Question

Respond to each question as if you were the managerial accountant for the company and are presenting to the company vice-president regarding the information requested

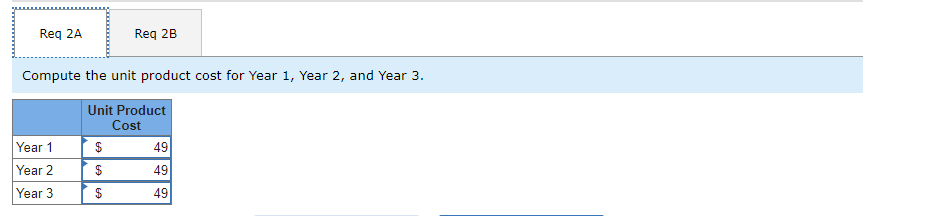

Respond to each question as if you were the managerial accountant for the company and are presenting to the company vice-president regarding the information requested in the case study. Please give the correct numbers and also explain to management what variable costing is, why variable costing is useful and why the net income is different for absorption vs variable costing and also why net income is different for LIFO vs FIFO. Then follow the explanation up with a recommendation for management reporting.

For each answer explain the terminology and concepts used. For example, rather than just give theproduct costet income, explain the calculation - this is a professional report from a managerial accountant to the company vice-president.

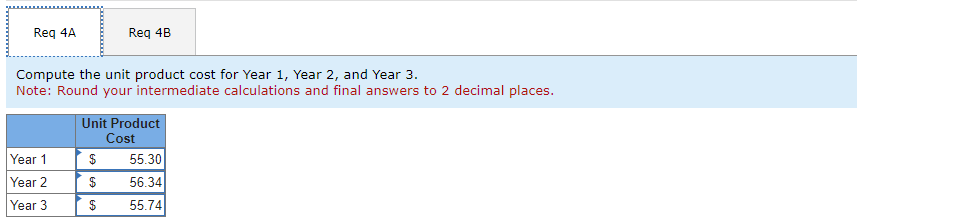

When giving a recommendation, back it up with numbers. Make sure to address the original dilemma - lowest bid in different situations. This particular answer should be managerial accountingreport to the company president. All numbers provided below are correct.

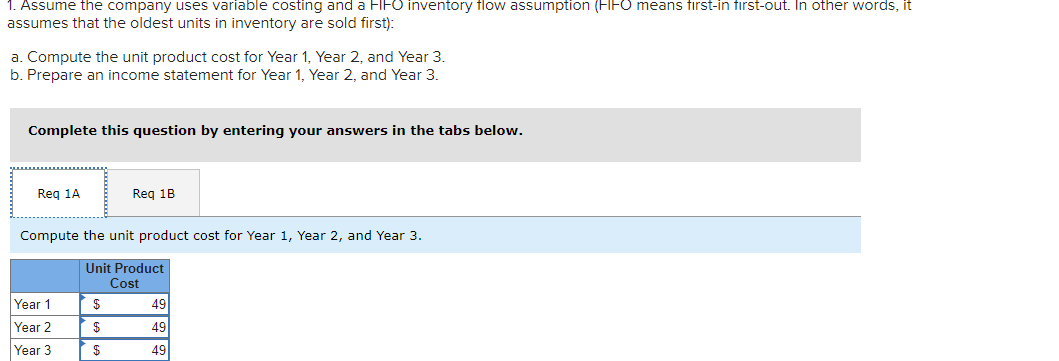

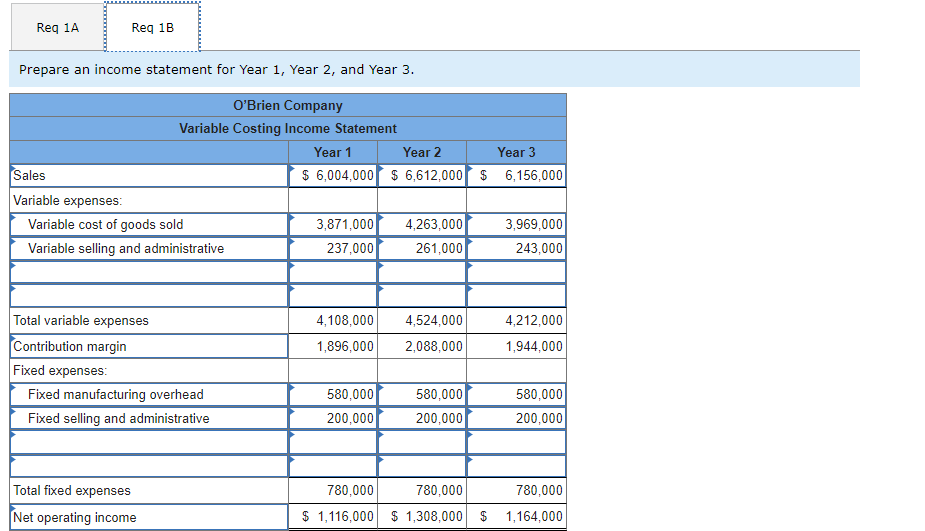

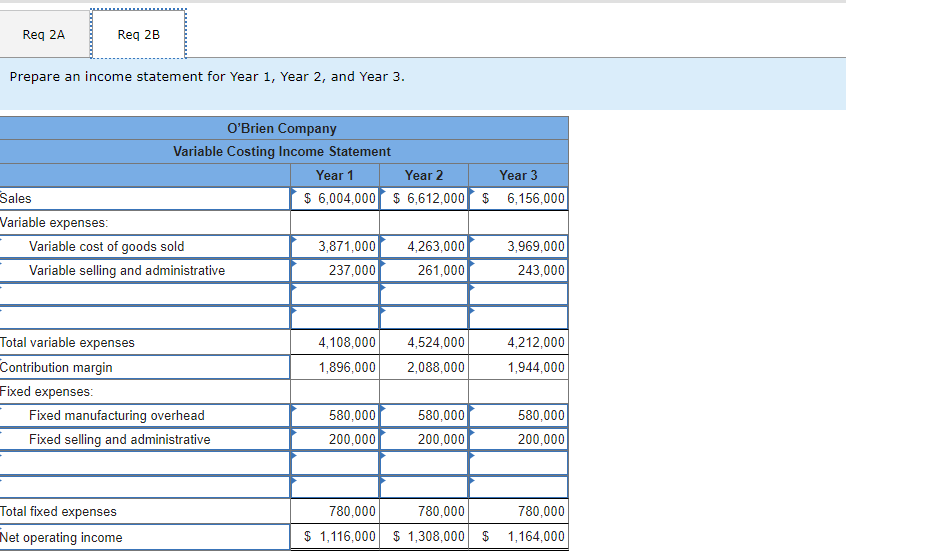

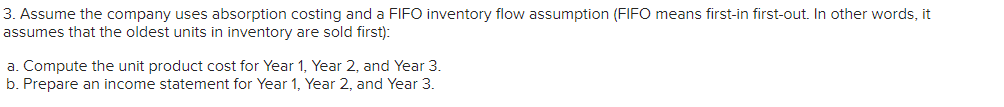

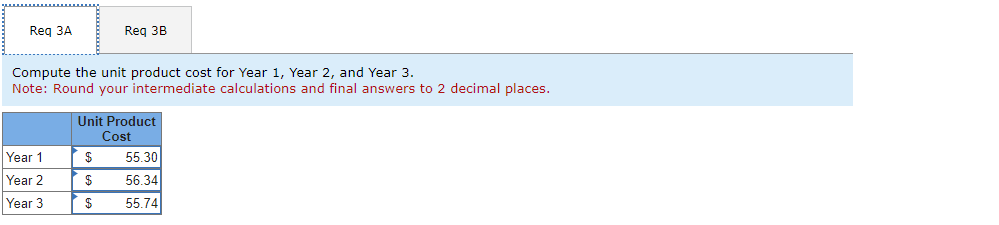

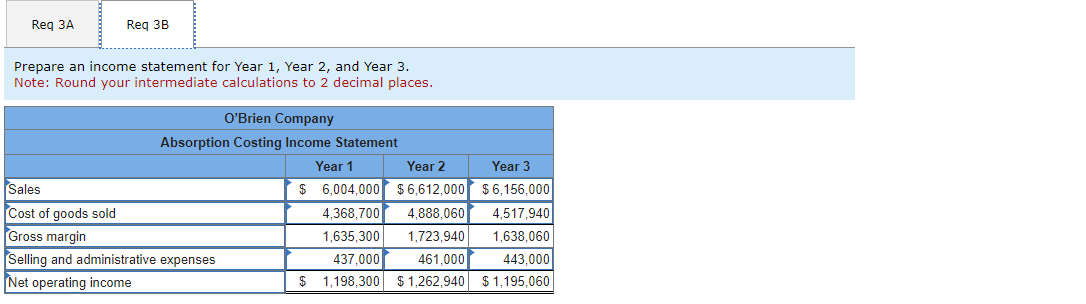

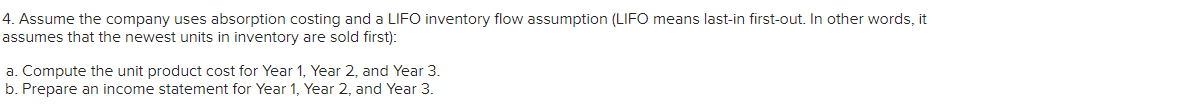

1. Assume the company uses variable costing and a FIFO inventory flow assumption (FIFO means first-in first-out. In other words, it assumes that the oldest units in inventory are sold first): a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Compute the unit product cost for Year 1, Year 2, and Year 3. Unit Product Cost Year 1 $ 49 Year 2 $ 49 Year 3 $ 49

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started