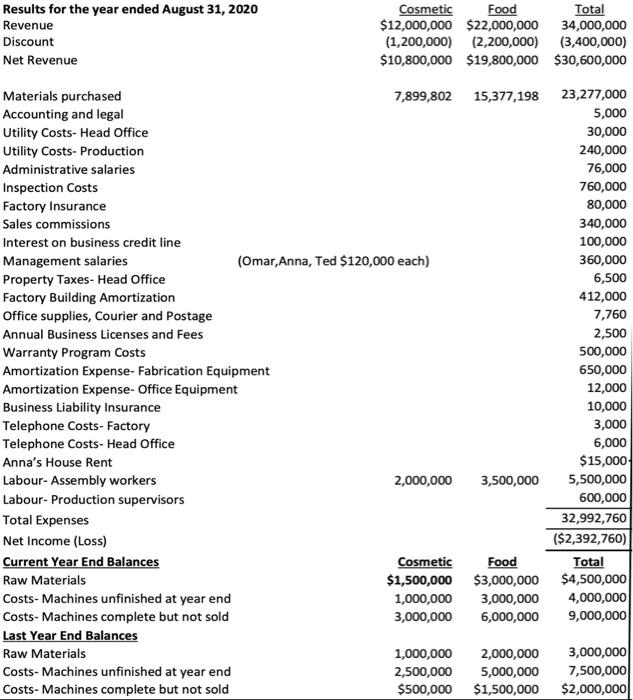

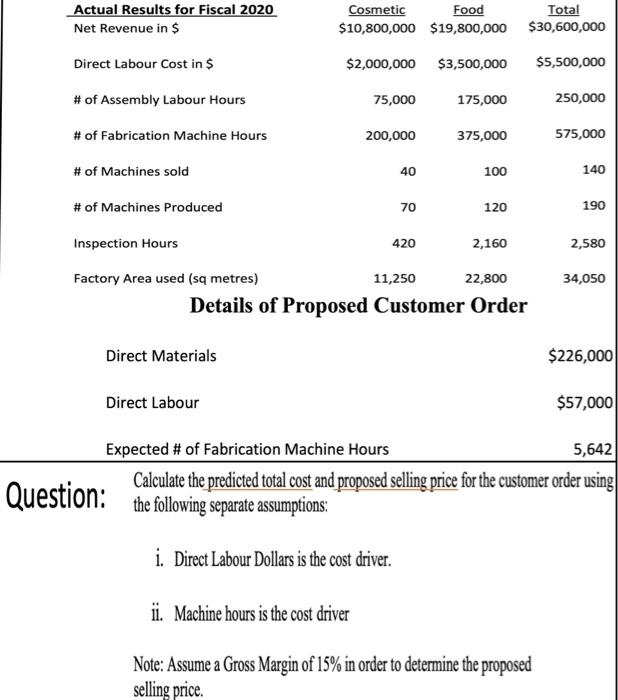

Results for the year ended August 31, 2020 Revenue Discount Net Revenue Cosmetic Food Total $12,000,000 $22,000,000 34,000,000 (1,200,000) (2,200,000) (3,400,000) $10,800,000 $19,800,000 $30,600,000 Materials purchased 7,899,802 15,377,198 23,277,000 Accounting and legal 5,000 Utility Costs- Head Office 30,000 Utility Costs- Production 240,000 Administrative salaries 76,000 Inspection Costs 760,000 Factory Insurance 80,000 Sales commissions 340,000 Interest on business credit line 100,000 Management salaries (Omar,Anna, Ted $120,000 each) 360,000 Property Taxes- Head Office 6,500 Factory Building Amortization 412,000 Office supplies, Courier and Postage 7,760 Annual Business Licenses and Fees 2,500 Warranty Program Costs 500,000 Amortization Expense - Fabrication Equipment 650,000 Amortization Expense-Office Equipment 12,000 Business Liability Insurance 10,000 Telephone Costs-Factory 3,000 Telephone Costs- Head Office 6,000 Anna's House Rent $15,000 Labour- Assembly workers 2,000,000 3,500,000 5,500,000 Labour-Production supervisors 600,000 Total Expenses 32,992,760 Net Income (Loss) ($2,392,760) Current Year End Balances Cosmetic Food Total Raw Materials $1,500,000 $3,000,000 $4,500,000 Costs- Machines unfinished at year end 1,000,000 3,000,000 4,000,000 Costs- Machines complete but not sold 3,000,000 6,000,000 9,000,000 Last Year End Balances Raw Materials 1,000,000 2,000,000 3,000,000 Costs- Machines unfinished at year end 2,500,000 5,000,000 7,500,000 Costs- Machines complete but not sold $500,000 $1,500,000 $2,000,000 Actual Results for Fiscal 2020 Net Revenue in $ Cosmetic Food Total $10,800,000 $19,800,000 $30,600,000 Direct Labour Cost in $ $2,000,000 $3,500,000 $5,500,000 # of Assembly Labour Hours 75,000 175,000 250,000 # of Fabrication Machine Hours 200,000 375,000 575,000 # of Machines sold 40 100 140 # of Machines Produced 70 120 190 Inspection Hours 420 2,160 2,580 34,050 Factory Area used (sq metres) 11,250 22,800 Details of Proposed Customer Order Direct Materials $226,000 Direct Labour $57,000 Expected # of Fabrication Machine Hours 5,642 Calculate the predicted total cost and proposed selling price for the customer order using Question: the following separate assumptions: i. Direct Labour Dollars is the cost driver. ii. Machine hours is the cost driver Note: Assume a Gross Margin of 15% in order to determine the proposed selling price. Results for the year ended August 31, 2020 Revenue Discount Net Revenue Cosmetic Food Total $12,000,000 $22,000,000 34,000,000 (1,200,000) (2,200,000) (3,400,000) $10,800,000 $19,800,000 $30,600,000 Materials purchased 7,899,802 15,377,198 23,277,000 Accounting and legal 5,000 Utility Costs- Head Office 30,000 Utility Costs- Production 240,000 Administrative salaries 76,000 Inspection Costs 760,000 Factory Insurance 80,000 Sales commissions 340,000 Interest on business credit line 100,000 Management salaries (Omar,Anna, Ted $120,000 each) 360,000 Property Taxes- Head Office 6,500 Factory Building Amortization 412,000 Office supplies, Courier and Postage 7,760 Annual Business Licenses and Fees 2,500 Warranty Program Costs 500,000 Amortization Expense - Fabrication Equipment 650,000 Amortization Expense-Office Equipment 12,000 Business Liability Insurance 10,000 Telephone Costs-Factory 3,000 Telephone Costs- Head Office 6,000 Anna's House Rent $15,000 Labour- Assembly workers 2,000,000 3,500,000 5,500,000 Labour-Production supervisors 600,000 Total Expenses 32,992,760 Net Income (Loss) ($2,392,760) Current Year End Balances Cosmetic Food Total Raw Materials $1,500,000 $3,000,000 $4,500,000 Costs- Machines unfinished at year end 1,000,000 3,000,000 4,000,000 Costs- Machines complete but not sold 3,000,000 6,000,000 9,000,000 Last Year End Balances Raw Materials 1,000,000 2,000,000 3,000,000 Costs- Machines unfinished at year end 2,500,000 5,000,000 7,500,000 Costs- Machines complete but not sold $500,000 $1,500,000 $2,000,000 Actual Results for Fiscal 2020 Net Revenue in $ Cosmetic Food Total $10,800,000 $19,800,000 $30,600,000 Direct Labour Cost in $ $2,000,000 $3,500,000 $5,500,000 # of Assembly Labour Hours 75,000 175,000 250,000 # of Fabrication Machine Hours 200,000 375,000 575,000 # of Machines sold 40 100 140 # of Machines Produced 70 120 190 Inspection Hours 420 2,160 2,580 34,050 Factory Area used (sq metres) 11,250 22,800 Details of Proposed Customer Order Direct Materials $226,000 Direct Labour $57,000 Expected # of Fabrication Machine Hours 5,642 Calculate the predicted total cost and proposed selling price for the customer order using Question: the following separate assumptions: i. Direct Labour Dollars is the cost driver. ii. Machine hours is the cost driver Note: Assume a Gross Margin of 15% in order to determine the proposed selling price