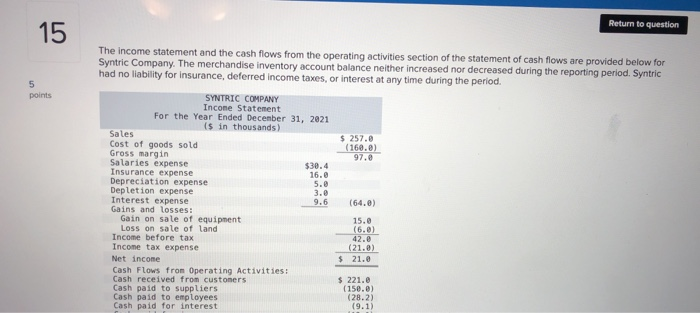

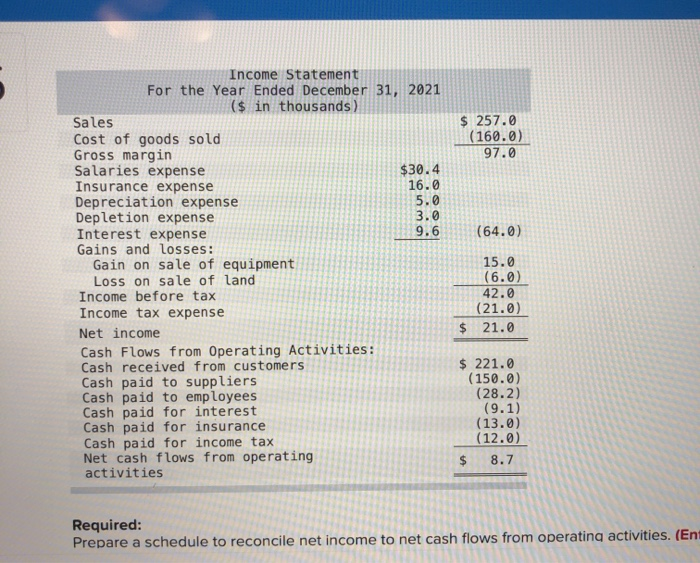

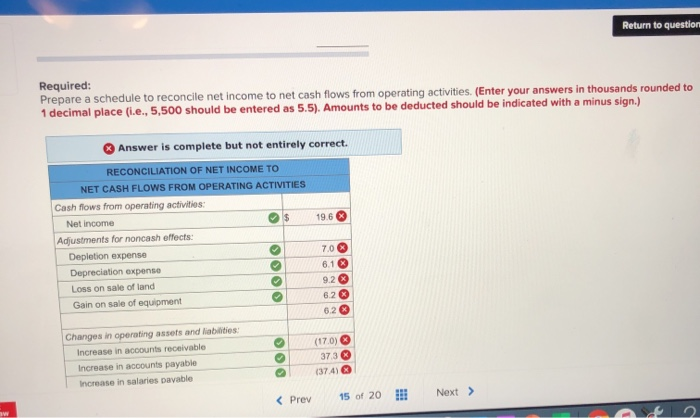

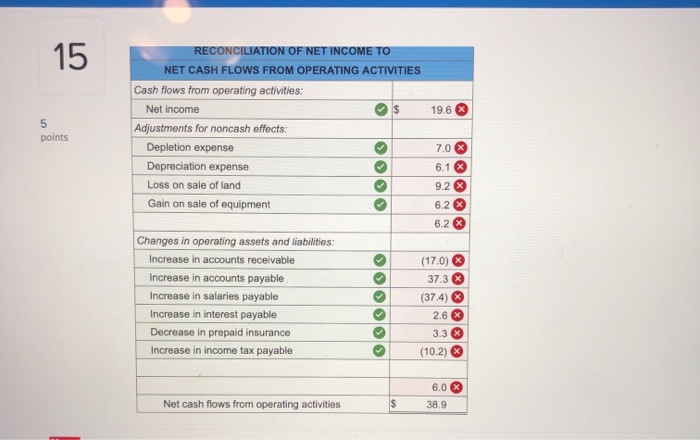

Return to question 15 5 points The income statement and the cash flows from the operating activities section of the statement of cash flows are provided below for Syntric Company. The merchandise inventory account balance neither increased nor decreased during the reporting period. Syntric had no liability for insurance, deferred income taxes, or interest at any time during the period. SYNTRIC COMPANY Incone Statement For the Year Ended December 31, 2021 (s in thousands) Sales $ 257.0 Cost of goods sold (160.0) Gross margin 97. Salaries expense $30.4 Insurance expense 16.0 Depreciation expense 5.0 Depletion expense 3.0 Interest expense 9.6 (64.0) Gains and losses: Gain on sale of equipment 15.0 Loss on sale of land (6.0) Income before tax 42.0 Income tax expense (21.0) Net income $ 21.0 Cash Flows from Operating Activities: Cash received from customers $ 221.0 Cash paid to suppliers (150.0) Cash paid to employees (28.2) Cash paid for interest (9.1) $ 257.0 (160.0) 97.0 (64.0) Income Statement For the Year Ended December 31, 2021 ($ in thousands) Sales Cost of goods sold Gross margin Salaries expense $30.4 Insurance expense 16.0 Depreciation expense 5.0 Depletion expense 3.0 Interest expense 9.6 Gains and losses: Gain on sale of equipment Loss on sale of land Income before tax Income tax expense Net income Cash Flows from Operating Activities: Cash received from customers Cash paid to suppliers Cash paid to employees Cash paid for interest Cash paid for insurance Cash paid for income tax Net cash flows from operating activities 15.0 (6.0) 42.0 (21.0) $ 21.0 $ 221.0 (150.0) (28.2) (9.1) (13.0) (12.0) $ 8.7 Required: Prepare a schedule to reconcile net income to net cash flows from operating activities. (Ent Return to question Required: Prepare a schedule to reconcile net income to net cash flows from operating activities. (Enter your answers in thousands rounded to 1 decimal place (i.e., 5,500 should be entered as 5.5). Amounts to be deducted should be indicated with a minus sign.) Answer is complete but not entirely correct. RECONCILIATION OF NET INCOME TO NET CASH FLOWS FROM OPERATING ACTIVITIES Cash flows from operating activities: Net Income $ 19.6 Adjustments for noncash effects: Depletion expense 7.0 Depreciation expense 6.13 Loss on sale of land 9.2 % Gain on sale of equipment 6.2 62 Changes in operating assets and liabilities: Increase in accounts receivable (170) Increase in accounts payable 3733 Increase in salaries pavable (374) 15 19.6 5 points RECONCILIATION OF NET INCOME TO NET CASH FLOWS FROM OPERATING ACTIVITIES Cash flows from operating activities: Net income $ Adjustments for noncash effects: Depletion expense Depreciation expense Loss on sale of land Gain on sale of equipment 7.0 6.1 x OOO 9.2 X 6.2 X 6.2 X Changes in operating assets and liabilities: Increase in accounts receivable Increase in accounts payable Increase in salaries payable Increase in interest payable Decrease in prepaid insurance Increase in income tax payable (17.0) 37.3 X (37.4) 2.6 X 3.3 X (10.2) X 6.0 X Net cash flows from operating activities $ 38.9