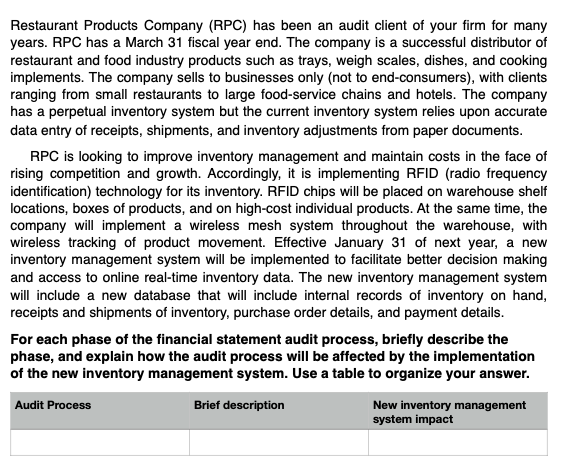

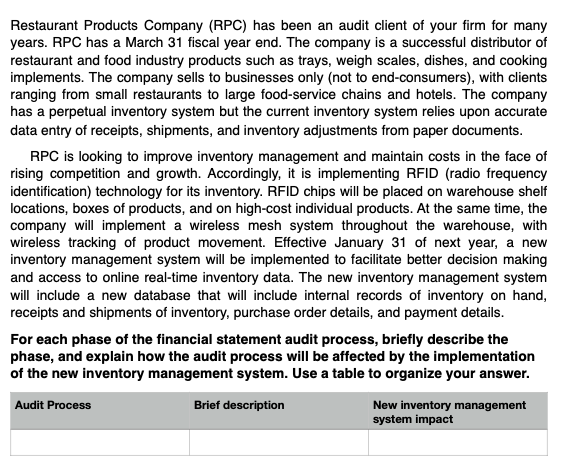

Restaurant Products Company (RPC) has been an audit client of your firm for many years. RPC has a March 31 fiscal year end. The company is a successful distributor of restaurant and food industry products such as trays, weigh scales, dishes, and cooking implements. The company sells to businesses only (not to end-consumers), with clients ranging from small restaurants to large food-service chains and hotels. The company has a perpetual inventory system but the current inventory system relies upon accurate data entry of receipts, shipments, and inventory adjustments from paper documents. RPC is looking to improve inventory management and maintain costs in the face of rising competition and growth. Accordingly, it is implementing RFID (radio frequency identification) technology for its inventory. RFID chips will be placed on warehouse shelf locations, boxes of products, and on high-cost individual products. At the same time, the company will implement a wireless mesh system throughout the warehouse, with wireless tracking of product movement. Effective January 31 of next year, a new inventory management system will be implemented to facilitate better decision making and access to online real-time inventory data. The new inventory management system will include a new database that will include internal records of inventory on hand, receipts and shipments of inventory, purchase order details, and payment details. For each phase of the financial statement audit process, briefly describe the phase, and explain how the audit process will be affected by the implementation of the new inventory management system. Use a table to organize your answer. Audit Process Brief description New inventory management system impact Restaurant Products Company (RPC) has been an audit client of your firm for many years. RPC has a March 31 fiscal year end. The company is a successful distributor of restaurant and food industry products such as trays, weigh scales, dishes, and cooking implements. The company sells to businesses only (not to end-consumers), with clients ranging from small restaurants to large food-service chains and hotels. The company has a perpetual inventory system but the current inventory system relies upon accurate data entry of receipts, shipments, and inventory adjustments from paper documents. RPC is looking to improve inventory management and maintain costs in the face of rising competition and growth. Accordingly, it is implementing RFID (radio frequency identification) technology for its inventory. RFID chips will be placed on warehouse shelf locations, boxes of products, and on high-cost individual products. At the same time, the company will implement a wireless mesh system throughout the warehouse, with wireless tracking of product movement. Effective January 31 of next year, a new inventory management system will be implemented to facilitate better decision making and access to online real-time inventory data. The new inventory management system will include a new database that will include internal records of inventory on hand, receipts and shipments of inventory, purchase order details, and payment details. For each phase of the financial statement audit process, briefly describe the phase, and explain how the audit process will be affected by the implementation of the new inventory management system. Use a table to organize your answer. Audit Process Brief description New inventory management system impact