Answered step by step

Verified Expert Solution

Question

1 Approved Answer

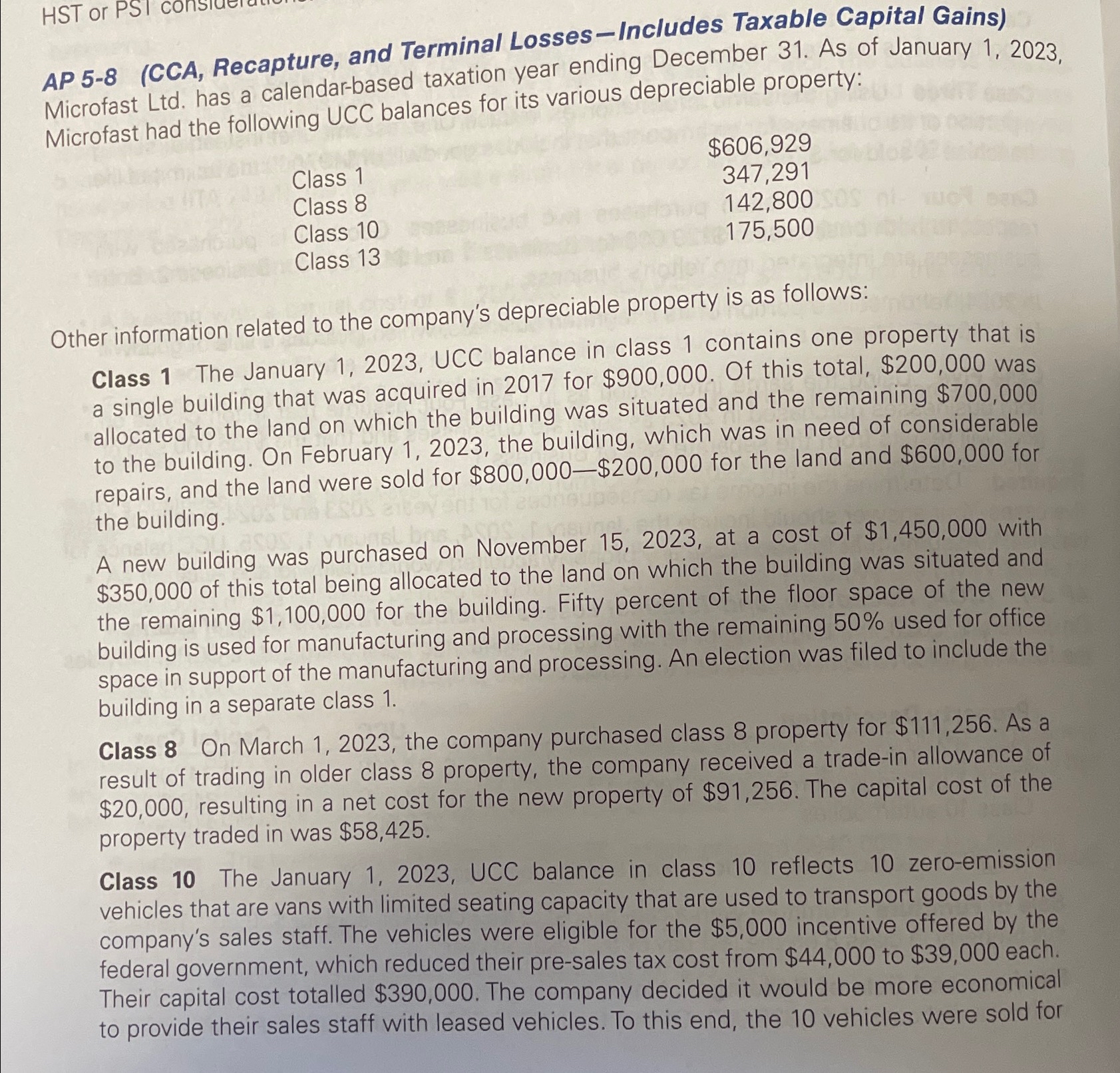

Rest pf the Question total proceeds of $ 1 5 0 , 0 0 0 on October 3 1 , 2 0 2 3 .

Rest pf the Question

total proceeds of $ on October The amount received for each vehicle was less than its capital cost.Class On August the company purchases a BMW for use by the company's president. The capital cost of the automobile is $ The president drives it kilometres in with only kilometres representing employment use.The president is not a shareholder of the company nor are any family members. The vehicle is not a ZEPV.Class Some of the company's business is conducted out of a building that is leased.The lease, which had an initial term of six years, can be renewed for two additional years at the end of the initial term. Immediately after the lease was signed on January Microfast spent $ on leasehold improvements. In April an additional $ of leasehold improvements were made on upgrading the property.It is the policy of the company to deduct maximum CCA in each taxation year.Required: Calculate the maximum CCA for the taxation year. Your answer should include the maximum that can be claimed for each CCA class. In addition, indicate the amount of any recapture, terminal loss, or taxable capital gain that results from dispositions in The UCC balance at January is not required. Also comment on whether the company misclassified the zeroemission vehicles as class Assume that any purchases of depreciable property would have met the conditions to qualify for the Acell. Ignore the availability of immediate expensing and any GSTHST or PST considerations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started