Answered step by step

Verified Expert Solution

Question

1 Approved Answer

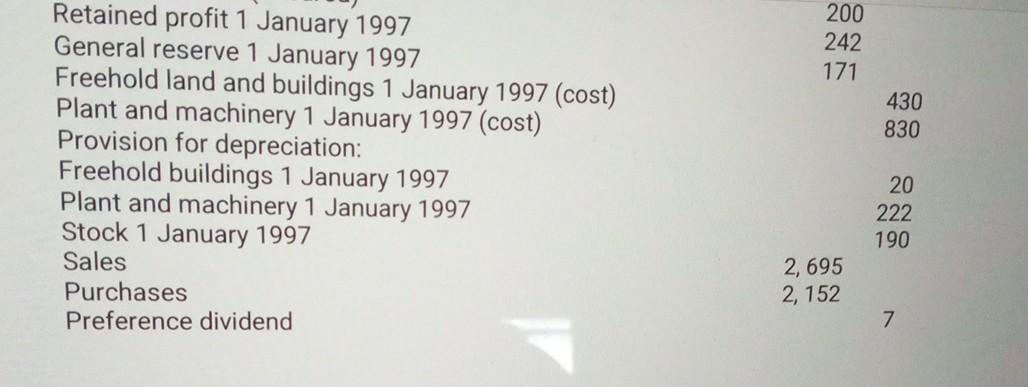

Retained profit 1 January 1997 General reserve 1 January 1997 Freehold land and buildings 1 January 1997 (cost) Plant and machinery 1 January 1997 (cost)

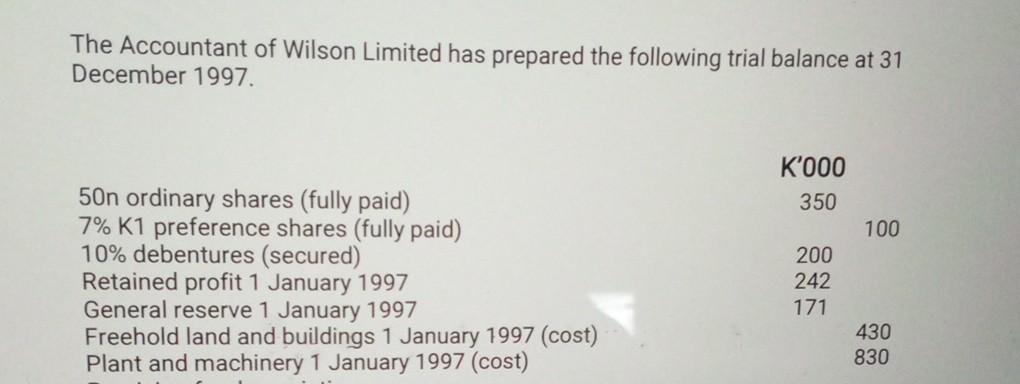

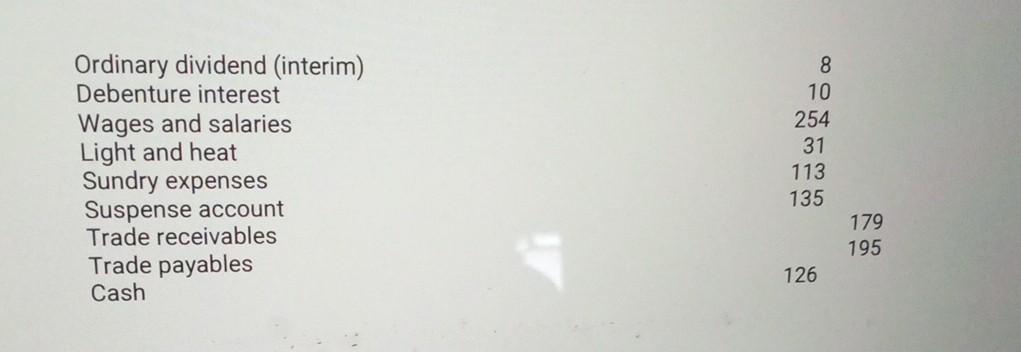

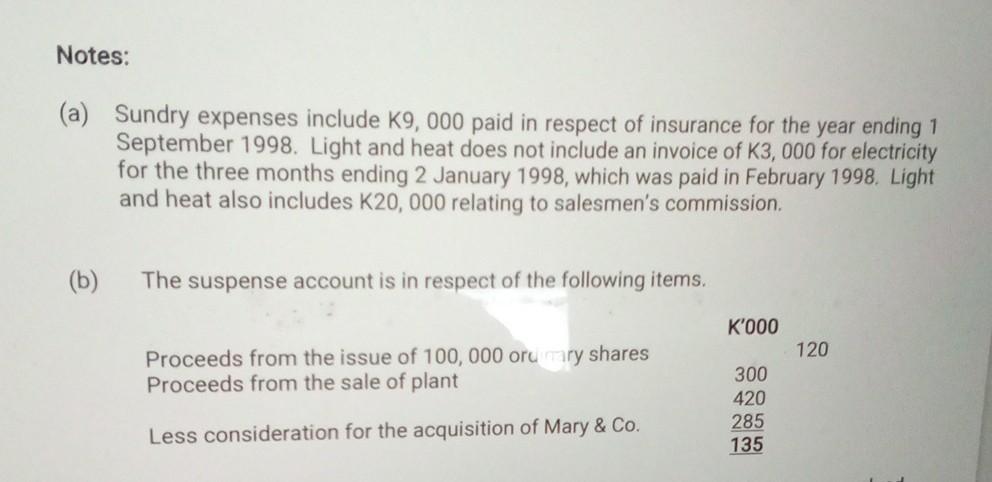

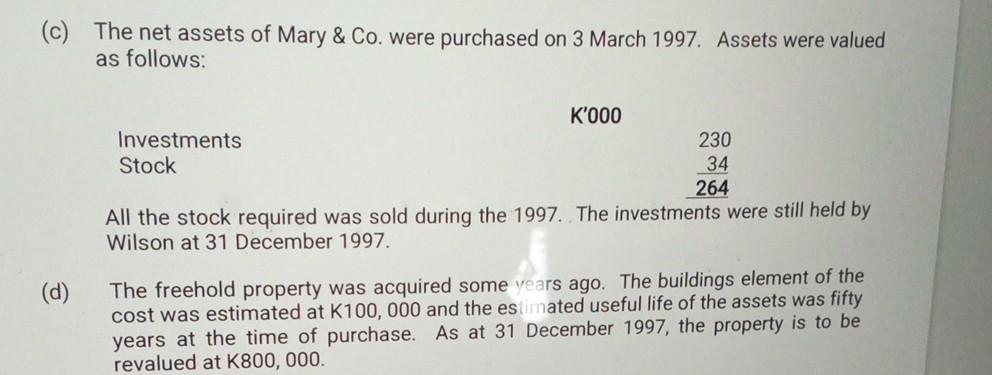

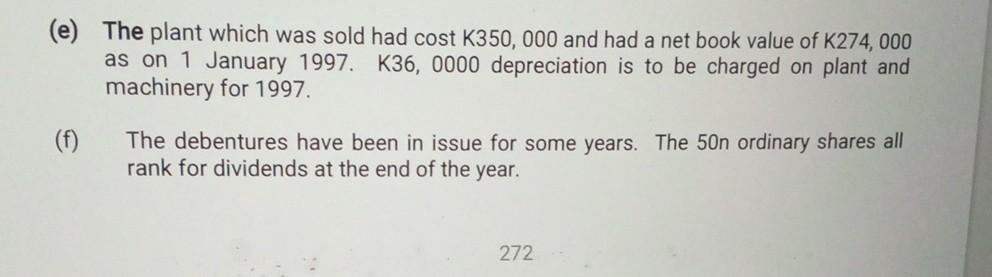

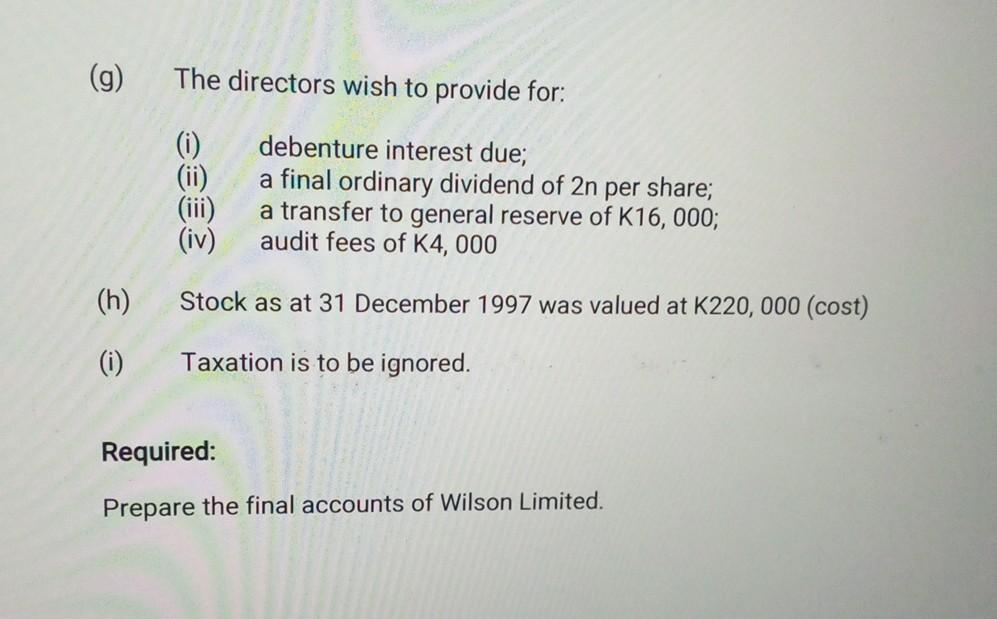

Retained profit 1 January 1997 General reserve 1 January 1997 Freehold land and buildings 1 January 1997 (cost) Plant and machinery 1 January 1997 (cost) Provision for depreciation: Freehold buildings 1 January 1997 Plant and machinery 1 January 1997 Stock 1 January 1997 Sales 200 242 171 Purchases 2, 695 430 830 Preference dividend 2,152 20 222 190 7 The Accountant of Wilson Limited has prepared the following trial balance at 31 December 1997. Ordinary dividend (interim) Debenture interest Wages and salaries Light and heat Sundry expenses Suspense account Trade receivables Trade payables Cash 81025431113135126179195 (a) Sundry expenses include K9,000 paid in respect of insurance for the year ending 1 September 1998. Light and heat does not include an invoice of K3, 000 for electricity for the three months ending 2 January 1998, which was paid in February 1998. Light and heat also includes K20,000 relating to salesmen's commission. c) The net assets of Mary \& Co. were purchased on 3 March 1997. Assets were valued as follows: All the stock required was sold during the 1997. The investments were still held by Wilson at 31 December 1997. d) The freehold property was acquired some years ago. The buildings element of the cost was estimated at K100,000 and the es imated useful life of the assets was fifty years at the time of purchase. As at 31 December 1997, the property is to be revalued at K800,000. (e) The plant which was sold had cost K350,000 and had a net book value of K274,000 as on 1 January 1997. K36, 0000 depreciation is to be charged on plant and machinery for 1997. (f) The debentures have been in issue for some years. The 50n ordinary shares all rank for dividends at the end of the year. (g) The directors wish to provide for: (i) debenture interest due; (ii) a final ordinary dividend of 2n per share; (iii) a transfer to general reserve of K16,000; (iv) audit fees of K4,000 (h) Stock as at 31 December 1997 was valued at K220, 000 (cost) (i) Taxation is to be ignored. Required: Prepare the final accounts of Wilson Limited

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started