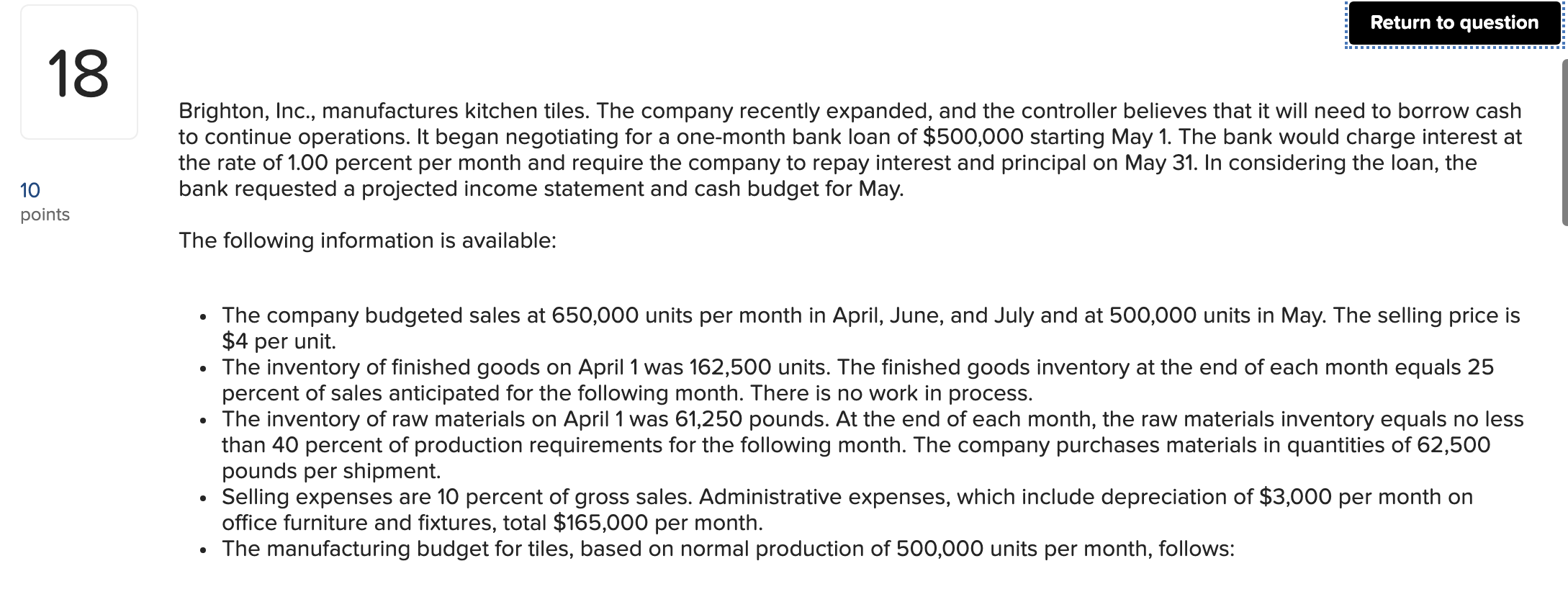

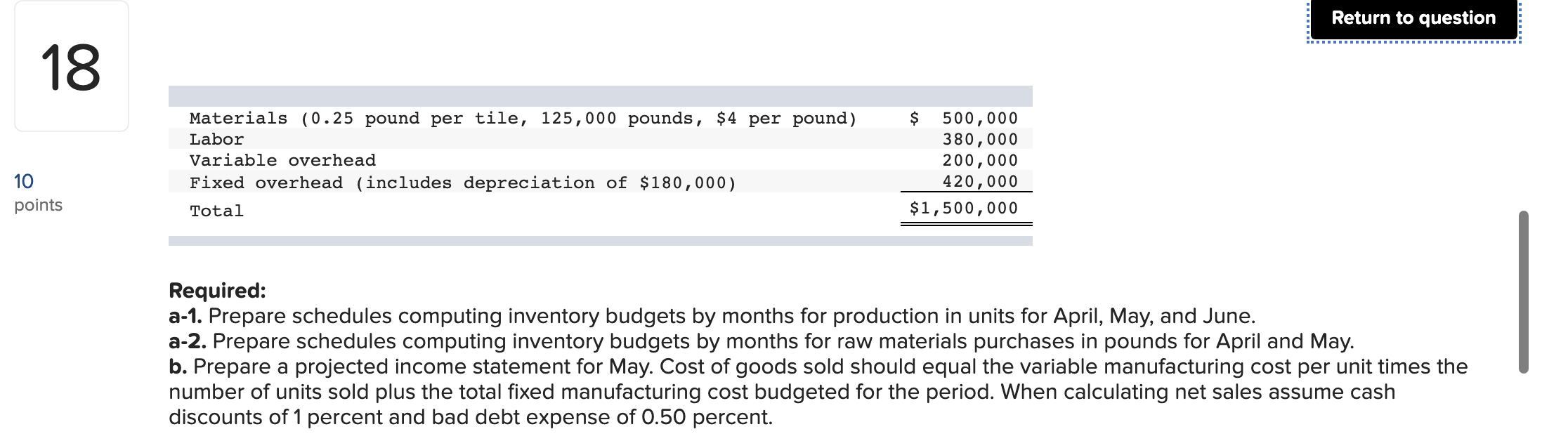

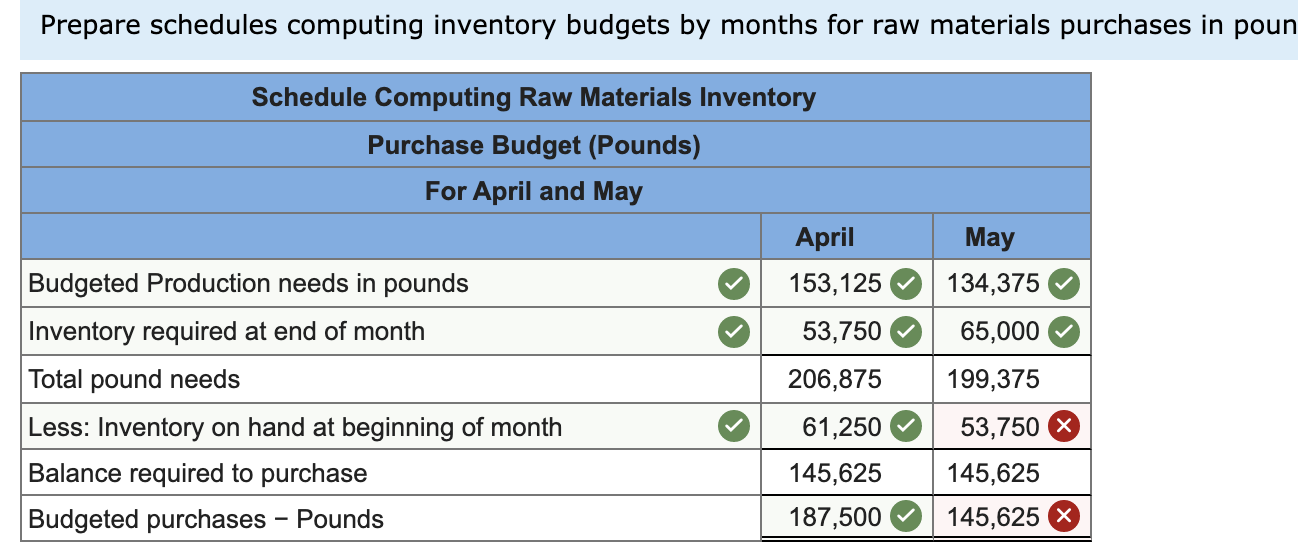

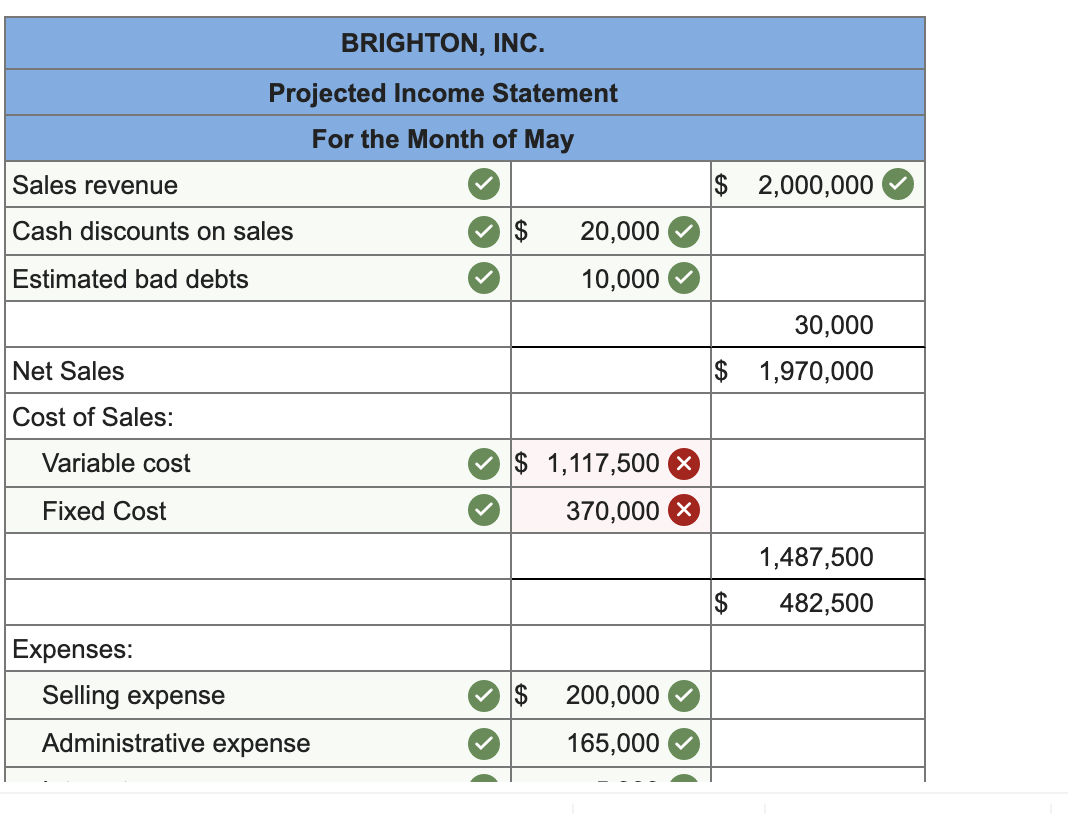

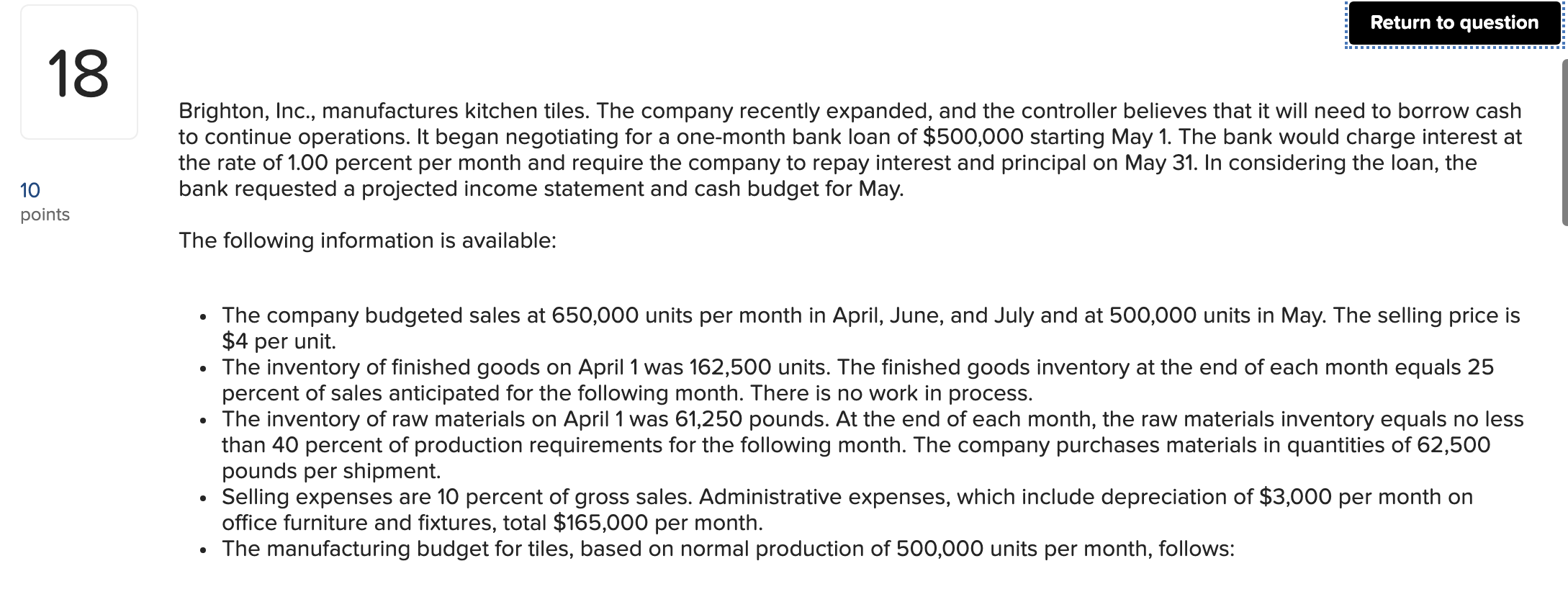

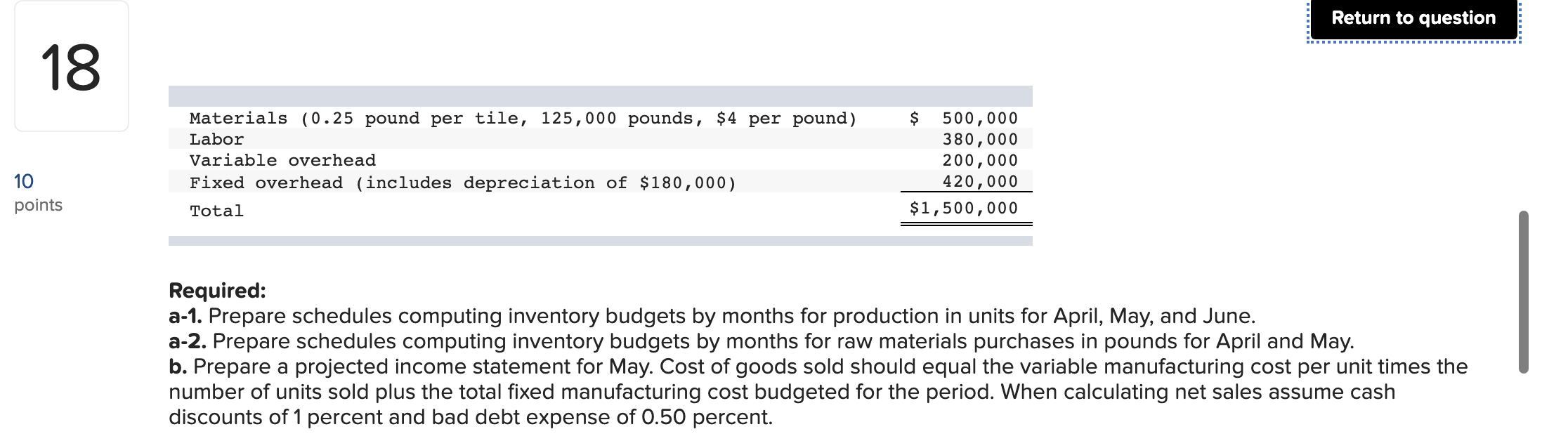

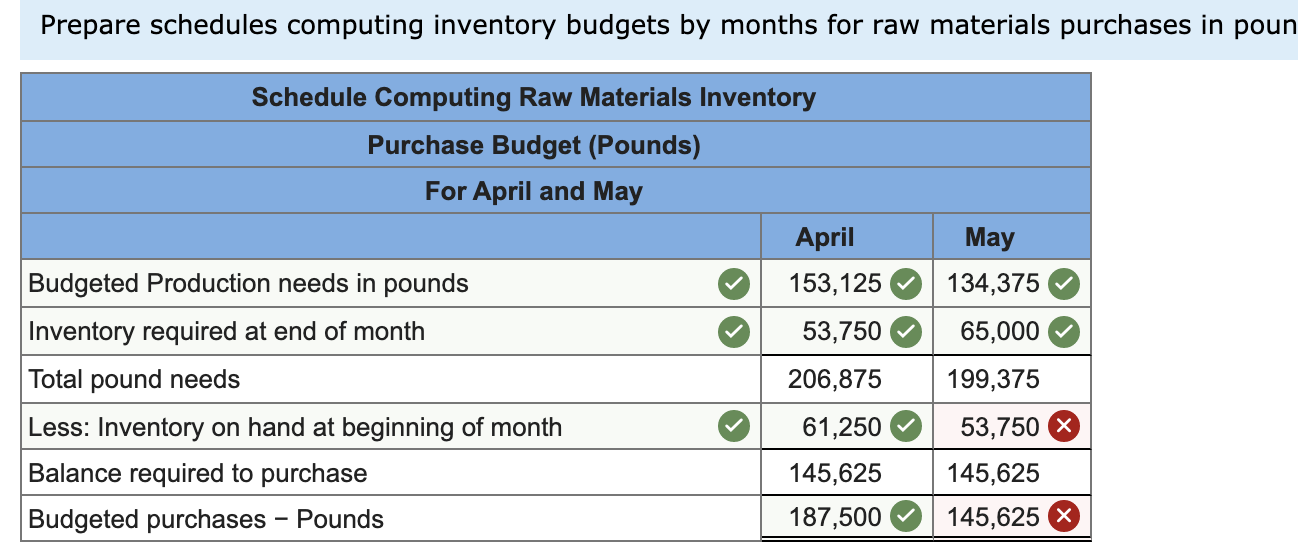

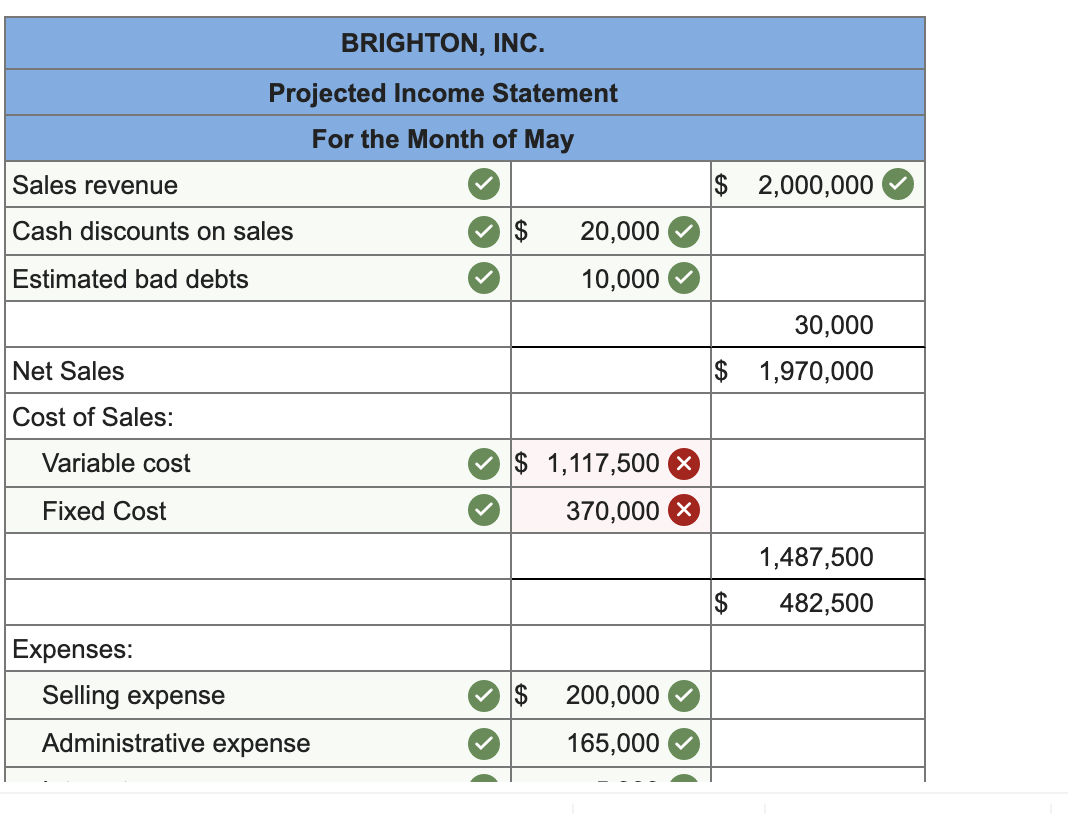

Return to question 18 Brighton, Inc., manufactures kitchen tiles. The company recently expanded, and the controller believes that it will need to borrow cash to continue operations. It began negotiating for a one-month bank loan of $500,000 starting May 1. The bank would charge interest at the rate of 1.00 percent per month and require the company to repay interest and principal on May 31. In considering the loan, the bank requested a projected income statement and cash budget for May. 10 points The following information is available: . The company budgeted sales at 650,000 units per month in April, June, and July and at 500,000 units in May. The selling price is $4 per unit. The inventory of finished goods on April 1 was 162,500 units. The finished goods inventory at the end of each month equals 25 percent of sales anticipated for the following month. There is no work in process. The inventory of raw materials on April 1 was 61,250 pounds. At the end of each month, the raw materials inventory equals no less than 40 percent of production requirements for the following month. The company purchases materials in quantities of 62,500 pounds per shipment. Selling expenses are 10 percent of gross sales. Administrative expenses, which include depreciation of $3,000 per month on office furniture and fixtures, total $165,000 per month. The manufacturing budget for tiles, based on normal production of 500,000 units per month, follows: . . Return to question 18 Materials (0.25 pound per tile, 125,000 pounds, $4 per pound) Labor Variable overhead Fixed overhead (includes depreciation of $180,000) Total $ 500,000 380,000 200,000 420,000 $1,500,000 10 points Required: a-1. Prepare schedules computing inventory budgets by months for production in units for April, May, and June. a-2. Prepare schedules computing inventory budgets by months for raw materials purchases in pounds for April and May. b. Prepare a projected income statement for May. Cost of goods sold should equal the variable manufacturing cost per unit times the number of units sold plus the total fixed manufacturing cost budgeted for the period. When calculating net sales assume cash discounts of 1 percent and bad debt expense of 0.50 percent. Prepare schedules computing inventory budgets by months for raw materials purchases in poun Schedule Computing Raw Materials Inventory Purchase Budget (Pounds) For April and May April May Budgeted Production needs in pounds 153,125 134,375 Inventory required at end of month 53,750 65,000 Total pound needs 206,875 199,375 Less: Inventory on hand at beginning of month 61,250 53,750 Balance required to purchase 145,625 145,625 Budgeted purchases Pounds 187,500 145,625 X BRIGHTON, INC. Projected Income Statement For the Month of May Sales revenue $ 2,000,000 Cash discounts on sales $ 20,000 10,000 Estimated bad debts 30,000 $ 1,970,000 Net Sales Cost of Sales: Variable cost $ 1,117,500 Fixed Cost 370,000 1,487,500 482,500 $ Expenses: Selling expense Administrative expense $ 200,000 165,000