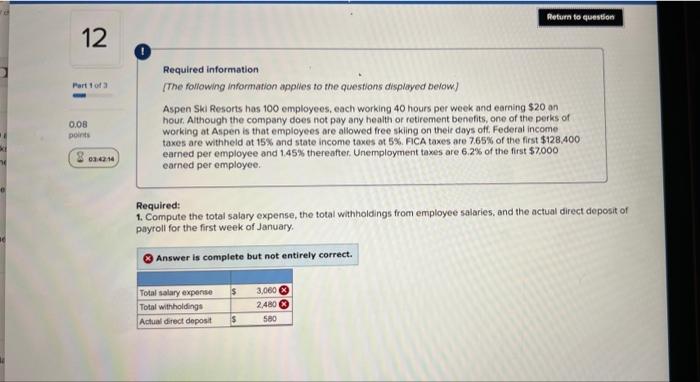

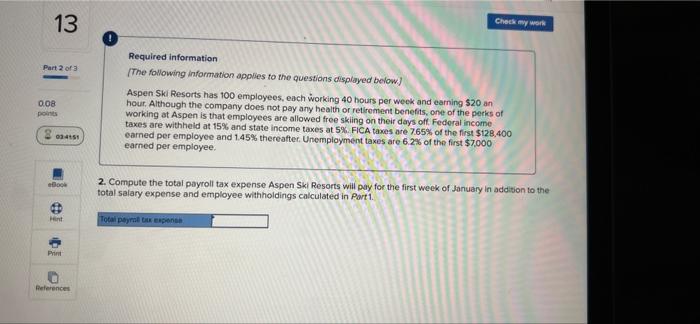

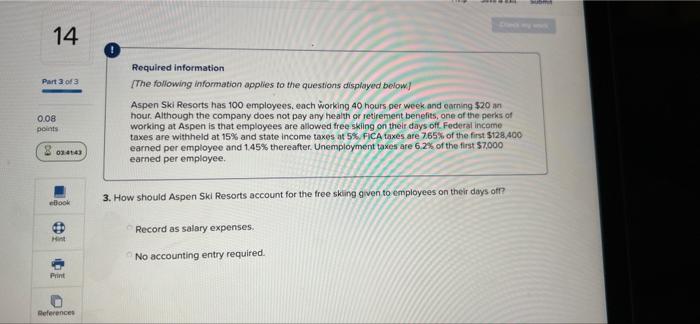

Return to question 12 Part of a 0.08 points Required information The following information applies to the questions displayed below) Aspen Ski Resorts has 100 employees, each working 40 hours per week and earning $20 on hour. Although the company does not pay any health or retirement benefits, one of the perks of working at Aspen is that employees are allowed free skiing on their days off. Federal income taxes are withheld at 15% and state income taxes at 5% FICA taxes are 7.65% of the first $128.400 earned per employee and 145% thereafter. Unemployment taxes are 6.2% of the first $7,000 earned per employee. 80 24 Required: 1. Compute the total salary expense, the total withholdings from employee salaries, and the actual direct deposit of payroll for the first week of January Answer is complete but not entirely correct. $ Total salary expense Total withholding Actual direct deposit 3,060 24803 580 $ 13 Check my w Part 2 of 3 0.08 points Required information The following information applies to the questions displayed below) Aspen Ski Resorts has 100 employees, each working 40 hours per week and earning 520 an hour. Although the company does not pay any health or retirement benefits, one of the perks of working at Aspen is that employees are allowed free skiing on their days off. Federal income taxes are withheld at 15% and state income taxes at 5% FICA taxes are 765% of the first $128.400 earned per employee and 1.45% thereafter. Unemployment taxes are 6.2% of the first $7,000 earned per employee. 09:45 eBook 2. Compute the total payroll tax expense Aspen Ski Resorts will pay for the first week of January in addition to the total salary expense and employee withholdings calculated in Part 1 Hint Total para tempore Print References sum 14 Part 3 of 3 0.08 points Required information The following information applies to the questions displayed below! Aspen Ski Resorts has 100 employees. each working 40 hours per week and caring 520 a hour. Although the company does not pay any health or retirement benefits, one of the perks of working at Aspen is that employees are allowed free skiing on their days of Federal income taxes are withheld at 15% and state income taxes at 5% FICA taxes are 765% of the first $128.400 earned per employee and 145% thereafter. Unemployment taxes are 6.2% of the first $7,000 earned per employee. 03:41:49 book 3. How should Aspen Ski Resorts account for the free skiing given to employees on their days off? Record as salary expenses. int No accounting entry required. Print References