Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Retirement planning Personal Finance Problem Hal Thomas, a 25-year-old college graduate, wishes to retire at age 65. To supplement other sources of retirement income, he

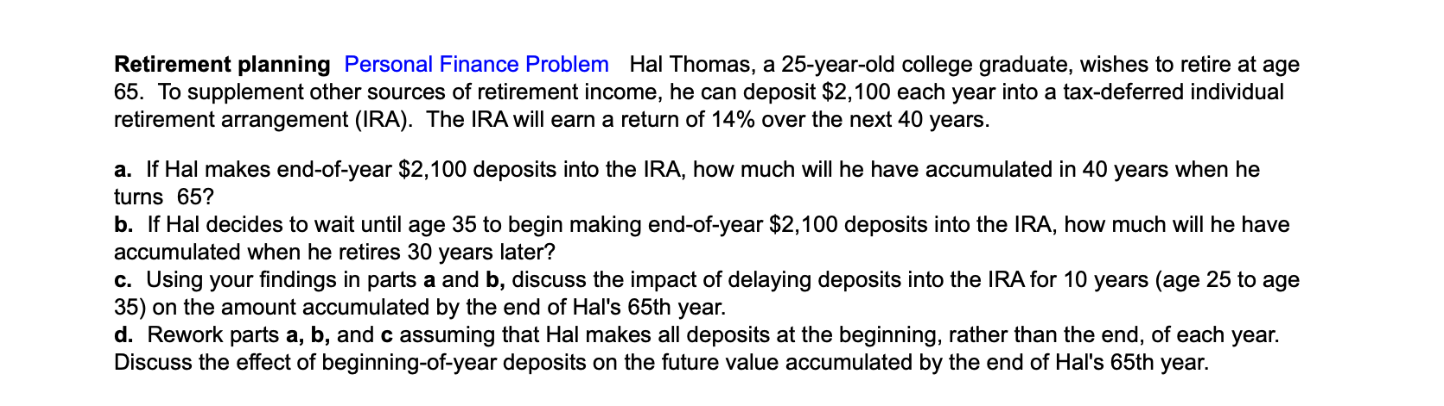

Retirement planning Personal Finance Problem Hal Thomas, a 25-year-old college graduate, wishes to retire at age 65. To supplement other sources of retirement income, he can deposit $2,100 each year into a tax-deferred individual retirement arrangement (IRA). The IRA will earn a return of 14% over the next 40 years. a. If Hal makes end-of-year $2,100 deposits into the IRA, how much will he have accumulated in 40 years when he turns 65? b. If Hal decides to wait until age 35 to begin making end-of-year $2,100 deposits into the IRA, how much will he have accumulated when he retires 30 years later? c. Using your findings in parts a and b, discuss the impact of delaying deposits into the IRA for 10 years (age 25 to age 35 ) on the amount accumulated by the end of Hal's 65 th year. d. Rework parts a, b, and c assuming that Hal makes all deposits at the beginning, rather than the end, of each year. Discuss the effect of beginning-of-year deposits on the future value accumulated by the end of Hal's 65th year

Retirement planning Personal Finance Problem Hal Thomas, a 25-year-old college graduate, wishes to retire at age 65. To supplement other sources of retirement income, he can deposit $2,100 each year into a tax-deferred individual retirement arrangement (IRA). The IRA will earn a return of 14% over the next 40 years. a. If Hal makes end-of-year $2,100 deposits into the IRA, how much will he have accumulated in 40 years when he turns 65? b. If Hal decides to wait until age 35 to begin making end-of-year $2,100 deposits into the IRA, how much will he have accumulated when he retires 30 years later? c. Using your findings in parts a and b, discuss the impact of delaying deposits into the IRA for 10 years (age 25 to age 35 ) on the amount accumulated by the end of Hal's 65 th year. d. Rework parts a, b, and c assuming that Hal makes all deposits at the beginning, rather than the end, of each year. Discuss the effect of beginning-of-year deposits on the future value accumulated by the end of Hal's 65th year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started