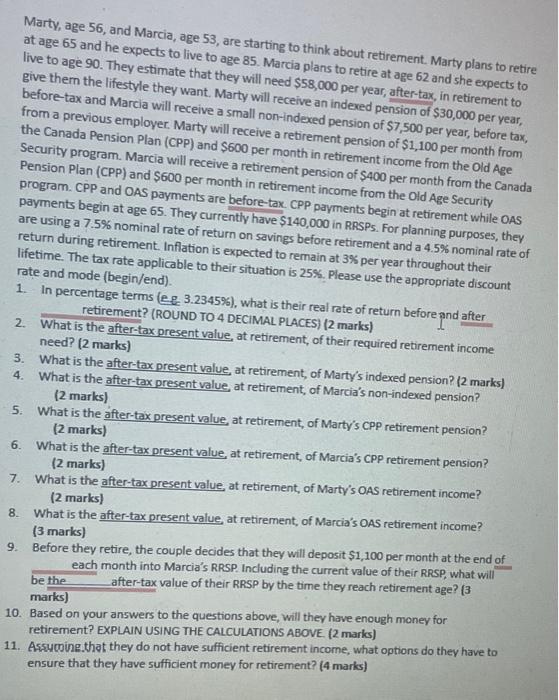

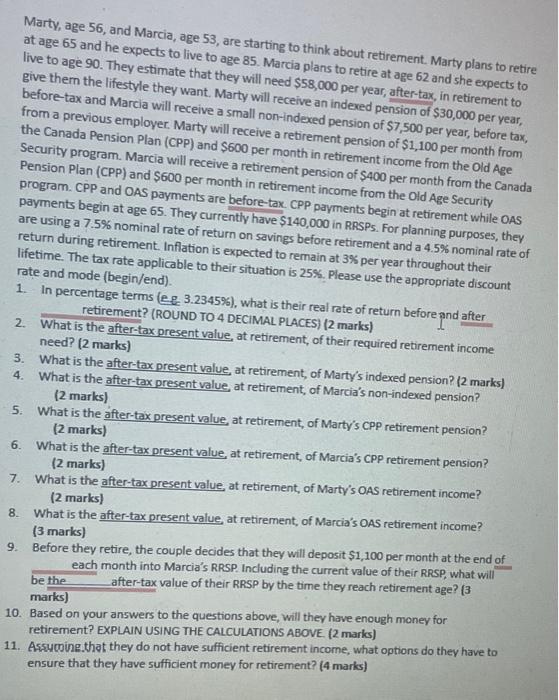

Marty, age 56, and Marcia, age 53, are starting to think about retirement. Marty plans to retire at age 65 and he expects to live to age 85 . Marcia plans to retire at age 62 and she expects to live to age 90 . They estimate that they will need $58,000 per vear, after-tax, in retirement to give thern the lifestyle they want. Marty will receive an indexed pension of $30,000 per year, before-tax and Marcia will receive a small non-indexed pension of $7,500 per year, before tax, from a previous employer. Marty will receive a retirement pension of $1,100 per month from the Canada Pension Plan (CPP) and $600 per month in retirement income from the Old Age Security program. Marcia will receive a retirement pension of $400 per month from the Canada Pension Plan (CPP) and $600 per month in retirement income from the Old Age Security program. CPP and OAS payments are before-tax. CPP payments begin at retirement while OAS payments begin at age 65 . They currently have $140,000 in RRSPs. For planning purposes, they are using a 7.5% nominal rate of return on savings before retirement and a 4.5% nominal rate of return during retirement. Inflation is expected to remain at 3% per year throughout their lifetime. The tax rate applicable to their situation is 25%. Please use the appropriate discount rate and mode (begin/end). 1. In percentage terms ( eg,3.2345%), what is their real rate of return before pnd after retirement? (ROUND TO 4 DECIMAL PLACES) (2 marks) 2. What is the after-tax present value, at retirement, of their required retirement income need? ( 2 marks) 3. What is the after-tax present value at retirement, of Marty's indexed pension? (2 marks) 4. What is the after-tax present value, at retirement, of Marcia's non-indered pension? (2 marks) 5. What is the after-tax present value, at retirement, of Marty's CPP retirement pension? (2 marks) 6. What is the after-tax present value, at retirement, of Marcia's CPP retirement pension? (2 marks) 7. What is the after-tax present value, at retirement, of Marty's OAS retirement income? (2 marks) 8. What is the after-tax present value, at retirement, of Marcia's OAS retirement income? (3 marks) 9. Before they retire, the couple decides that they will deposit $1,100 per month at the end of each month into Marcia's RRSP. Including the current value of their RRSP, what will" be the marks) after-tax value of their RRSP by the time they reach retirement age? [ 3 10. Based on your answers to the questions above, will they have enough money for retirement? EXPLAIN USING THE CALCULATIONS ABOVE. (2 marks) 11. Assuming.that they do not have sufficient retirement income, what options do they have to ensure that they have sufficient money for retirement? ( 4 marks)