Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Retirement Portfolio Mutual Fund Type Net Asset Value Shares Total Value Fidelity Capital Appreciation Large Cap $25.14 1225 $30,796.50 Fidelity Contrafund Large Cap $55.32 1500

| Retirement Portfolio | ||||

| Mutual Fund | Type | Net Asset Value | Shares | Total Value |

| Fidelity Capital Appreciation | Large Cap | $25.14 | 1225 | $30,796.50 |

| Fidelity Contrafund | Large Cap | $55.32 | 1500 | $82,980.00 |

| Fidelity Equity Income | Large Cap | $51.00 | 1400 | $71,400.00 |

| Fidelity Export & Multinational | Large Cap | $19.11 | 600 | $11,466.00 |

| Fidelity Strategic Large Cap Value | Large Cap | $12.68 | 1800 | $22,824.00 |

| Fidelity Mid Cap Stock | Mid Cap | $22.38 | 600 | $13,428.00 |

| Fidelity Value | Mid Cap | $69.92 | 850 | $59,432.00 |

| Fidelity Small Cap Independence | Small Cap | $19.02 | 1000 | $19,020.00 |

| Fidelity Low Priced Stock | Small Cap | $39.54 | 400 | $15,816.00 |

| Fidelity Puritan | Blended | $19.87 | 1500 | $29,805.00 |

| Fidelity Fidelity Fund | Blended | $30.44 | 675 | $20,547.00 |

| Fidelity Mortgage Securities | Bond | $11.23 | 700 | $7,861.00 |

| Fidelity Strategic Income | Bond | $10.59 | 400 | $4,236.00 |

| $389,611.50 |

Please show excel steps!

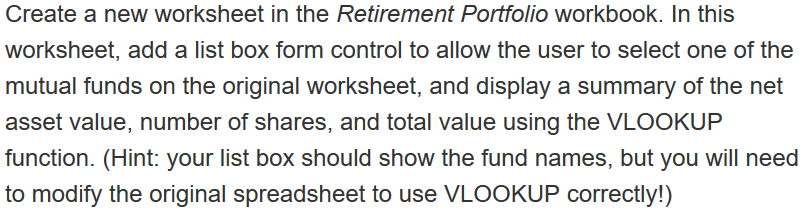

Create a new worksheet in the Retirement Portfolio workbook. In this worksheet, add a list box form control to allow the user to select one of the mutual funds on the original worksheet, and display a summary of the net asset value, number of shares, and total value using the VLOOKUP function. (Hint: your list box should show the fund names, but you will need to modify the original spreadsheet to use VLOOKUP correctly!)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started