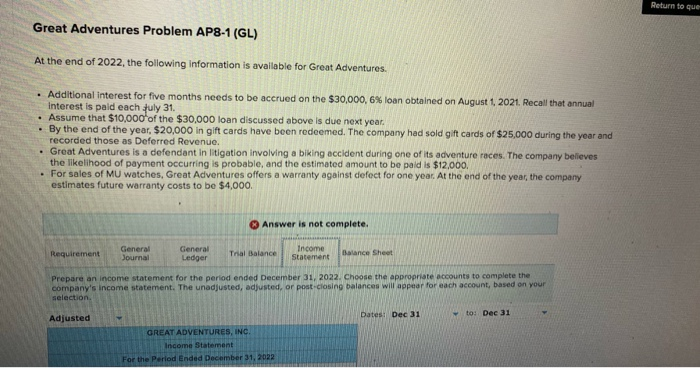

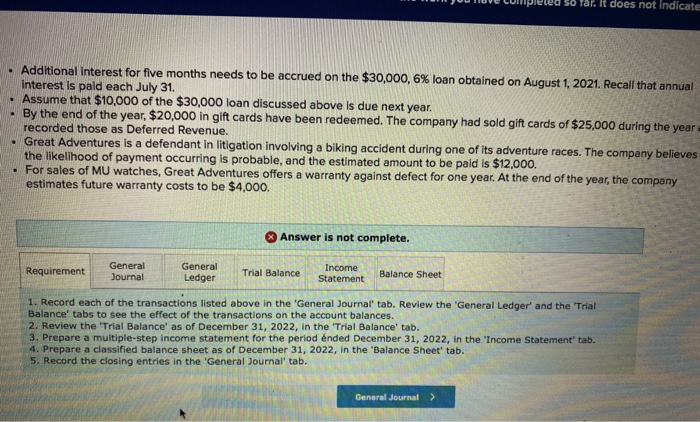

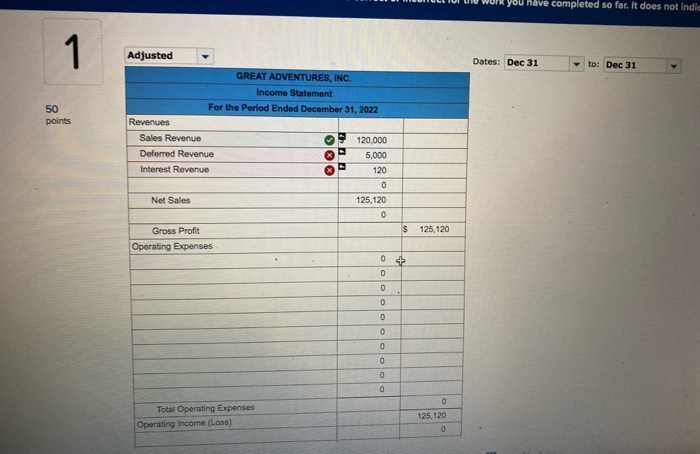

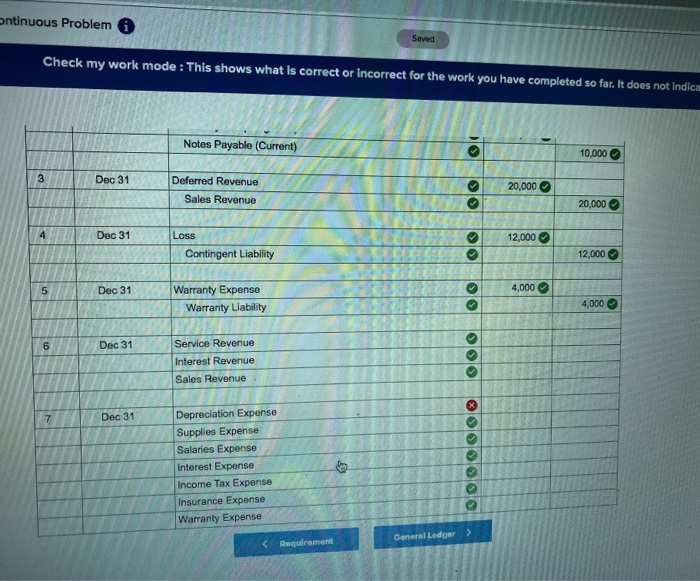

Return to que Great Adventures Problem AP8-1 (GL) At the end of 2022, the following information is available for Great Adventures. Additional interest for five months needs to be accrued on the $30,000, 6% loan obtained on August 1, 2021. Recall that annual Interest is paid each fuly 31. Assume that $10,000 of the $30,000 loan discussed above is due next year. . By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $25,000 during the year and recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $12,000. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $4,000. Answer is not complete. General Requirement General Journal Ledger Tral Balance Income Statement Balance Sheet Prepare an income statement for the period ended December 31, 2022. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-closing balances will appear for each account based on your Dates! Dec 31 to: Dec 31 Adjusted GREAT ADVENTURES, INC. Income Statement For the Period Ended December 31, 2022 Additional interest for five months needs to be accrued on the $30,000, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $10,000 of the $30,000 loan discussed above is due next year. . By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $25,000 during the year recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $12,000. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $4,000. Answer is not complete. General Journal General Requirement Trial Balance Income Statement Balance Sheet Ledger 1. Record each of the transactions listed above in the 'General Journal' tab. Review the 'General Ledger and the Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Review the Trial Balance' as of December 31, 2022, in the 'Trial Balancel tab. 3. Prepare a multiple-step income statement for the period ended December 31, 2022, in the Income Statement' tab. 4. Prepare a classified balance sheet as of December 31, 2022, in the Balance Sheet' tab. 5. Record the closing entries in the 'General Journar tab. General Journal > ILLIUI LITO WOIR you have completed so far. It does not India Adjusted Dates: Dec 31 to: Dec 31 points GREAT ADVENTURES, INC. Income Statement For the Period Ended December 31, 2022 Revenues Sales Revenue $ 120,000 Deferred Revenue - 5,000 Interest Revenue 120 0 Net Sales 125,120 0 Gross Profit Operating Expenses 0 $ 125,120 + 0 0 0 Total Operating Expenses Operating Income (Loss) 125, 120 ontinuous Problem Saved Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indice Notes Payable (Current) 10,000 Dec 31 Deferred Revenue Sales Revenue 20,000 20,000 Dec 31 12,000 Loss Contingent Liability 12,000 Dec 31 4,000 Warranty Expense Warranty Liability 4,000 Dec 31 Service Revenue Interest Revenue Sales Revenue OOOOOOOOOOOOO Dec 31 Depreciation Expense Supplies Expense Salaries Expense Interest Expense Income Tax Expense Insurance Expense Warranty Expense Ceneral Ledger > ILLIUI LITO WOIR you have completed so far. It does not India Adjusted Dates: Dec 31 to: Dec 31 points GREAT ADVENTURES, INC. Income Statement For the Period Ended December 31, 2022 Revenues Sales Revenue $ 120,000 Deferred Revenue - 5,000 Interest Revenue 120 0 Net Sales 125,120 0 Gross Profit Operating Expenses 0 $ 125,120 + 0 0 0 Total Operating Expenses Operating Income (Loss) 125, 120 ontinuous Problem Saved Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indice Notes Payable (Current) 10,000 Dec 31 Deferred Revenue Sales Revenue 20,000 20,000 Dec 31 12,000 Loss Contingent Liability 12,000 Dec 31 4,000 Warranty Expense Warranty Liability 4,000 Dec 31 Service Revenue Interest Revenue Sales Revenue OOOOOOOOOOOOO Dec 31 Depreciation Expense Supplies Expense Salaries Expense Interest Expense Income Tax Expense Insurance Expense Warranty Expense Ceneral Ledger >