Answered step by step

Verified Expert Solution

Question

1 Approved Answer

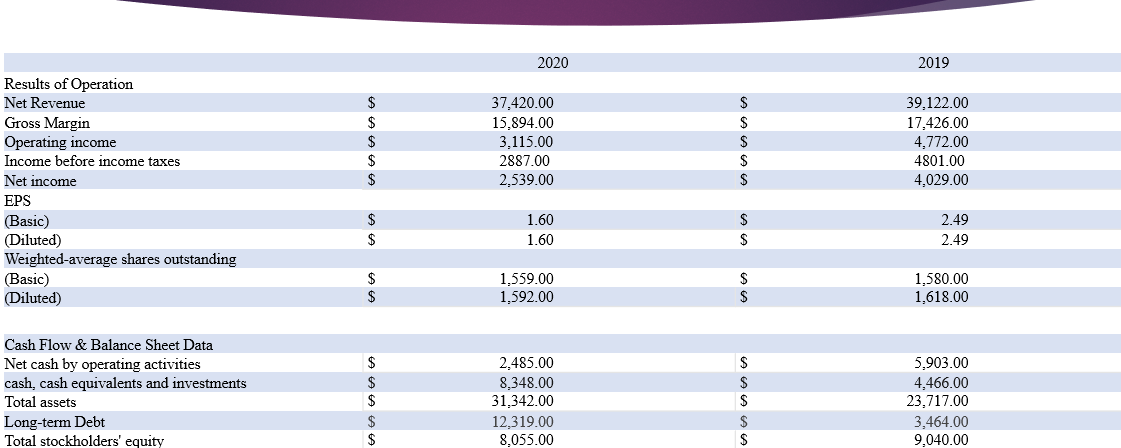

Results of operation for Nike: Create a common-sized income statement for Nike for the year 2020-2019 Following is an example of a common-sized income statement

Results of operation for Nike:

Create a common-sized income statement for Nike for the year 2020-2019

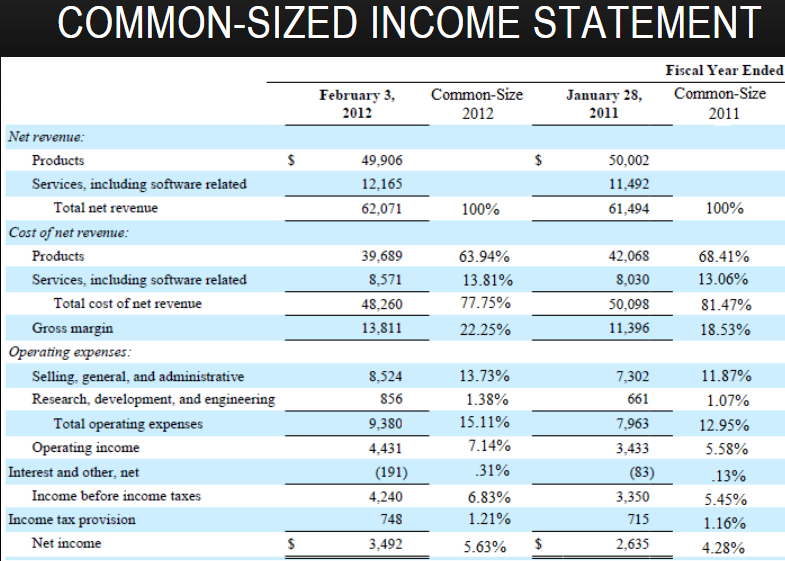

Following is an example of a common-sized income statement of Dell:

Dont copy paste

2020 2019 $ $ $ $ 37,420.00 15,894.00 3.115.00 2887.00 2,539.00 $ $ $ $ S 39,122.00 17,426.00 4,772.00 4801.00 4,029.00 $ Results of Operation Net Revenue Gross Margin Operating income Income before income taxes Net income EPS (Basic) (Diluted) Weighted average shares outstanding (Basic) (Diluted) $ $ 1.60 1.60 2.49 2.49 $ S S $ $ 1,559.00 1,592.00 $ 1,580.00 1,618.00 Cash Flow & Balance Sheet Data Net cash by operating activities cash, cash equivalents and investments Total assets Long-term Debt Total stockholders' equity $ $ $ 2.485.00 8,348.00 31,342.00 12,319.00 8,055.00 $ $ $ $ $ 5.903.00 4,466.00 23,717.00 3,464.00 9,040.00 $ COMMON-SIZED INCOME STATEMENT February 3, 2012 Common-Size 2012 January 28, 2011 Fiscal Year Ended Common-Size 2011 $ 49,906 12,165 62,071 50,002 11,492 61,494 100% 100% 39,689 8,571 48,260 13,811 63.94% 13.81% 77.75% 22.25% 42,068 8,030 50,098 11,396 68.41% 13.06% 81.47% 18.53% Net revenue: Products Services, including software related Total net revenue Cost of net revenue: Products Services, including software related Total cost of net revenue Gross margin Operating expenses: Selling, general, and administrative Research, development, and engineering Total operating expenses Operating income Interest and other, net Income before income taxes Income tax provision Net income 8.524 856 9,380 4,431 (191) 4,240 748 3,492 13.73% 1.38% 15.11% 7.14% 31% 6.83% 1.21% 7,302 661 7,963 3,433 (83) 3,350 715 2,635 11.87% 1.07% 12.95% 5.58% .13% 5.45% 1.16% 4.28% $ 5.63% $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started