets 12/31/2013 12/31/2012 Cash Receivables Inventory Total Current Assets $16,500 $65,000 $96,000 $18,000 $61,750 $77,800 $157,550 $177,500 Equipment Less Accumulated Deprec. Ex. Net Equipment Total Assets $60,000 $14,500 $50,000 $11,000 $45,500 $223,000 $39,000 $196,550 Liabilities & Equity Accounts Payable Notes Payable Total Current Liabilities $10,000 $59,500 $14,000 $52,100 $69,500 $66,100 Long-term Debt $28,000 $28,000 Equty Total Liabilities & Equity $125,500 $223,000 $102,450 $196,550 Total Liabilities & Equity $223,000 $196,550 Income Statement Year Ended: Industry Financial Ratios Ratio Ind. Avg. Net Sales Cost of Goods Sold 12/31/2013 $273,000 $152,950 $120,050 2.00 1.25 Gross Profit 32% 47% Current Ratio Quick Ratio Debt to Asset Debt to Equity Inventory Turnover Receivables Days Profit Margin Return on Assets 4.6 Expenses Wages Lease Payments Interest Expense on LTD Depreciation Expense Total Expenses Net Income MOUNTAN 46 $71,250 $15,600 $6,650 $3,500 10.6% 17.0% $97,000 $23,050 AIN DISPUNSARY 1. How liquid is the marijuana dispensary store? Can they meet their current obligations? Add Text Here Liquidity Ratios Ratio for Store Ratio Calculation (as of 12/31/13) Industry Average Current Ratio Quick Ratio Add Text Here Operating Efficiency Ratios Ratio for Store Industry Average Ratio Calculation (Year 2013) Receivables Collection Period Operating Efficiency Ratios Ratio for Store Ratio Industry Average Calculation (Year 2013) Receivables Collection Period Inventory Turnover Add Text Here 2. How efficiently is the marijuana dispensary store using its resources? What are the major areas of concerns? Add Text Here Operating Efficiency Ratios Ratio for Store Industry Average Ratio Calculation (Year 2013) Receivables Collection Period Inventory Turnover 3. How does the store's leverage compare with the leverage of other marijuana dispensary stores? Leverage Ratio for Store Industry Average Ratio Calculation (as of 12/31/13) Debt / Equity 4. How does Store's profitability compare to the industry average? Is the store's level of profitability acceptable? Add Text Here Profitability Ratios Ratio for Store Industry Average Ratio Calculation (Year 2013) Profit Margin Return on Assets 4. How does Store's profitability compare to the industry average? Is the store's level of profitability acceptable? Add Text Here Profitability Ratios Ratio for Store Industry Average Ratio Calculation (Year 2013) Profit Margin Return on Assets 5. What recommendations would you to the Best Bud Marijuana dispensary Network regarding Rocky Mountain High Marijuana dispensary? Should BEST BUD select Rocky Mountain High Marijuana dispensary to become part of its networkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started