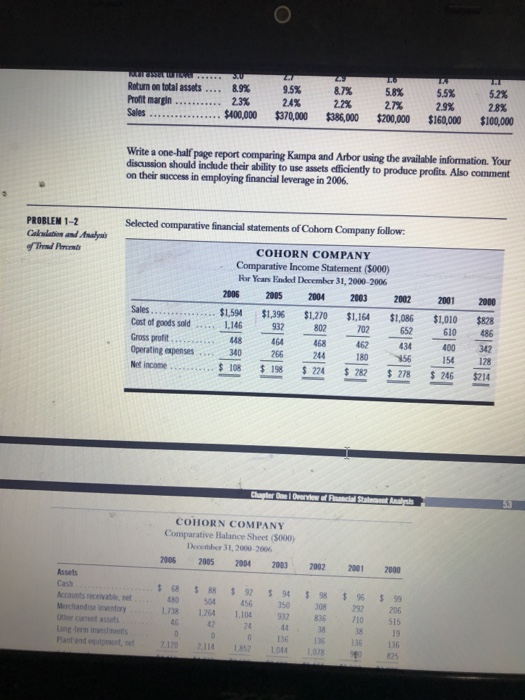

Return on total assets Profit margin... Sales 89% 23% ..$400,000 95% 2.4% $370,000 22% $38600 58% 27% $200,000 55% 29% $16a000 52% 28% maa $100,000 Kampa and Arbor using the available information. Your Write a one-half page report comparing discussion should include their ability to use assets efficiently to produce profits Also comment on their success in employing financial leverage in 2006. PROBLEM 1-2 Selected comparative financial statements of Cohorn Company follow: Trend Percm COHORN COMPANY Comparative Income Statement (5000) For Years Ended December 31, 2000-2006 2006 2004 2003 2002 2000 $1,594 $1,396 $1,270 $1,164 $,086 $1,010 $828 400 342 Sales Cost of goods sold1146 93 0 702652 610 486 . . Gross profit Operating expenses Net income 448 46 340 468 244 462 180 434 154 128 COHORN COMPANY Comparative Balance Sheet ($000) Deccthber 31, 2000-2006 2006 2005 2004 2003 2002 2001 2000 Assets $68 $88 $ 92 $94 $98 96 $99 Accounts receivable, net Merchandise inventory Other cureet assets Long term investmets Plant and 80504 456 350308 1738 1264 1104 932 835 38 292 10 515 38 136 19 136 1,078 825 Return on total assets Profit margin... Sales 89% 23% ..$400,000 95% 2.4% $370,000 22% $38600 58% 27% $200,000 55% 29% $16a000 52% 28% maa $100,000 Kampa and Arbor using the available information. Your Write a one-half page report comparing discussion should include their ability to use assets efficiently to produce profits Also comment on their success in employing financial leverage in 2006. PROBLEM 1-2 Selected comparative financial statements of Cohorn Company follow: Trend Percm COHORN COMPANY Comparative Income Statement (5000) For Years Ended December 31, 2000-2006 2006 2004 2003 2002 2000 $1,594 $1,396 $1,270 $1,164 $,086 $1,010 $828 400 342 Sales Cost of goods sold1146 93 0 702652 610 486 . . Gross profit Operating expenses Net income 448 46 340 468 244 462 180 434 154 128 COHORN COMPANY Comparative Balance Sheet ($000) Deccthber 31, 2000-2006 2006 2005 2004 2003 2002 2001 2000 Assets $68 $88 $ 92 $94 $98 96 $99 Accounts receivable, net Merchandise inventory Other cureet assets Long term investmets Plant and 80504 456 350308 1738 1264 1104 932 835 38 292 10 515 38 136 19 136 1,078 825