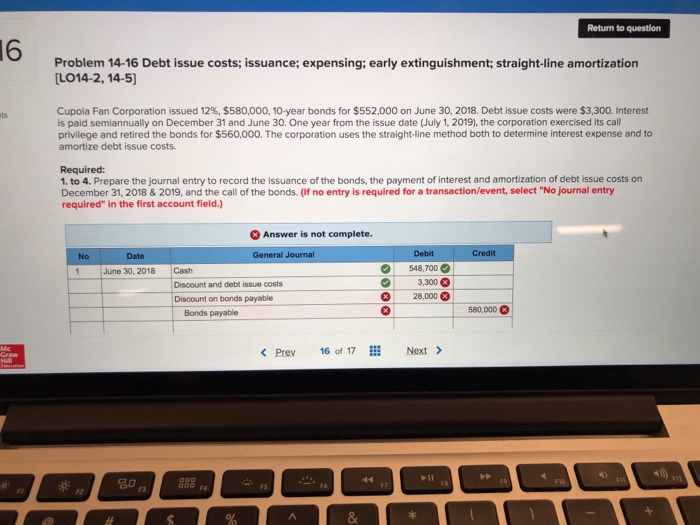

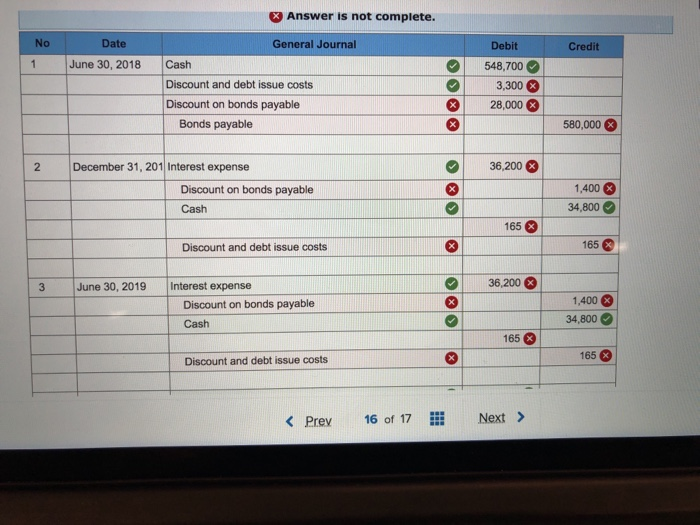

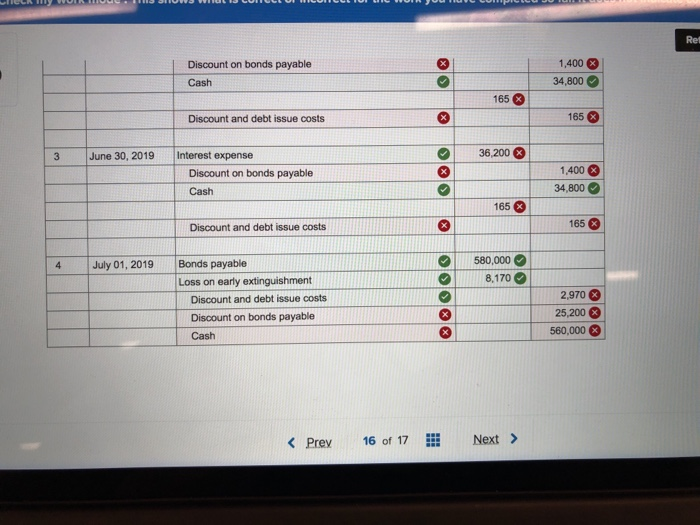

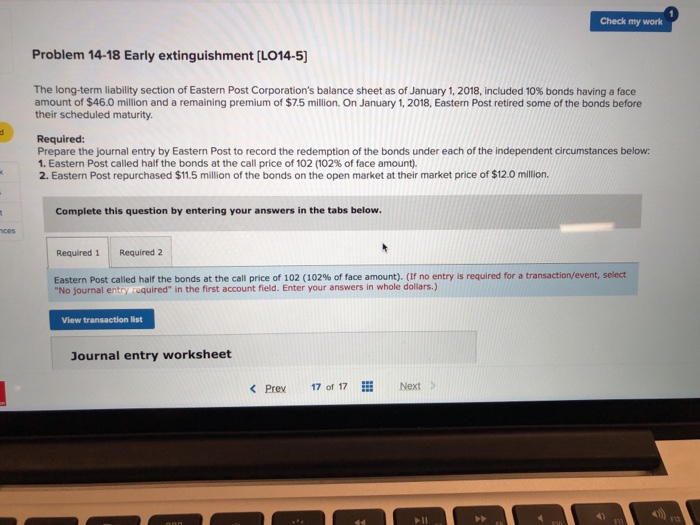

Return to question 16 Problem 14-16 Debt issue costs; issuance; expensing; early extinguishment; straight-line amortization LO14-2, 14-5 cupola Fan Corporation issued 12%, $580,000, 10-year bonds for $552,000 on June 30, 2018. Debt issue costs were $3.300. Interest is paid semiannually on December 31 and June 30. One year from the issue date (July 1, 2019), the corporation exercised its call privilege and retired the bonds for $560,000. The corporation uses the straight-line method both to determine interest expense and to amortize debt issue costs ts Required: 1. to 4. Prepare the journal entry to record the issuance of the bonds, the payment of interest and amortization of debt issue costs on December 31, 2018 & 2019, and the call of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. No Date General Journal Debit Credit 548,700 3,300 June 30, 2018 Cash Discount and debt issue costs Discount on bonds payable 28,000 Bonds payable 80,000 F4 FS 3 Answer is not complete. No Date General Journal Debit Credit 548,700 3,300 28,000 June 30, 2018 Cash Discount and debt issue costs Discount on bonds payable Bonds payable 580,000 2 December 31, 201 Interest expense 36.2000 Discount on bonds payable Cash 1,400 4,800 165 0 Discount and debt issue costs 165 3 June 30, 2019 Interest expense 36,200 Discount on bonds payable Cash 1,400 34,800 165 165 Discount and debt issue costs K Prev 16 of 17 Next> Ret Discount on bonds payable Cash 1,400 34,800 165 Discount and debt issue costs 165 3 June 30, 2019 Interest expense 36,200 Discount on bonds payable Cash 1,400 34,800 165 Discount and debt issue costs 165 580,000 8.170 4 July 01, 2019Bonds payable Loss on early extinguishment 2,970 Discount and debt issue costs Discount on bonds payable Cash RNNON25,200 560,0003 Check my work Problem 14-18 Early extinguishment [LO14-5) The long-term liability section of Eastern Post Corporation's balance sheet as of January 1, 2018, included 10% bonds having a face amount of $46.0 million and a remaining premium of $7.5 million. On January 1, 2018, Eastern Post retired some of the bonds before their scheduled maturity. Required: Prepare the journal entry by Eastern Post to record the redemption of the bonds under each of the independent circumstances below 1, Eastern Post called half the bonds at the call price of 102 (102% of face amount). 2. Eastern Post repurchased $11.5 million of the bonds on the open market at their market price of $12.0 million. Complete this question by entering your answers in the tabs below Required 1 Required 2 Eastern Post called half the bonds at the call price of 102 (102% of face amount). (if no entry is required for a transaction event, select No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet KPrev 17 or 17E Next 12