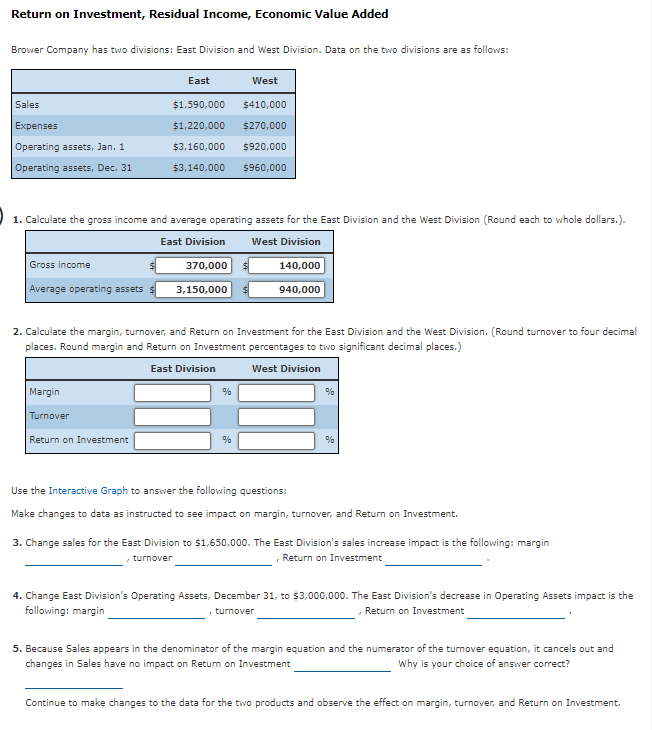

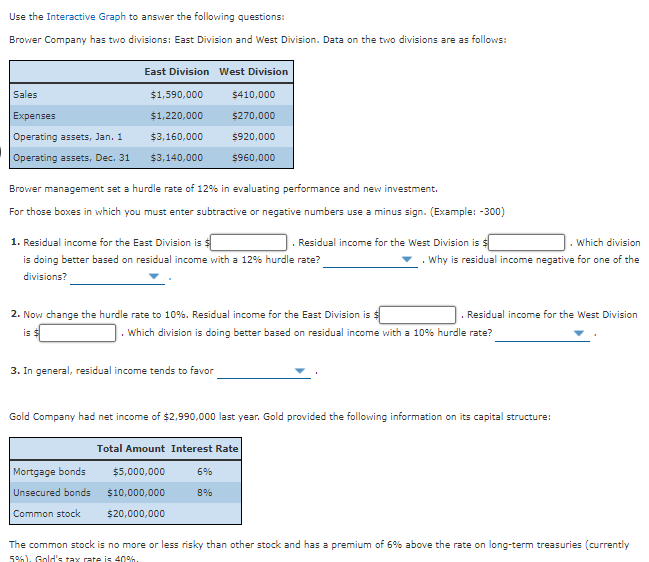

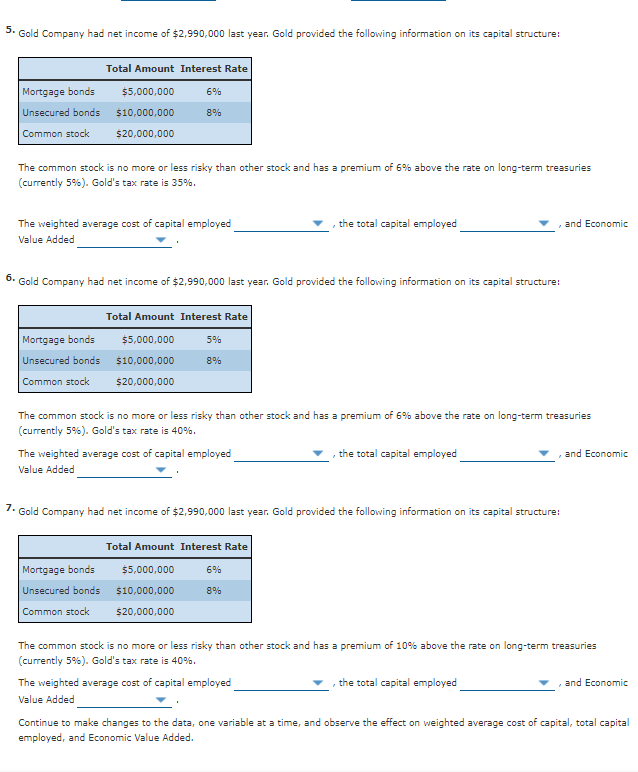

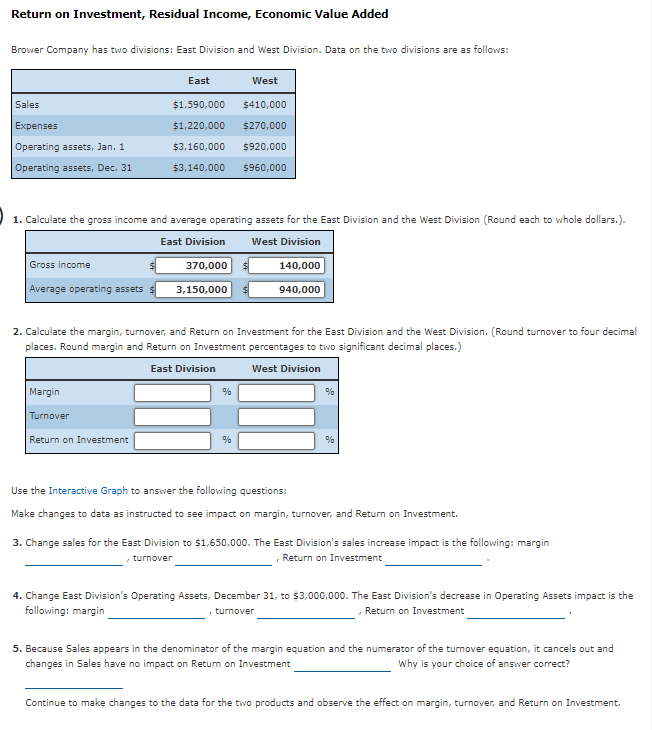

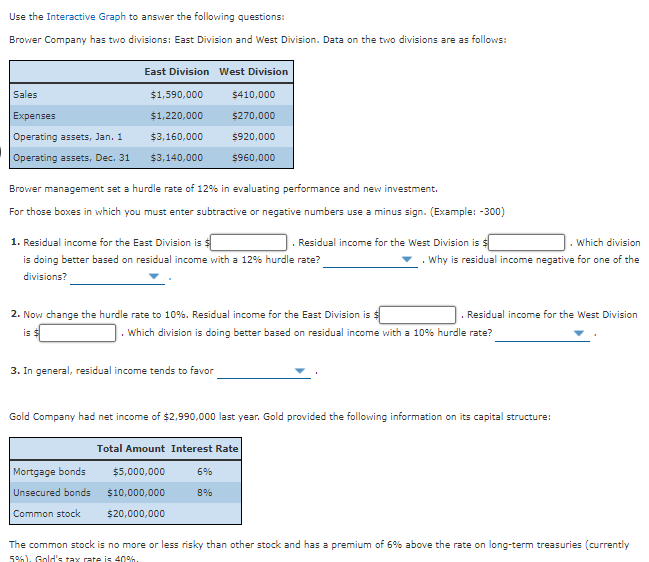

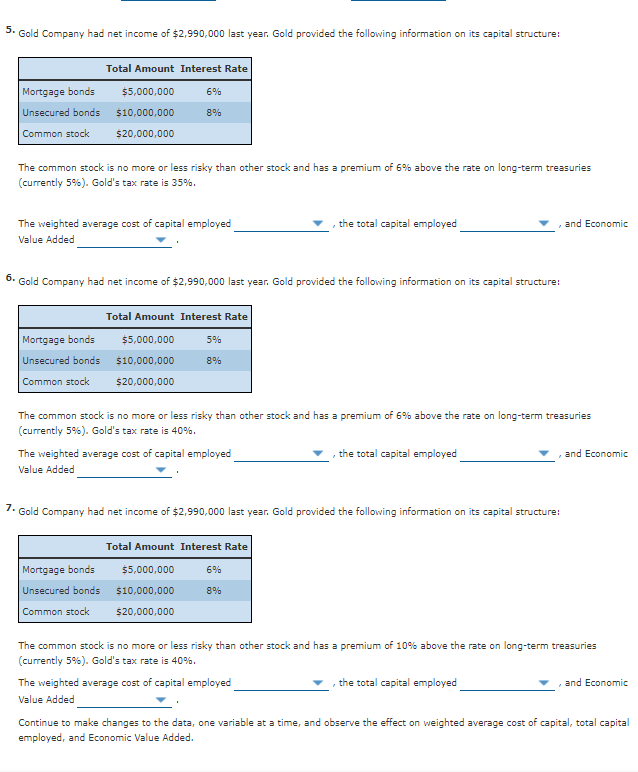

Return on Investment, Residual Income, Economic Value Added Brower Company has two divisions: East Division and West Division. Data on the two divisions are as follows: East West Sales $1,590,000 $410,000 Expenses $1,220,000 5270,000 Operating assets, Jan. 1 $3,160,000 5920,000 Operating assets, Dec. 31 $3,140,000 5960,000 1. Calculate the gross income and average operating assets for the East Division and the West Division (Round each to whole dollars.). West Division East Division Gross income 370,000 140,000 Average operating assets 3,150,000 940,000 2. Calculate the margin, turnover, and Return on Investment for the East Division and the West Division (Round turnover to four decimal places. Round margin and Return on Investment percentages to two significant decimal places.) East Division West Division Margin % % Turnover Return on Investment % % Use the Interactive Graph to answer the following questions: Make changes to data as instructed to see impact on margin, turnover, and Return on Investment. 3. Change sales for the East Division to $1,650,000. The East Division's sales increase impact is the following: margin Return on Investment turnover 4. Change East Division's Operating Assets, December 31, to $3,000,000. The East Division's decrease in Operating Assets impact is the following: margin turnover Return on Investment 5. Because Sales appears in the denominator of the margin equation and the numerator of the turnover equation, it cancels out and changes in Sales have no impact on Return on Investment Why is your choice of answer correct? Continue to make changes to the data for the two products and observe the effect on margin, turnover, and Return on Investment. Use the Interactive Graph to answer the following questions: Brower Company has two divisions: East Division and West Division. Data on the two divisions are as follows: Sales East Division West Division $1,590,000 $410,000 $1,220,000 $270,000 Expenses Operating assets, Jan. 1 $3,160,000 5920,000 Operating assets, Dec. 31 $3,140,000 5960,000 Brower management set a hurdle rate of 12% in evaluating performance and new investment. For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300) 1. Residual income for the East Division is $ Residual income for the West Division is $ . Which division is doing better based on residual income with a 12% hurdle rate? . Why is residual income negative for one of the divisions? 2. Now change the hurdle rate to 10%. Residual income for the East Division is $ Residual income for the West Division is $ Which division is doing better based on residual income with a 10% hurdle rate? 3. In general, residual income tends to favor Gold Company had net income of $2,990,000 last year. Gold provided the following information on its capital structure: Total Amount Interest Rate 6% Mortgage bonds Unsecured bonds $5,000,000 $10,000,000 8% Common stock $20,000,000 The common stock is no more or less risky than other stock and has a premium of 5% above the rate on long-term treasuries (currently 596). Gold's tax rate is 4096 5. Gold Company had net income of $2,990,000 last year. Gold provided the following information on its capital structure: Total Amount Interest Rate Mortgage bonds $5,000,000 6% Unsecured bonds $10,000,000 8% Common stock $20,000,000 The common stock is no more or less risky than other stock and has a premium of 6% above the rate on long-term treasures (currently 5%). Gold's tax rate is 35%. The weighted average cost of capital employed Value Added the total capital employed and Economic 6. Gold Company had net income of $2,990,000 last year. Gold provided the following information on its capital structure: Total Amount Interest Rate Mortgage bonds $5,000,000 5% Unsecured bonds $10,000,000 8% Common stock $20,000,000 The common stock is no more or less risky than other stock and has a premium of 6% above the rate on long-term treasures (currently 5%). Gold's tax rate is 40%. The weighted average cost of capital employed the total capital employed and Economic Value Added 7. Gold Company had net income of $2,990,000 last year. Gold provided the following information on its capital structure: Total Amount Interest Rate Mortgage bonds $5,000,000 6% Unsecured bonds $10,000,000 8% Common stock $20,000,000 The common stock is no more or less risky than other stock and has a premium of 10% above the rate on long-term treasures (currently 5%). Gold's tax rate is 40%. The weighted average cost of capital employed the total capital employed and Economic Value Added Continue to make changes to the data, one variable at a time, and observe the effect on weighted average cost of capital, total capital employed, and Economic Value Added