Answered step by step

Verified Expert Solution

Question

1 Approved Answer

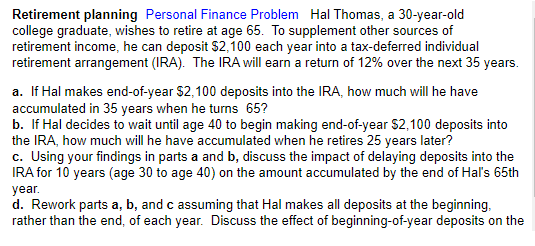

Retirement planning Personal Finance Problem Hal Thomas, a 3 0 - year - old college graduate, wishes to retire at age 6 5 . To

Retirement planning Personal Finance Problem Hal Thomas, a yearold

college graduate, wishes to retire at age To supplement other sources of

retirement income, he can deposit $ each year into a taxdeferred individual

retirement arrangement IRA The IRA will earn a return of over the next years.

a If Hal makes endofyear $ deposits into the IRA, how much will he have

accumulated in years when he turns

b If Hal decides to wait until age to begin making endofyear $ deposits into

the IRA, how much will he have accumulated when he retires years later?

c Using your findings in parts a and discuss the impact of delaying deposits into the

IRA for years age to age on the amount accumulated by the end of Hal's th

year.

d Rework parts a b and c assuming that Hal makes all deposits at the beginning,

rather than the end, of each year. Discuss the effect of beginningofyear deposits on the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started