Question

Restructuring versus liquidation. Atoyo Fabricating, Inc., has not been able to service its debts adequately. The company is a family business that has been in

Restructuring versus liquidation. Atoyo Fabricating, Inc., has not been able to service its debts adequately. The company is a family business that has been in existence for 35 years. The shareholders want to avoid liquidating the business and are seeking your help in formulating a plan of reorganization which:

a. Provides creditors with at least as much consideration as, if not more than, they would receive if the company were liquidated.

b. Does not require monthly debt service in excess of $75,000.

Information regarding the various creditor claims and possible restructuring parameters is as follows:

a. Accounts payable due vendors total $134,000. Terms are generally 2/10 net 30, and virtually all accounts are past due. Vendors with balances of $40,000 due have indicated that in satisfaction of the amount due, they would accept equal monthly installment payments bearing no less than 12% and not exceeding three months in duration. These vendors have secured their claims with inventory that has a book value and net realizable value of $55,000 and $42,000, respectively. Vendors with a balance due of $74,000 have a secured interest in inventory with a book value of $60,000 and a net realizable value of $46,000. These vendors would accept three monthly installment payments of $20,000 including interest at the rate of 12% in satisfaction of the amount due. The remaining payables represent unsecured amounts that would be paid $3,000 per month for the next five months including interest at 12%.

b. The equipment note has a balance due of $320,000 plus accrued interest of $18,000. Equipment with a book value of $280,000 and a net realizable value of $325,000 serves as collateral for this loan. The original loan had an interest rate of 11% and a remaining term of 30 months. The creditor will not agree to a change in the interest rate but will accept a revised term of 36 to 42 months in exchange for a personal guarantee of the amount due by each of the shareholders of record.

c. The note due a shareholder in the amount of $20,000 is secured by the cash surrender value of an insurance policy in the amount of $15,000 and is payable on demand. The shareholder would accept four semiannual payments, including interest at 12%, if the present value of these payments is equal to 120% of what would have been received if the company had been liquidated.

d. The mortgage payable of $420,000 plus accrued interest of $28,000 is fully secured by real estate with a book value of $310,000 and a net realizable value of $460,000. The original mortgage has a remaining term of 334 months and an interest rate of 9%. The mortgage company would agree to a restructuring of 360 months and an interest rate of 11%.

e. All other creditors totaling $160,000 are unsecured without priority. Management would like to propose that these creditors receive monthly payments over the next eight months with interest at 12%. The net present value of these payments should equal 110% of what would have been received had the company been liquidated.

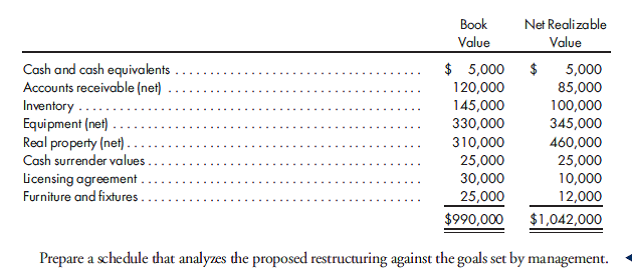

The book values and net realizable values of the companys assets are as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started