Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Return on Equity (or ROE) is calculated as income divided by average shareholder equity. The income number is listed on a company's Income Statement. Shareholder

Return on Equity (or ROE) is calculated as income divided by average shareholder equity. The income number is listed on a company's Income Statement. Shareholder Equity (which is the difference between Total Assets and Total Liabilities) can be found on the Balance Sheet.

What does ROE reveal about Citigroup and what makes Citibank different from other banks? Analysis Citigroups ROE.

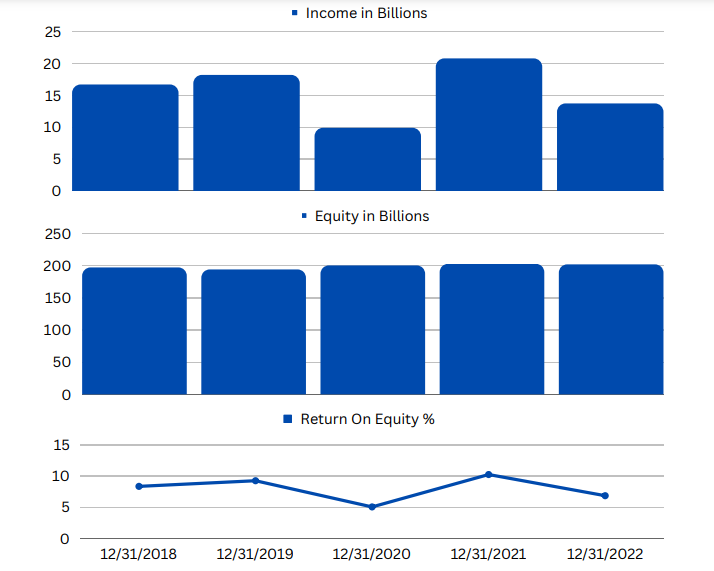

| Year | TTM NET INCOME |

| 2018 | $16.67B |

| 2019 | $18.17B |

| 2020 | $9.88B |

| 2021 | $20.76B |

| 2022 | $13.70B |

| Year | Shareholder's Equity |

| 2018 | $197.07B |

| 2019 | $193.95B |

| 2020 | $200.20B |

| 2021 | $202.67B |

| 2022 | $201.84B |

| Year | ROE |

| 2018 | 8.35% |

| 2019 | 9.25% |

| 2020 | 5.07% |

| 2021 | 10.24% |

| 2022 | 6.86% |

Income in Billions 25 22 20 15 10 5 0 250 200 150 Equity in Billions 100 50 0 15 10 5 Return On Equity % 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022 Income in Billions 25 22 20 15 10 5 0 250 200 150 Equity in Billions 100 50 0 15 10 5 Return On Equity % 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution The Return on Equity ROE for Citigroup a large American bank has fluctuated over the past few years ROE is calculated as net income divided b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started