Answered step by step

Verified Expert Solution

Question

1 Approved Answer

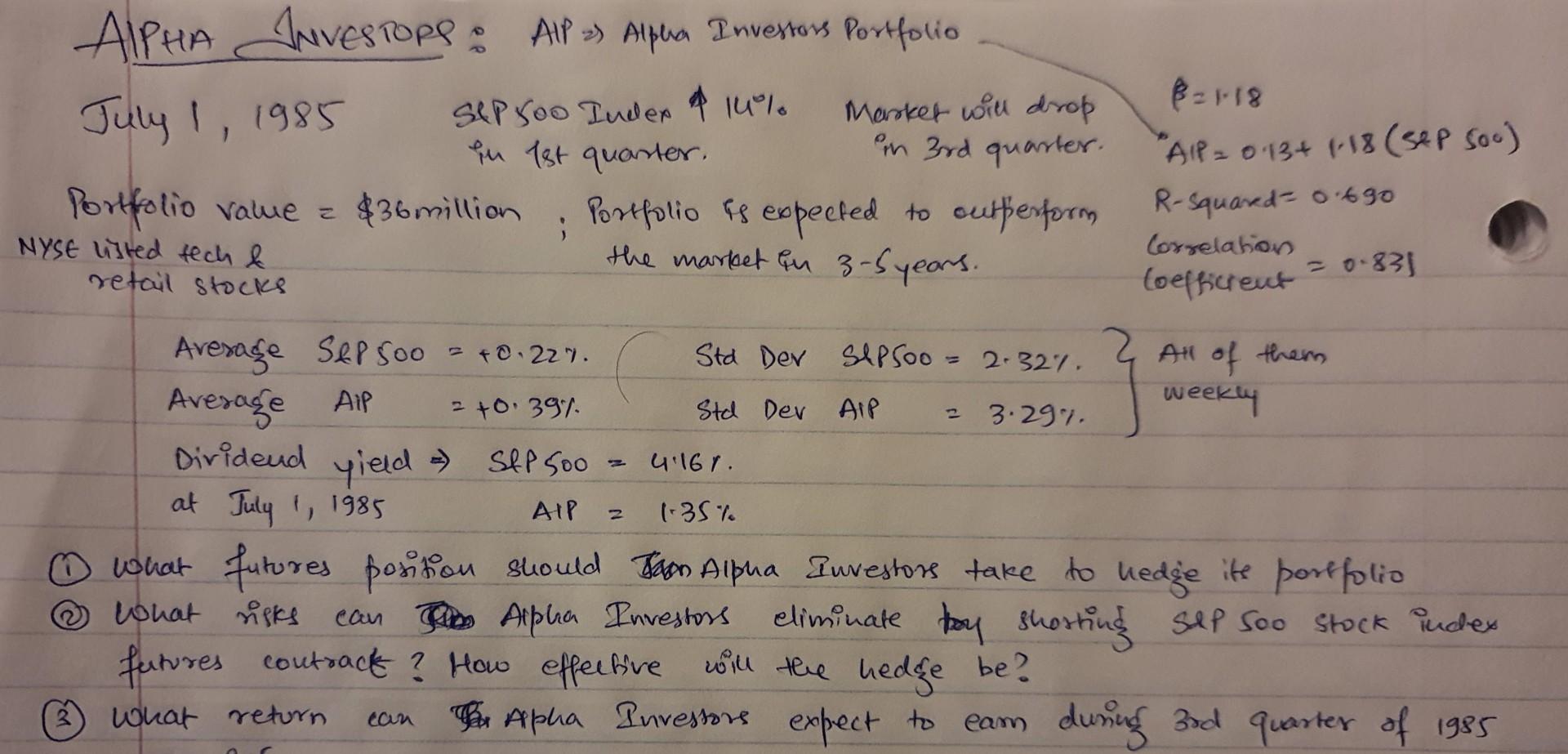

retail stocks ALPHA INVEstops: INVESTORS : All 2 Alpha Investors Portfolio Seproo Inder & 14% July 1, 1985 821-18 Market will drop in 1st quarter.

retail stocks ALPHA INVEstops: INVESTORS : All 2 Alpha Investors Portfolio Seproo Inder & 14% July 1, 1985 821-18 Market will drop in 1st quarter. on 3rd quarter. "All = 0.13 + 118 (sep soo) Portfolio value = $36 million Portfolio is expected to outperform R-Squando o 690 NYSE listed tech & the market in 3-5 years. Congelaton toefficrent = 0.831 Average Sep soo - +0.227. Std Der Sepsoo = 2.327. 2 All of them Average All weekly 3.297. Diridend yield SEP 500 at July 1, 1985 What futures position should Tan Alpha Investors take to hedge its portfolio What risks can To Alpha Investors eliminate boy shorting sep Soo Stock index features contract? How effective will the hedge be? What return The Alpha Investors expect to eam durung 3rd quarter of 1985 Aip 2+0.39% Std Der AIR 2 4.16r. AIP 2 1.35% can retail stocks ALPHA INVEstops: INVESTORS : All 2 Alpha Investors Portfolio Seproo Inder & 14% July 1, 1985 821-18 Market will drop in 1st quarter. on 3rd quarter. "All = 0.13 + 118 (sep soo) Portfolio value = $36 million Portfolio is expected to outperform R-Squando o 690 NYSE listed tech & the market in 3-5 years. Congelaton toefficrent = 0.831 Average Sep soo - +0.227. Std Der Sepsoo = 2.327. 2 All of them Average All weekly 3.297. Diridend yield SEP 500 at July 1, 1985 What futures position should Tan Alpha Investors take to hedge its portfolio What risks can To Alpha Investors eliminate boy shorting sep Soo Stock index features contract? How effective will the hedge be? What return The Alpha Investors expect to eam durung 3rd quarter of 1985 Aip 2+0.39% Std Der AIR 2 4.16r. AIP 2 1.35% can

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started