Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Retirement 1: You want to retire 15 years from now. You plan on investing 10K a year for the first 5 years, 15K for the

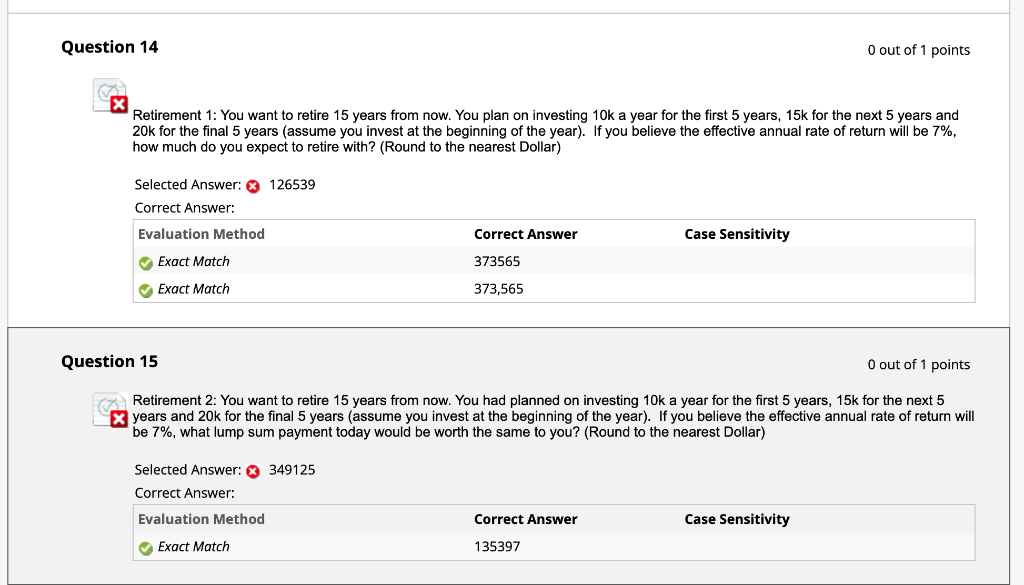

Retirement 1: You want to retire 15 years from now. You plan on investing 10K a year for the first 5 years, 15K for the next 5 years and 20K for the final 5 years (assume you invest at the beginning of the year). If you believe the effective annual rate of return will be 7%, how much do you expect to retire with?

** I know the answer, I just need help finding it on excel

Question 14 O out of 1 points x Retirement 1: You want to retire 15 years from now. You plan on investing 10k a year for the first 5 years, 15k for the next 5 years and 20k for the final 5 years (assume you invest at the beginning of the year). If you believe the effective annual rate of return will be 7%, how much do you expect to retire with? (Round to the nearest Dollar) Selected Answer: 126539 Correct Answer: Evaluation Method Correct Answer Case Sensitivity Exact Match 373565 Exact Match 373,565 Question 15 O out of 1 points Retirement 2: You want to retire 15 years from now. You had planned on investing 10k a year for the first 5 years, 15k for the next 5 x years and 20k for the final 5 years (assume you invest at the beginning of the year). If you believe the effective annual rate of return will be 7%, what lump sum payment today would be worth the same to you? (Round to the nearest Dollar) Selected Answer: 349125 Correct Answer: Evaluation Method Correct Answer Case Sensitivity Exact Match 135397Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started