Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Retirement Planning at J&J Bagel You recently graduated from Suffolk University, and your job search led you to J&J Bagel, Inc. As you are finishing

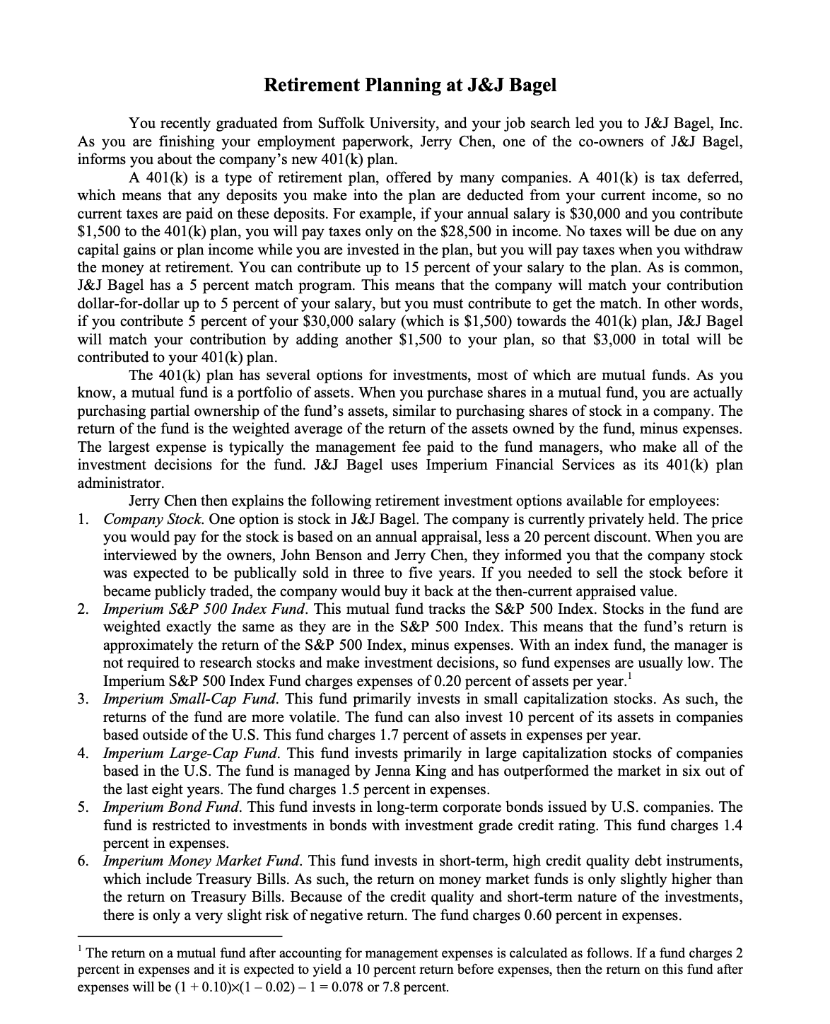

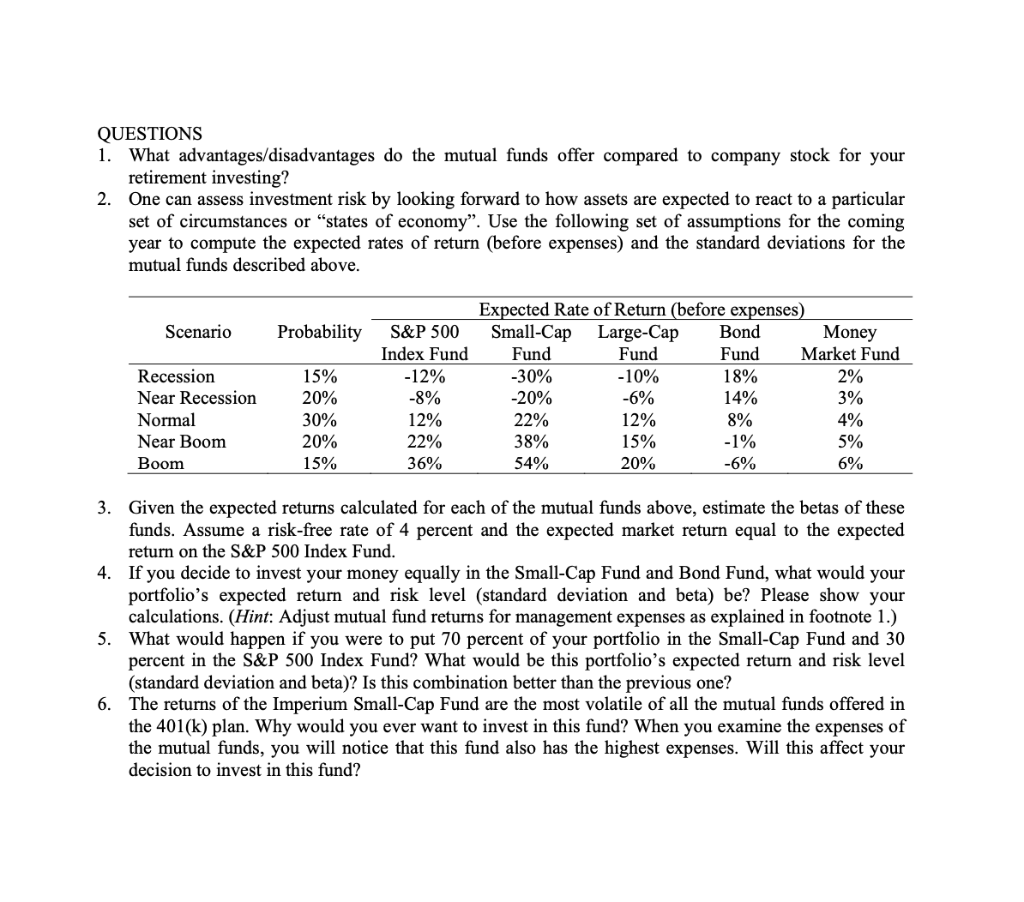

Retirement Planning at J&J Bagel You recently graduated from Suffolk University, and your job search led you to J&J Bagel, Inc. As you are finishing your employment paperwork, Jerry Chen, one of the co-owners of J&J Bagel, informs you about the company's new 401(k) plan. A 401(k) is a type of retirement plan, offered by many companies. A 401(k) is tax deferred, which means that any deposits you make into the plan are deducted from your current income, so no current taxes are paid on these deposits. For example, if your annual salary is $30,000 and you contribute $1,500 to the 401(k) plan, you will pay taxes only on the $28,500 in income. No taxes will be due on any capital gains or plan income while you are invested in the plan, but you will pay taxes when you withdraw the money at retirement. You can contribute up to 15 percent of your salary to the plan. As is common, J&J Bagel has a 5 percent match program. This means that the company will match your contribution dollar-for-dollar up to 5 percent of your salary, but you must contribute to get the match. In other words, if you contribute 5 percent of your $30,000 salary (which is $1,500) towards the 401(k) plan, J&J Bagel will match your contribution by adding another $1,500 to your plan, so that $3,000 in total will be contributed to your 401(k) plan. The 401(k) plan has several options for investments, most of which are mutual funds. As you know, a mutual fund is a portfolio of assets. When you purchase shares in a mutual fund, you are actually purchasing partial ownership of the fund's assets, similar to purchasing shares of stock in a company. The return of the fund is the weighted average of the return of the assets owned by the fund, minus expenses. The largest expense is typically the management fee paid to the fund managers, who make all of the investment decisions for the fund. J&J Bagel uses Imperium Financial Services as its 401(k) plan administrator. Jerry Chen then explains the following retirement investment options available for employees: 1. Company Stock. One option is stock in J&J Bagel. The company is currently privately held. The price you would pay for the stock is based on an annual appraisal, less a 20 percent discount. When you are interviewed by the owners, John Benson and Jerry Chen, they informed you that the company stock was expected to be publically sold in three to five years. If you needed to sell the stock before it became publicly traded, the company would buy it back at the then-current appraised value. 2. Imperium S&P 500 Index Fund. This mutual fund tracks the S&P 500 Index. Stocks in the fund are weighted exactly the same as they are in the S&P 500 Index. This means that the fund's return is approximately the return of the S&P 500 Index, minus expenses. With an index fund, the manager is not required to research stocks and make investment decisions, so fund expenses are usually low. The Imperium S&P 500 Index Fund charges expenses of 0.20 percent of assets per year.' 3. Imperium Small-Cap Fund. This fund primarily invests in small capitalization stocks. As such, the returns of the fund are more volatile. The fund can also invest 10 percent of its assets in companies based outside of the U.S. This fund charges 1.7 percent of assets in expenses per year. 4. Imperium Large-Cap Fund. This fund invests primarily in large capitalization stocks of companies based in the U.S. The fund is managed by Jenna King and has outperformed the market in six out of the last eight years. The fund charges 1.5 percent in expenses. 5. Imperium Bond Fund. This fund invests in long-term corporate bonds issued by U.S. companies. The fund is restricted to investments in bonds with investment grade credit rating. This fund charges 1.4 percent in expenses. 6. Imperium Money Market Fund. This fund invests in short-term, high credit quality debt instruments, which include Treasury Bills. As such, the return on money market funds is only slightly higher than the return on Treasury Bills. Because of the credit quality and short-term nature of the investments, there is only a very slight risk of negative return. The fund charges 0.60 percent in expenses. The return on a mutual fund after accounting for management expenses is calculated as follows. If a fund charges 2 percent in expenses and it is expected to yield a 10 percent return before expenses, then the return on this fund after expenses will be (1 +0.10X(1 -0.02) - 1 = 0.078 or 7.8 percent. QUESTIONS 1. What advantages/disadvantages do the mutual funds offer compared to company stock for your retirement investing? 2. One can assess investment risk by looking forward to how assets are expected to react to a particular set of circumstances or "states of economy. Use the following set of assumptions for the coming year to compute the expected rates of return (before expenses) and the standard deviations for the mutual funds described above. Scenario Probability Recession Near Recession Normal Near Boom Boom 15% 20% 30% 20% 15% Expected Rate of Return (before expenses) S&P 500 Small-Cap Large-Cap Bond Money Index Fund Fund Fund Fund Market Fund -12% -30% -10% 18% 2% -8% -20% -6% 14% 3% 12% 22% 12% 8% 4% 38% 15% -1% 5% 36% 54% 20% -6% 6% 22% 3. Given the expected returns calculated for each of the mutual funds above, estimate the betas of these funds. Assume a risk-free rate of 4 percent and the expected market return equal to the expected return on the S&P 500 Index Fund. 4. If you decide to invest your money equally in the Small-Cap Fund and Bond Fund, what would your portfolio's expected return and risk level (standard deviation and beta) be? Please show your calculations. (Hint: Adjust mutual fund returns for management expenses as explained in footnote 1.) 5. What would happen if you were to put 70 percent of your portfolio in the Small-Cap Fund and 30 percent in the S&P 500 Index Fund? What would be this portfolio's expected return and risk level (standard deviation and beta)? Is this combination better than the previous one? 6. The returns of the Imperium Small-Cap Fund are the most volatile of all the mutual funds offered in the 401(k) plan. Why would you ever want to invest in this fund? When you examine the expenses of the mutual funds, you will notice that this fund also has the highest expenses. Will this affect your decision to invest in this fund? Retirement Planning at J&J Bagel You recently graduated from Suffolk University, and your job search led you to J&J Bagel, Inc. As you are finishing your employment paperwork, Jerry Chen, one of the co-owners of J&J Bagel, informs you about the company's new 401(k) plan. A 401(k) is a type of retirement plan, offered by many companies. A 401(k) is tax deferred, which means that any deposits you make into the plan are deducted from your current income, so no current taxes are paid on these deposits. For example, if your annual salary is $30,000 and you contribute $1,500 to the 401(k) plan, you will pay taxes only on the $28,500 in income. No taxes will be due on any capital gains or plan income while you are invested in the plan, but you will pay taxes when you withdraw the money at retirement. You can contribute up to 15 percent of your salary to the plan. As is common, J&J Bagel has a 5 percent match program. This means that the company will match your contribution dollar-for-dollar up to 5 percent of your salary, but you must contribute to get the match. In other words, if you contribute 5 percent of your $30,000 salary (which is $1,500) towards the 401(k) plan, J&J Bagel will match your contribution by adding another $1,500 to your plan, so that $3,000 in total will be contributed to your 401(k) plan. The 401(k) plan has several options for investments, most of which are mutual funds. As you know, a mutual fund is a portfolio of assets. When you purchase shares in a mutual fund, you are actually purchasing partial ownership of the fund's assets, similar to purchasing shares of stock in a company. The return of the fund is the weighted average of the return of the assets owned by the fund, minus expenses. The largest expense is typically the management fee paid to the fund managers, who make all of the investment decisions for the fund. J&J Bagel uses Imperium Financial Services as its 401(k) plan administrator. Jerry Chen then explains the following retirement investment options available for employees: 1. Company Stock. One option is stock in J&J Bagel. The company is currently privately held. The price you would pay for the stock is based on an annual appraisal, less a 20 percent discount. When you are interviewed by the owners, John Benson and Jerry Chen, they informed you that the company stock was expected to be publically sold in three to five years. If you needed to sell the stock before it became publicly traded, the company would buy it back at the then-current appraised value. 2. Imperium S&P 500 Index Fund. This mutual fund tracks the S&P 500 Index. Stocks in the fund are weighted exactly the same as they are in the S&P 500 Index. This means that the fund's return is approximately the return of the S&P 500 Index, minus expenses. With an index fund, the manager is not required to research stocks and make investment decisions, so fund expenses are usually low. The Imperium S&P 500 Index Fund charges expenses of 0.20 percent of assets per year.' 3. Imperium Small-Cap Fund. This fund primarily invests in small capitalization stocks. As such, the returns of the fund are more volatile. The fund can also invest 10 percent of its assets in companies based outside of the U.S. This fund charges 1.7 percent of assets in expenses per year. 4. Imperium Large-Cap Fund. This fund invests primarily in large capitalization stocks of companies based in the U.S. The fund is managed by Jenna King and has outperformed the market in six out of the last eight years. The fund charges 1.5 percent in expenses. 5. Imperium Bond Fund. This fund invests in long-term corporate bonds issued by U.S. companies. The fund is restricted to investments in bonds with investment grade credit rating. This fund charges 1.4 percent in expenses. 6. Imperium Money Market Fund. This fund invests in short-term, high credit quality debt instruments, which include Treasury Bills. As such, the return on money market funds is only slightly higher than the return on Treasury Bills. Because of the credit quality and short-term nature of the investments, there is only a very slight risk of negative return. The fund charges 0.60 percent in expenses. The return on a mutual fund after accounting for management expenses is calculated as follows. If a fund charges 2 percent in expenses and it is expected to yield a 10 percent return before expenses, then the return on this fund after expenses will be (1 +0.10X(1 -0.02) - 1 = 0.078 or 7.8 percent. QUESTIONS 1. What advantages/disadvantages do the mutual funds offer compared to company stock for your retirement investing? 2. One can assess investment risk by looking forward to how assets are expected to react to a particular set of circumstances or "states of economy. Use the following set of assumptions for the coming year to compute the expected rates of return (before expenses) and the standard deviations for the mutual funds described above. Scenario Probability Recession Near Recession Normal Near Boom Boom 15% 20% 30% 20% 15% Expected Rate of Return (before expenses) S&P 500 Small-Cap Large-Cap Bond Money Index Fund Fund Fund Fund Market Fund -12% -30% -10% 18% 2% -8% -20% -6% 14% 3% 12% 22% 12% 8% 4% 38% 15% -1% 5% 36% 54% 20% -6% 6% 22% 3. Given the expected returns calculated for each of the mutual funds above, estimate the betas of these funds. Assume a risk-free rate of 4 percent and the expected market return equal to the expected return on the S&P 500 Index Fund. 4. If you decide to invest your money equally in the Small-Cap Fund and Bond Fund, what would your portfolio's expected return and risk level (standard deviation and beta) be? Please show your calculations. (Hint: Adjust mutual fund returns for management expenses as explained in footnote 1.) 5. What would happen if you were to put 70 percent of your portfolio in the Small-Cap Fund and 30 percent in the S&P 500 Index Fund? What would be this portfolio's expected return and risk level (standard deviation and beta)? Is this combination better than the previous one? 6. The returns of the Imperium Small-Cap Fund are the most volatile of all the mutual funds offered in the 401(k) plan. Why would you ever want to invest in this fund? When you examine the expenses of the mutual funds, you will notice that this fund also has the highest expenses. Will this affect your decision to invest in this fund

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started