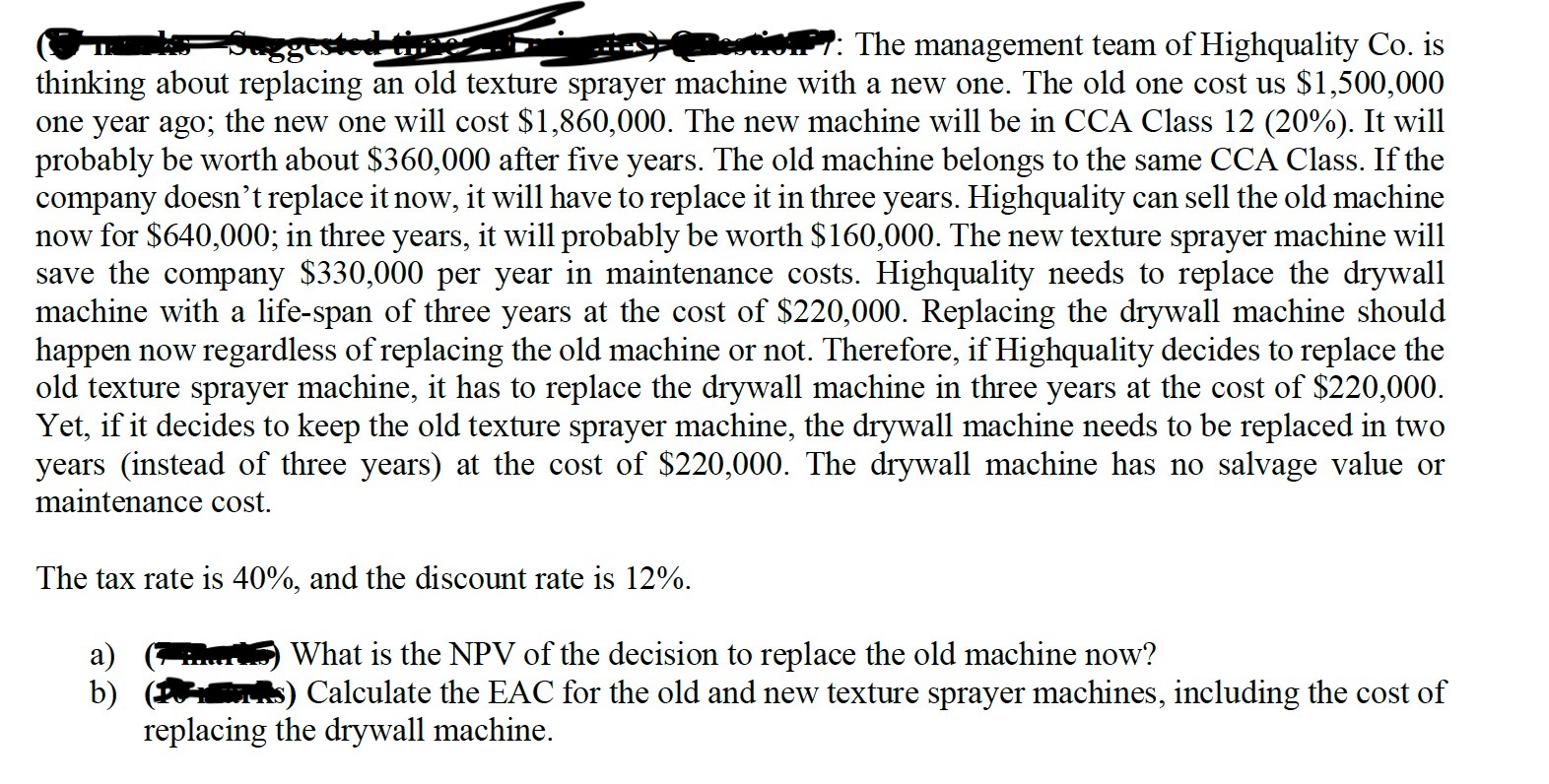

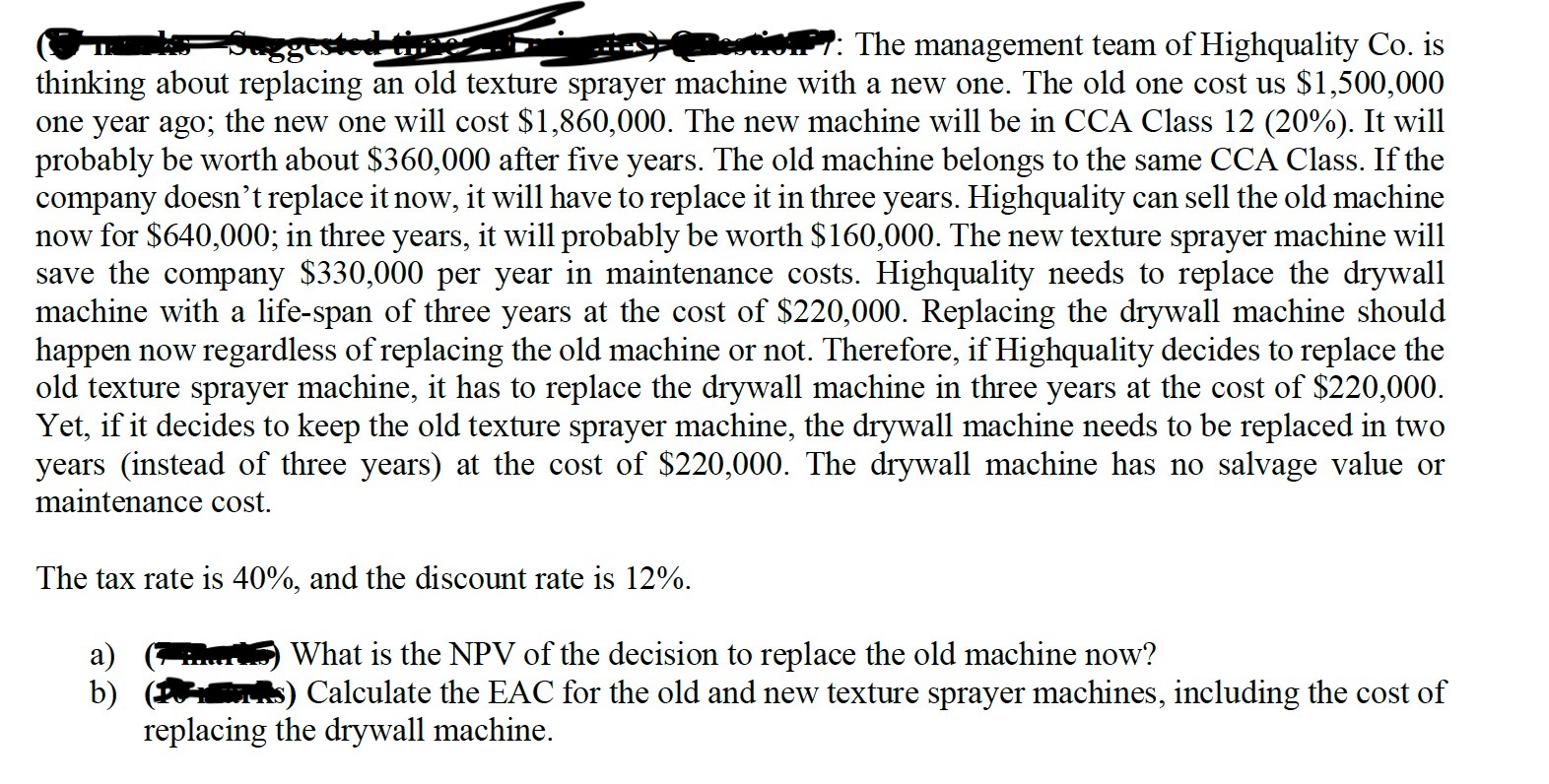

RET: The management team of Highquality Co. is thinking about replacing an old texture sprayer machine with a new one. The old one cost us $1,500,000 one year ago; the new one will cost $1,860,000. The new machine will be in CCA Class 12 (20%). It will probably be worth about $360,000 after five years. The old machine belongs to the same CCA Class. If the company doesn't replace it now, it will have to replace it in three years. Highquality can sell the old machine now for $640,000; in three years, it will probably be worth $160,000. The new texture sprayer machine will save the company $330,000 per year in maintenance costs. Highquality needs to replace the drywall machine with a life-span of three years at the cost of $220,000. Replacing the drywall machine should happen now regardless of replacing the old machine or not. Therefore, if Highquality decides to replace the old texture sprayer machine, it has to replace the drywall machine in three years at the cost of $220,000. Yet, if it decides to keep the old texture sprayer machine, the drywall machine needs to be replaced in two years (instead of three years) at the cost of $220,000. The drywall machine has no salvage value or maintenance cost. The tax rate is 40%, and the discount rate is 12%. a) ( What is the NPV of the decision to replace the old machine now? b) s) Calculate the EAC for the old and new texture sprayer machines, including the cost of replacing the drywall machine. RET: The management team of Highquality Co. is thinking about replacing an old texture sprayer machine with a new one. The old one cost us $1,500,000 one year ago; the new one will cost $1,860,000. The new machine will be in CCA Class 12 (20%). It will probably be worth about $360,000 after five years. The old machine belongs to the same CCA Class. If the company doesn't replace it now, it will have to replace it in three years. Highquality can sell the old machine now for $640,000; in three years, it will probably be worth $160,000. The new texture sprayer machine will save the company $330,000 per year in maintenance costs. Highquality needs to replace the drywall machine with a life-span of three years at the cost of $220,000. Replacing the drywall machine should happen now regardless of replacing the old machine or not. Therefore, if Highquality decides to replace the old texture sprayer machine, it has to replace the drywall machine in three years at the cost of $220,000. Yet, if it decides to keep the old texture sprayer machine, the drywall machine needs to be replaced in two years (instead of three years) at the cost of $220,000. The drywall machine has no salvage value or maintenance cost. The tax rate is 40%, and the discount rate is 12%. a) ( What is the NPV of the decision to replace the old machine now? b) s) Calculate the EAC for the old and new texture sprayer machines, including the cost of replacing the drywall machine