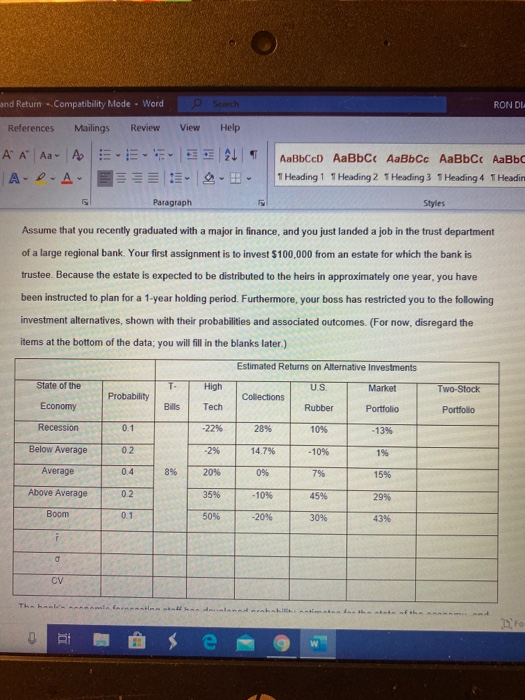

Return - Compatibility Mode - Word eferences Mailings Review Se View Help A Aa - Po :=-=-=- APA-EE = = 21 THeading 1 T Heading 2 Heading 3 T Heading 4 THE royes H LUNG Paragraph LUTS FUNS GLUTEO B Styles UTES b. Calculate the expected rate of return on each alternative and fill in the row for i in the table c. You should recognize that basing a decision solely on expected returns is appropriate only for risk neutral individuals. Because the beneficiaries of the trust, like virtually everyone, are risk averse, the riskiness of each alternative is an important aspect of the decision. One possible measure of risk is the standard deviation of returns (1) Calculate this value for each alternative, and fill in the row for in the table (2) What type of risk does the standard deviation measure? d. Suppose you suddenly remembered that the coefficient of variation (CV) is generally regarded as being a better measure of total risk than the standard deviation when the alternatives being considered have widely differing expected returns Calculate the CVs for the different securities, and fill in the row for CV in the table. Does the CV measurement produce the same risk rankings as the standard deviation? e. Suppose you created a two-stock portfolio by investing $50,000 in High Tech and $50,000 in Collections (1) Calculate the expected return (1) the standard deviation (del and the coefficient of variation (CVO for this portfolio and fill in the appropriate rows in the table (2) How does the riskiness of this two-stock portfolio compare to the riskiness of the individual stocks if they were held in isolation? f. Suppose an investor starts with a portfolio consisting of one randomly selected stock. What would happen (1) to the riskiness and (2) to the expected return of the portfolio as more randomly selected and Return - Compatibility Mode - Word Search RONDI References Mailings Review View Help A A A A E B 21 A-D-A-EEEE - 1 Heading 1 T Heading 2 T Heading 3 T Heading 4 T Headin Paragraph Styles Assume that you recently graduated with a major in finance, and you just landed a job in the trust department of a large regional bank. Your first assignment is to invest $100.000 from an estate for which the bank is trustee. Because the estate is expected to be distributed to the heirs in approximately one year, you have been instructed to plan for a 1-year holding period. Furthermore, your boss has restricted you to the following investment alternatives, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data; you will fill in the blanks later.) Estimated Returns on Alternative Investments State of the High US Market Two-Stock Probability Collections Economy Bills Rubber Portfolio Portfolio Recession 0.1 10% - 13% Tech -22% -2% 20% Below Average 02 - 10% 1% Average 15% Above Average 02 Boom 0 1 50% -20% 2014 43% CV