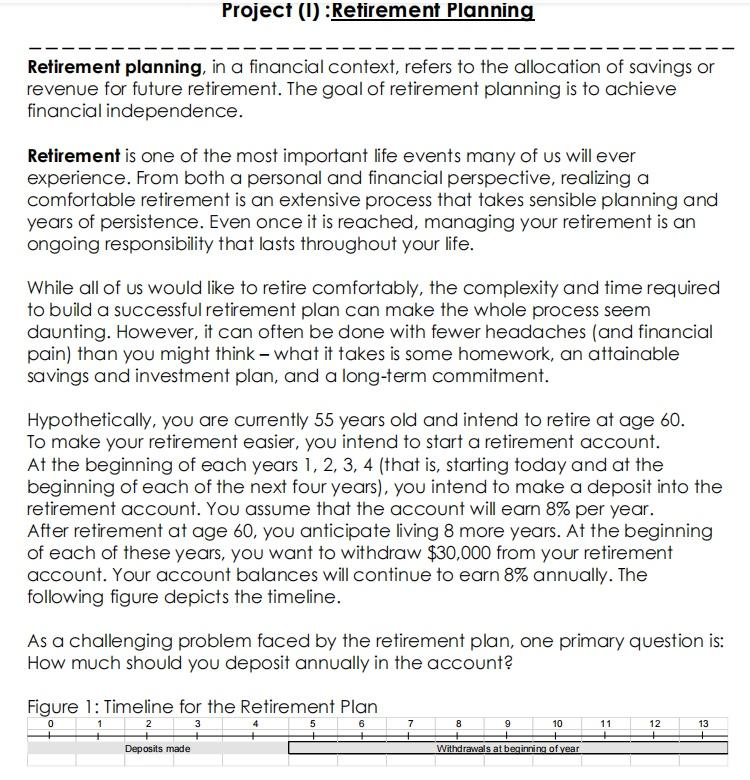

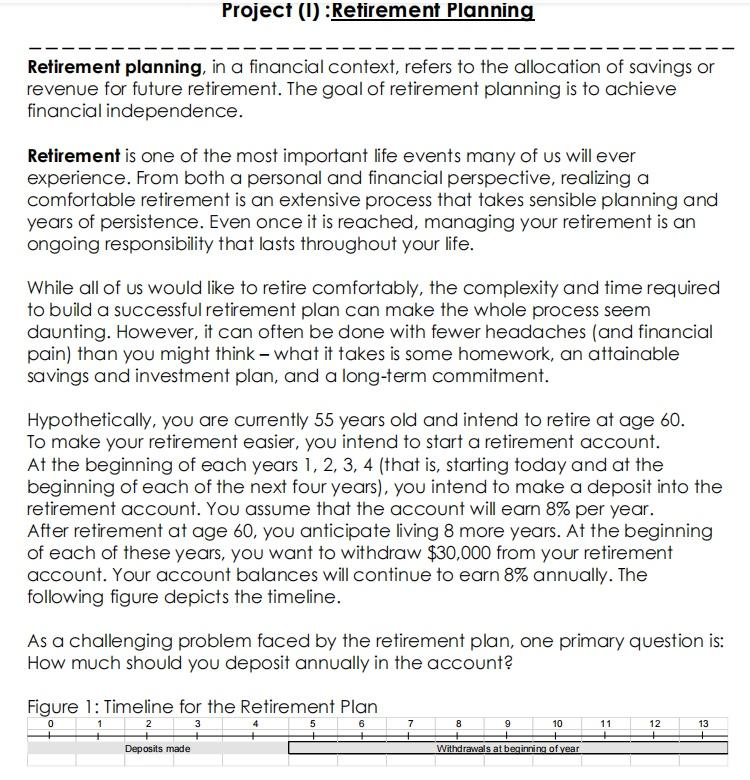

Retirement planning, in a financial context, refers to the allocation of savings or revenue for future retirement. The goal of retirement planning is to achieve financial independence. Retirement is one of the most important life events many of us will ever experience. From both a personal and financial perspective, realizing a comfortable retirement is an extensive process that takes sensible planning and years of persistence. Even once it is reached, managing your retirement is an ongoing responsibility that lasts throughout your life. While all of us would like to retire comfortably, the complexity and time required to build a successful retirement plan can make the whole process seem daunting. However, it can often be done with fewer headaches /and financial pain) than you might think - what it takes is some homework, an attainable savings and investment plan, and a long-term commitment. Hypothetically, you are currently 55 years old and intend to retire at age 60 . To make your retirement easier, you intend to start a retirement account. At the beginning of each years 1, 2, 3, 4 (that is, starting today and at the beginning of each of the next four years), you intend to make a deposit into the retirement account. You assume that the account will earn 8% per year. After retirement at age 60, you anticipate living 8 more years. At the beginning of each of these years, you want to withdraw $30,000 from your retirement account. Your account balances will continue to earn 8% annually. The following figure depicts the timeline. As a challenging problem faced by the retirement plan, one primary question is: How much should you deposit annually in the account? Fiqure 1: Timeline for the Retirement Plan In this project, we shall solve the problem with Excel Spreadsheet, with two different approaches: 1. Goal-Seek and Solver Based Approach: The exhibit the cash flow for the retirement plan, please create a Retirement Plan Table. In the table, for each year, please track the following major financial components: 1) "Account balance, beginning of year" 2) "Deposit/Withdraw at beginning of year" 3) "Interest earned during year" 4) "Total in account, end year" This problem has 5 deposits and 8 annual withdrawals, all made at the beginning of the year. The beginning of year 13 is the last year of the retirement plan; if the annual deposit is correctly computed, the balance at the beginning of year 13 after the withdrawal should be zero. To this end, you may apply Goal-Seek tool to find the proper annual deposit. Instead of Goal-Seek, please use Solver to find the proper annual deposit. With two different tools, please confirm that both yield the same solution. 2. Cash-Flow Formula, e.g., PMT The second approach is based on the following equality: Present value of withdrawals=Present Value of Deposits In this case, you may track the present value of withdraws, which can be treated as an initial loan. Therefore, the annual deposit can be obtained via =PMT() to compute the payment. Compare the results via both approaches, they should be the same. Otherwise, there should be some error. As a manager of retirement plan, it is necessary to have some sense of what-ifs. As the last task of this project, please consider the case with annual interest rate of 10% and 12%, in lieu of 8%. Comparing those annual deposits associated with those annual interest rates. What is your observation? Please comment and explain. You are expected to prepare a nice report in a Word document and submit your well-structured report with a maximum of 5 pages. The analysis needs to be done with Excel Spreadsheet, and the project report should be prepared with MS Word. The report may include two sections: 1) A page or two to introduce the retirement business (make it clear to someone who is totally new to such service, what is current market, how does it work for the business, etc.) 2) Please highlight your results for the above questions as clearly as possible. Retirement planning, in a financial context, refers to the allocation of savings or revenue for future retirement. The goal of retirement planning is to achieve financial independence. Retirement is one of the most important life events many of us will ever experience. From both a personal and financial perspective, realizing a comfortable retirement is an extensive process that takes sensible planning and years of persistence. Even once it is reached, managing your retirement is an ongoing responsibility that lasts throughout your life. While all of us would like to retire comfortably, the complexity and time required to build a successful retirement plan can make the whole process seem daunting. However, it can often be done with fewer headaches /and financial pain) than you might think - what it takes is some homework, an attainable savings and investment plan, and a long-term commitment. Hypothetically, you are currently 55 years old and intend to retire at age 60 . To make your retirement easier, you intend to start a retirement account. At the beginning of each years 1, 2, 3, 4 (that is, starting today and at the beginning of each of the next four years), you intend to make a deposit into the retirement account. You assume that the account will earn 8% per year. After retirement at age 60, you anticipate living 8 more years. At the beginning of each of these years, you want to withdraw $30,000 from your retirement account. Your account balances will continue to earn 8% annually. The following figure depicts the timeline. As a challenging problem faced by the retirement plan, one primary question is: How much should you deposit annually in the account? Fiqure 1: Timeline for the Retirement Plan In this project, we shall solve the problem with Excel Spreadsheet, with two different approaches: 1. Goal-Seek and Solver Based Approach: The exhibit the cash flow for the retirement plan, please create a Retirement Plan Table. In the table, for each year, please track the following major financial components: 1) "Account balance, beginning of year" 2) "Deposit/Withdraw at beginning of year" 3) "Interest earned during year" 4) "Total in account, end year" This problem has 5 deposits and 8 annual withdrawals, all made at the beginning of the year. The beginning of year 13 is the last year of the retirement plan; if the annual deposit is correctly computed, the balance at the beginning of year 13 after the withdrawal should be zero. To this end, you may apply Goal-Seek tool to find the proper annual deposit. Instead of Goal-Seek, please use Solver to find the proper annual deposit. With two different tools, please confirm that both yield the same solution. 2. Cash-Flow Formula, e.g., PMT The second approach is based on the following equality: Present value of withdrawals=Present Value of Deposits In this case, you may track the present value of withdraws, which can be treated as an initial loan. Therefore, the annual deposit can be obtained via =PMT() to compute the payment. Compare the results via both approaches, they should be the same. Otherwise, there should be some error. As a manager of retirement plan, it is necessary to have some sense of what-ifs. As the last task of this project, please consider the case with annual interest rate of 10% and 12%, in lieu of 8%. Comparing those annual deposits associated with those annual interest rates. What is your observation? Please comment and explain. You are expected to prepare a nice report in a Word document and submit your well-structured report with a maximum of 5 pages. The analysis needs to be done with Excel Spreadsheet, and the project report should be prepared with MS Word. The report may include two sections: 1) A page or two to introduce the retirement business (make it clear to someone who is totally new to such service, what is current market, how does it work for the business, etc.) 2) Please highlight your results for the above questions as clearly as possible