Answered step by step

Verified Expert Solution

Question

1 Approved Answer

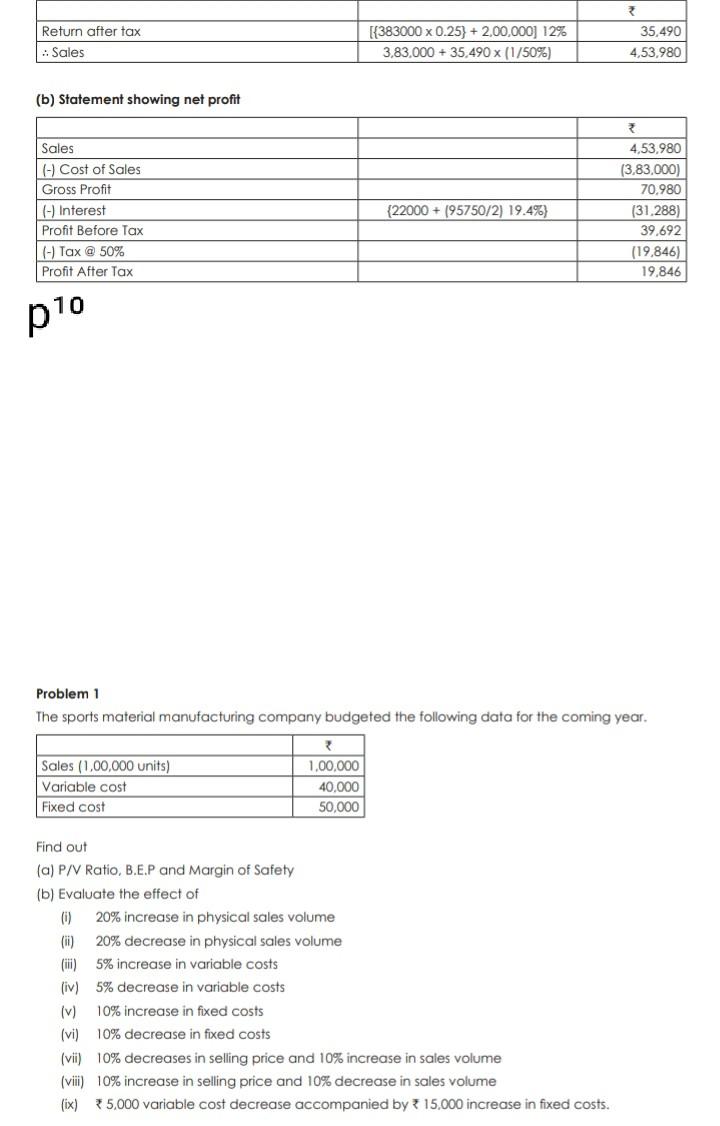

Return after tax : Sales [{383000 x 0.25) + 2,00,000) 12% 3.83.000 + 35,490 x (1/50%) 2 35,490 4,53,980 (b) Statement showing net profit Sales

Return after tax : Sales [{383000 x 0.25) + 2,00,000) 12% 3.83.000 + 35,490 x (1/50%) 2 35,490 4,53,980 (b) Statement showing net profit Sales (-) Cost of Sales Gross Profit (-) Interest Profit Before Tax (-) Tax @ 50% Profit After Tax (22000 + (95750/2) 19.4%) 4,53.980 (3.83.000) 70.980 (31.288) 39.692 (19,846) 19,846 p10 Problem 1 The sports material manufacturing company budgeted the following data for the coming year. Sales (1,00,000 units) Variable cost Fixed cost 3 1,00,000 40.000 50,000 Find out (a) P/V Ratio, B.E.P and Margin of Safety (b) Evaluate the effect of (0) 20% increase in physical sales volume (ii) 20% decrease in physical sales volume (iii) 5% increase in variable costs (iv) 5% decrease in variable costs (v) 10% increase in fixed costs (vi) 10% decrease in fixed costs (vii) 10% decreases in selling price and 10% increase in sales volume (vii) 10% increase in selling price and 10% decrease in sales volume (ix) 5,000 variable cost decrease accompanied by 15.000 increase in fixed costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started