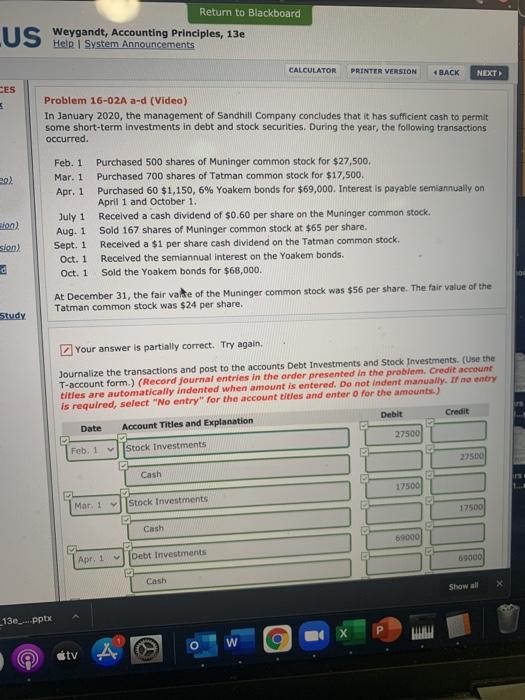

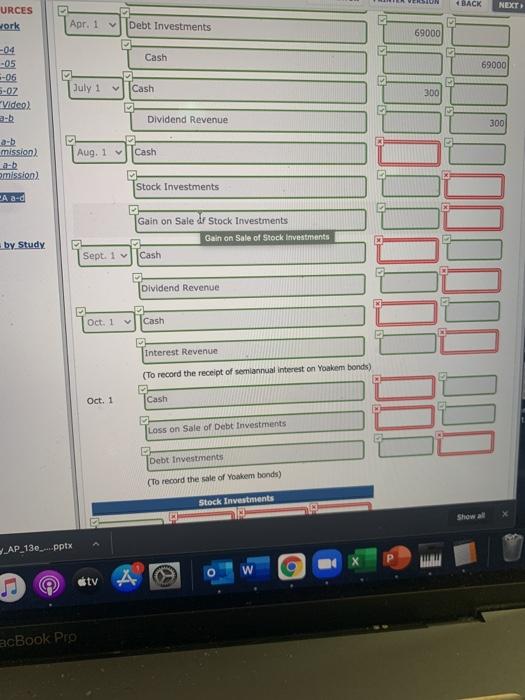

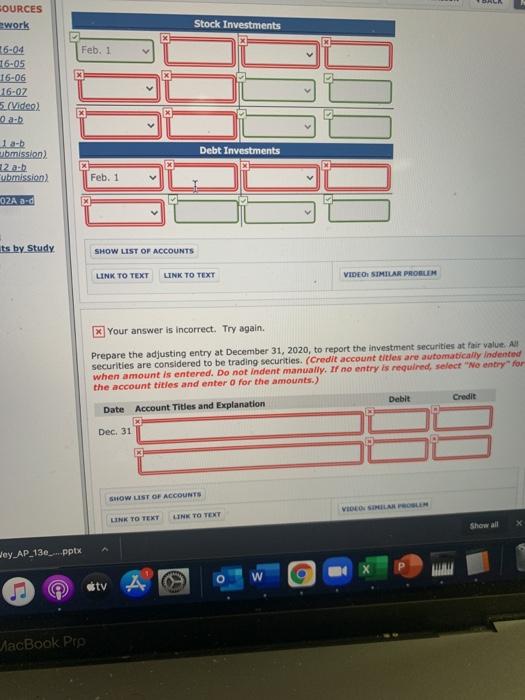

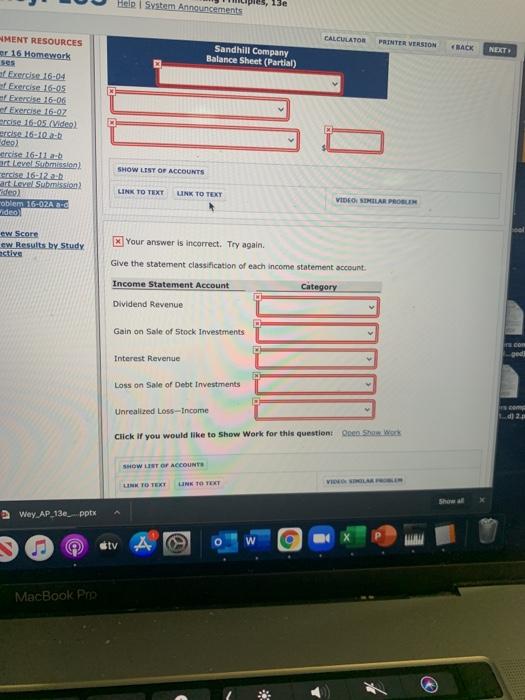

Return to Blackboard LUS Wayqanat, Accounting Principles, 136 CALCULATOR PRINTER VERSION BACK NEXT CES 5 Problem 16-02A a-d (Video) In January 2020, the management of Sandhill Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions occurred. 202 Bion) Feb. 1 Purchased 500 shares of Muninger common stock for $27,500. Mar. 1 Purchased 700 shares of Tatman common stock for $17.500 Apr. 1 Purchased 60 $1,150,6% Yoakem bonds for $69,000. Interest is payable semiannually on April 1 and October 1. July 1 Received a cash dividend of $0.60 per share on the Muninger common stock. Aug. 1 Sold 167 shares of Muninger common stock at $65 per share. Sept. 1 Received a $1 per share cash dividend on the Tatman common stock. Oct. 1 Received the semiannual interest on the Yoakem bonds. Oct. 1 Sold the Yoakem bonds for $68,000. At December 31, the fair vaite of the Muninger common stock was $56 per share. The fair value of the Tatman common stock was $24 per share. sion) Study Your answer is partially correct. Try again. Journalize the transactions and post to the accounts Debt Investments and Stock Investments. Use the T-account form.) (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If ne entry is required, select "No entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation 27500 Feb. 1 Stock Investments 27500 Cash 17500 Mar. 1 Stock Investments 17500 Cash 69000 Apr. 1 Debt Investments 69000 Cash Show all 13e_.pptx X P O W ( tv - BACK NEXT URCES work Apr. 1 Debt Investments 69000 Cash 69000 -05 --06 5-07 July 1 Cash 300 Video) Dividend Revenue 300 mission) Aug. 1 Cash mission) Stock Investments Aad Gain on Sale dr Stock Investments Gain on Sale of Stock Investments Sept. 1v Cash by Study Dividend Revenue Oct. 1 vCash Interest Revenue QUI DUD (To record the receipt of semiannual interest on Yoakem bonds) Oct. 1 Cash Loss on Sale of Debt Investments Debt Investments (To record the sale of Yoakem bonds) Stock Investments Show all AP_13e.pptx Que otvA acBook Pro Help System Announcements 13e CALCULATOR PAINTER VERSION BACK MENT RESOURCES er 16 Homework ses a. Exercise 16-04 Exercise 16-05 Sandhill Company Balance Sheet (Partial) NEXT Exercise 16-OZ ercise 16-05. (Video) deo) trise 16-12- art Level Submission zercise 16-12- art Level Submission SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TOKY VIDEO SIMILAR PROSEN oblem 16-02A - Wideo ew Score ew Results by Study active x Your answer is incorrect. Try again. Give the statement classification of each income statement account. Income Statement Account Category Dividend Revenue Gain on Sale of Stock Investments CO Interest Revenue Loss on Sale of Debt Investments Unrealized Loss-Income cm d22 Click If you would like to show Work for this question Open Show Work SHOW LIST OF ACCOUNTS VIDEO LINK TO TEXY LINK TO TEXT Show Wey AP_13e_ pptx D stv o W MacBook Pro Return to Blackboard LUS Wayqanat, Accounting Principles, 136 CALCULATOR PRINTER VERSION BACK NEXT CES 5 Problem 16-02A a-d (Video) In January 2020, the management of Sandhill Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions occurred. 202 Bion) Feb. 1 Purchased 500 shares of Muninger common stock for $27,500. Mar. 1 Purchased 700 shares of Tatman common stock for $17.500 Apr. 1 Purchased 60 $1,150,6% Yoakem bonds for $69,000. Interest is payable semiannually on April 1 and October 1. July 1 Received a cash dividend of $0.60 per share on the Muninger common stock. Aug. 1 Sold 167 shares of Muninger common stock at $65 per share. Sept. 1 Received a $1 per share cash dividend on the Tatman common stock. Oct. 1 Received the semiannual interest on the Yoakem bonds. Oct. 1 Sold the Yoakem bonds for $68,000. At December 31, the fair vaite of the Muninger common stock was $56 per share. The fair value of the Tatman common stock was $24 per share. sion) Study Your answer is partially correct. Try again. Journalize the transactions and post to the accounts Debt Investments and Stock Investments. Use the T-account form.) (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If ne entry is required, select "No entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation 27500 Feb. 1 Stock Investments 27500 Cash 17500 Mar. 1 Stock Investments 17500 Cash 69000 Apr. 1 Debt Investments 69000 Cash Show all 13e_.pptx X P O W ( tv - BACK NEXT URCES work Apr. 1 Debt Investments 69000 Cash 69000 -05 --06 5-07 July 1 Cash 300 Video) Dividend Revenue 300 mission) Aug. 1 Cash mission) Stock Investments Aad Gain on Sale dr Stock Investments Gain on Sale of Stock Investments Sept. 1v Cash by Study Dividend Revenue Oct. 1 vCash Interest Revenue QUI DUD (To record the receipt of semiannual interest on Yoakem bonds) Oct. 1 Cash Loss on Sale of Debt Investments Debt Investments (To record the sale of Yoakem bonds) Stock Investments Show all AP_13e.pptx Que otvA acBook Pro Help System Announcements 13e CALCULATOR PAINTER VERSION BACK MENT RESOURCES er 16 Homework ses a. Exercise 16-04 Exercise 16-05 Sandhill Company Balance Sheet (Partial) NEXT Exercise 16-OZ ercise 16-05. (Video) deo) trise 16-12- art Level Submission zercise 16-12- art Level Submission SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TOKY VIDEO SIMILAR PROSEN oblem 16-02A - Wideo ew Score ew Results by Study active x Your answer is incorrect. Try again. Give the statement classification of each income statement account. Income Statement Account Category Dividend Revenue Gain on Sale of Stock Investments CO Interest Revenue Loss on Sale of Debt Investments Unrealized Loss-Income cm d22 Click If you would like to show Work for this question Open Show Work SHOW LIST OF ACCOUNTS VIDEO LINK TO TEXY LINK TO TEXT Show Wey AP_13e_ pptx D stv o W MacBook Pro