Answered step by step

Verified Expert Solution

Question

1 Approved Answer

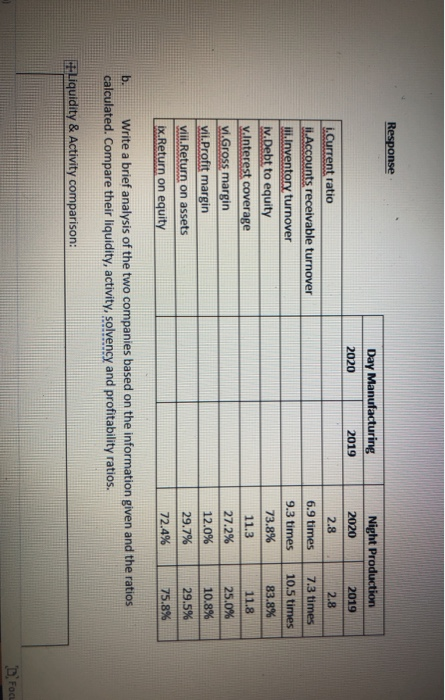

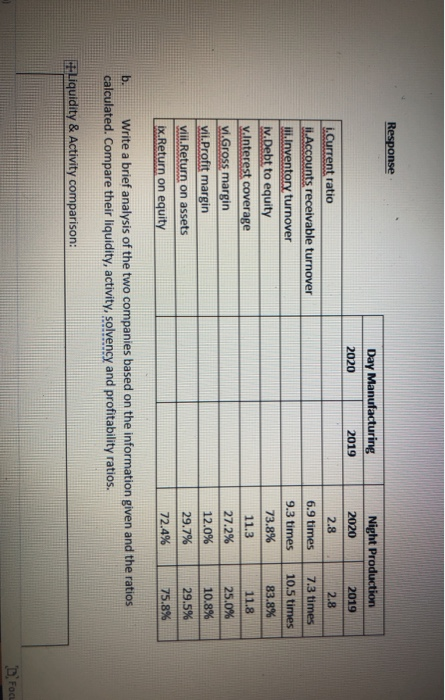

Response Day Manufacturing 2020 2019 Night Production 2020 2019 2.8 2.8 6.9 times 7.3 times 9.3 times 10.5 times 73.8% 83.8% 1.Current ratio ii.Accounts receivable

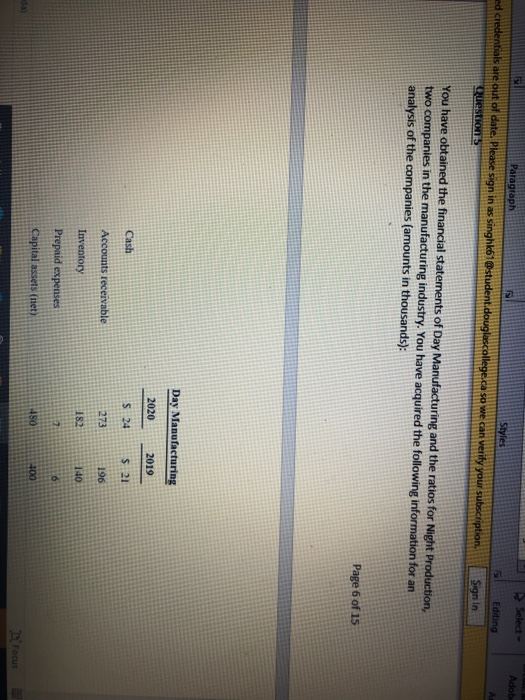

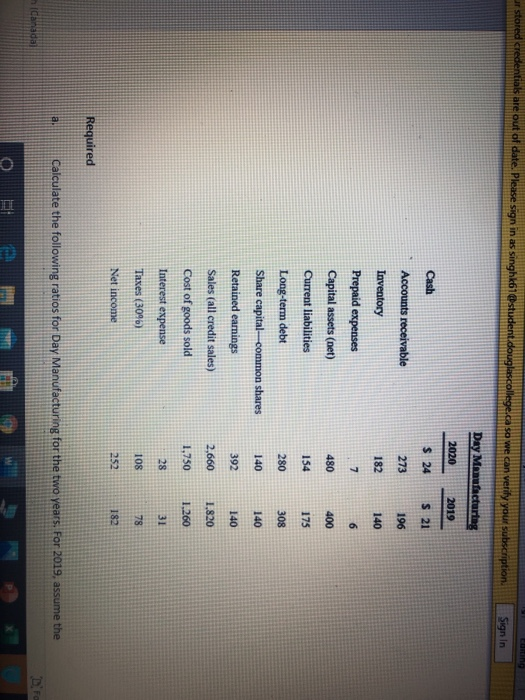

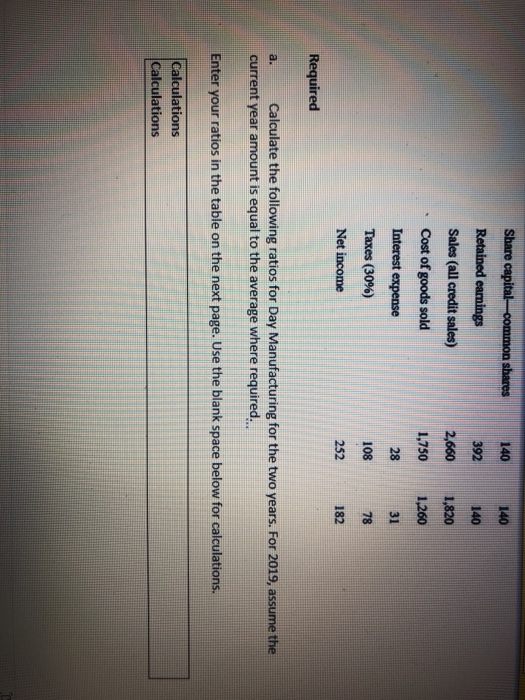

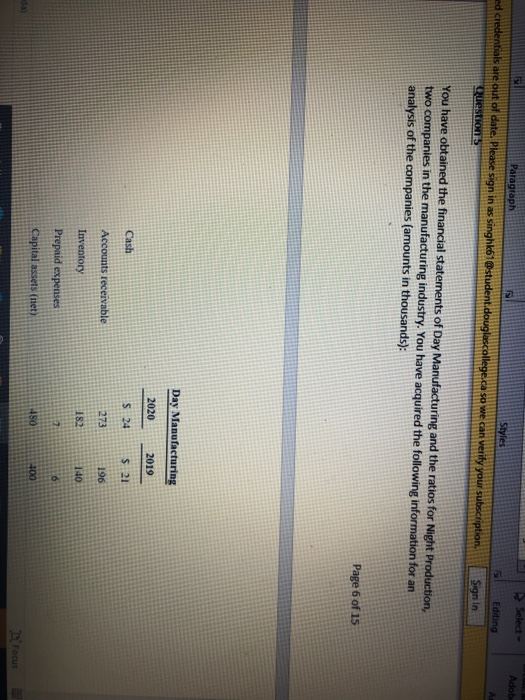

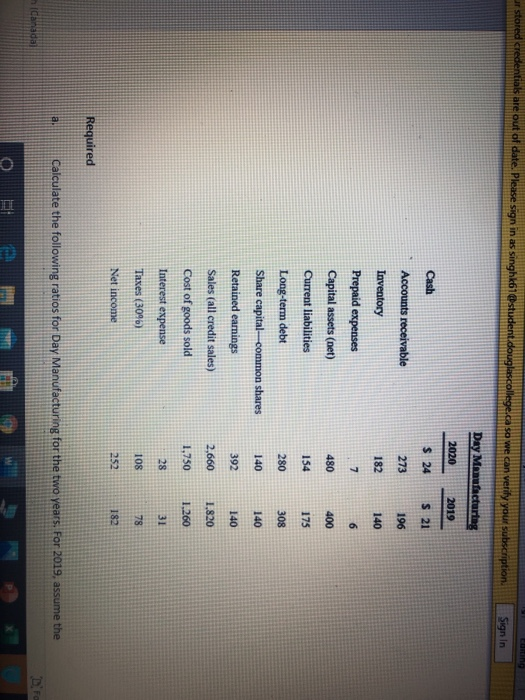

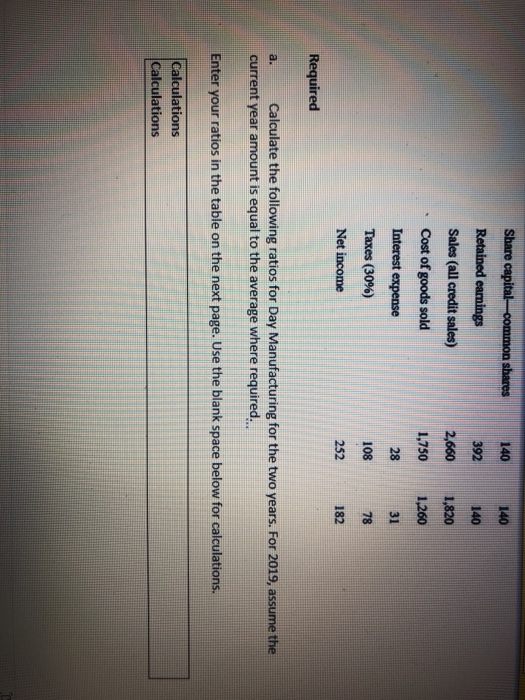

Response Day Manufacturing 2020 2019 Night Production 2020 2019 2.8 2.8 6.9 times 7.3 times 9.3 times 10.5 times 73.8% 83.8% 1.Current ratio ii.Accounts receivable turnover iii.Inventory turnover iv.Debt to equity V.Interest coverage vi.Gross margin Vii.Profit margin viii.Return on assets ix.Return on equity 11.3 27.2% 11.8 25.0% 10.8% 29.5% 12.0% 29.7% 72.4% 75.8% Write a brief analysis of the two companies based on the information given and the ratios calculated. Compare their liquidity, activity, solvency and profitability ratios. Liquidity & Activity comparison: D Focu Net income Required a. Calculate the following ratios for Day Manufacturing for the two years. For 2019, assume the current year amount is equal to the average where required... Enter your ratios in the table on the next page. Use the blank space below for calculations. Calculations Calculations TELLULU Write a brief analysis of the two companies based on the information given and the ratios calculated. Compare their liquidity, activity, solvency and profitability ratios. Liquidity & Activity comparison: Solvency comparison: D. Focus Paragraph Styles pred credentials are out of date. Please sign in as singhk61 student.douglascollege.ca so we can verify your subscription Adobe PDS Adobe Acre Editing Sign In Which company appears to be the better investment for the shareholder? Explain. Which company appears to be the better credit risk for the lender? Explain. Focus nadal Select- Adob Paragraph Styles ed credentials are out of date. Please sign in as singhk61@student.douglascollege.ca so we can verify your subscription Questions 51 Editing Sign In You have obtained the financial statements of Day Manufacturing and the ratios for Night Production, two companies in the manufacturing industry. You have acquired the following information for an analysis of the companies (amounts in thousands): Page 6 of 15 Day Manufacturing 2020 2019 Cash Accounts receivable 196 Inventory Prepaid expenses Capital assets (net D Focus credentials are out of date. Please sign in as singhk61@student.douglascollege.ca so we can verify your subscription Sign In Day Manufacturing 2020 2019 $ 24 S 21 Cash Accounts receivable 273 Inventory Prepaid expenses Capital assets (net) Current liabilities Long-term debt Share capital-common shares Retained earnings Sales (all credit sales) Cost of goods sold Interest expense Taxes (3096) Net income Required a. Calculate the following ratios for Day Manufacturing for the two years. For 2019, assume the Canada 392 2,660 Share capitalcommon shares Retained earnings Sales (all credit sales) Cost of goods sold Interest expense Taxes (30%) Net income 1,750 Required a. Calculate the following ratios for Day Manufacturing for the two years. For 2019, assume the current year amount is equal to the average where required... Enter your ratios in the table on the next page. Use the blank space below for calculations. Calculations Calculations

Response Day Manufacturing 2020 2019 Night Production 2020 2019 2.8 2.8 6.9 times 7.3 times 9.3 times 10.5 times 73.8% 83.8% 1.Current ratio ii.Accounts receivable turnover iii.Inventory turnover iv.Debt to equity V.Interest coverage vi.Gross margin Vii.Profit margin viii.Return on assets ix.Return on equity 11.3 27.2% 11.8 25.0% 10.8% 29.5% 12.0% 29.7% 72.4% 75.8% Write a brief analysis of the two companies based on the information given and the ratios calculated. Compare their liquidity, activity, solvency and profitability ratios. Liquidity & Activity comparison: D Focu Net income Required a. Calculate the following ratios for Day Manufacturing for the two years. For 2019, assume the current year amount is equal to the average where required... Enter your ratios in the table on the next page. Use the blank space below for calculations. Calculations Calculations TELLULU Write a brief analysis of the two companies based on the information given and the ratios calculated. Compare their liquidity, activity, solvency and profitability ratios. Liquidity & Activity comparison: Solvency comparison: D. Focus Paragraph Styles pred credentials are out of date. Please sign in as singhk61 student.douglascollege.ca so we can verify your subscription Adobe PDS Adobe Acre Editing Sign In Which company appears to be the better investment for the shareholder? Explain. Which company appears to be the better credit risk for the lender? Explain. Focus nadal Select- Adob Paragraph Styles ed credentials are out of date. Please sign in as singhk61@student.douglascollege.ca so we can verify your subscription Questions 51 Editing Sign In You have obtained the financial statements of Day Manufacturing and the ratios for Night Production, two companies in the manufacturing industry. You have acquired the following information for an analysis of the companies (amounts in thousands): Page 6 of 15 Day Manufacturing 2020 2019 Cash Accounts receivable 196 Inventory Prepaid expenses Capital assets (net D Focus credentials are out of date. Please sign in as singhk61@student.douglascollege.ca so we can verify your subscription Sign In Day Manufacturing 2020 2019 $ 24 S 21 Cash Accounts receivable 273 Inventory Prepaid expenses Capital assets (net) Current liabilities Long-term debt Share capital-common shares Retained earnings Sales (all credit sales) Cost of goods sold Interest expense Taxes (3096) Net income Required a. Calculate the following ratios for Day Manufacturing for the two years. For 2019, assume the Canada 392 2,660 Share capitalcommon shares Retained earnings Sales (all credit sales) Cost of goods sold Interest expense Taxes (30%) Net income 1,750 Required a. Calculate the following ratios for Day Manufacturing for the two years. For 2019, assume the current year amount is equal to the average where required... Enter your ratios in the table on the next page. Use the blank space below for calculations. Calculations Calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started