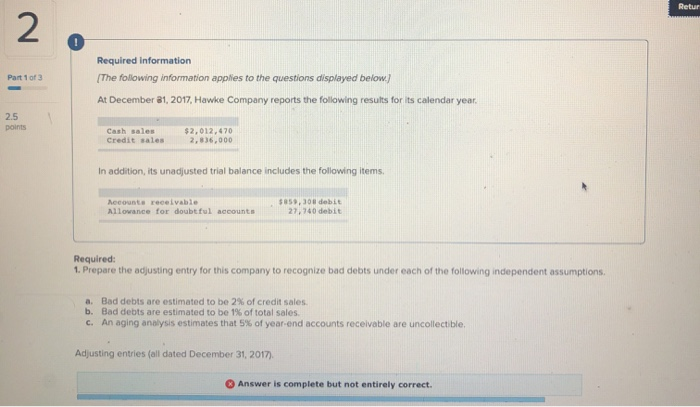

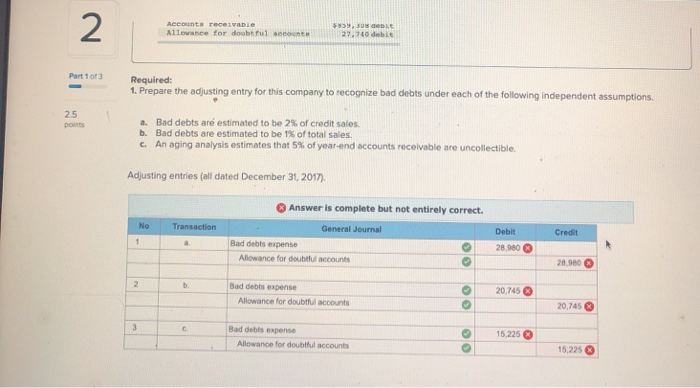

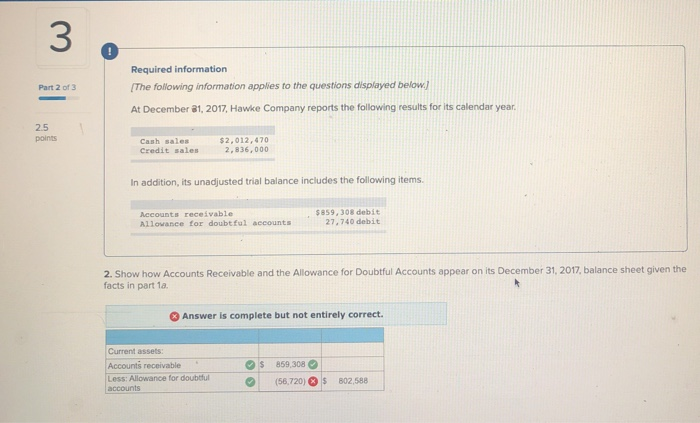

Retur 2 0 Part 1 of 3 Required information The following information applies to the questions displayed below.) At December 31, 2017, Hawke Company reports the following results for its calendar year. 2.5 points Cash sales Credit sales $2,012, 470 2,836,000 In addition, its unadjusted trial balance includes the following items, Recounts receivable Allowance for doubtful accounts $85,308 debit 27,740 debit Required: 1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions. a. Bad debts are estimated to be 2% of credit sales. b. Bad debts are estimated to be 1% of total sales c. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible, Adjusting entries (all dated December 31, 2017) Answer is complete but not entirely correct. 2 Accounts receivable Allowance for doubtful account $59,308 bit 27.740 debit Part 1 of 3 Required: 1. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions. 25 points a. Bad debts are estimated to be 2% of credit sales. b. Bad debts are estimated to be 1% of total sales An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31, 2017). No Transaction Answer is complete but not entirely correct. General Journal Bad debts expense Allowance for doubtful accounts Credit 1 28.980 plo 28.980 2 b. Bad debts expense Allowance for doubtful accounts 20,745 20,745 3 Baddebis expense Allowance for doubtful accounts 15,225 15,225 3 Part 2 of 3 Required information (The following information applies to the questions displayed below) At December 31, 2017, Hawke Company reports the following results for its calendar year, 25 points Cash sales Credit sales $2,012, 470 2,836,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $859,308 debit 27,740 debit 2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2017, balance sheet given the facts in part 10 Answer is complete but not entirely correct. $ 859,308 Current assets Accounts receivable Less: Allowance for doubtful accounts (56,720) $ 802,588