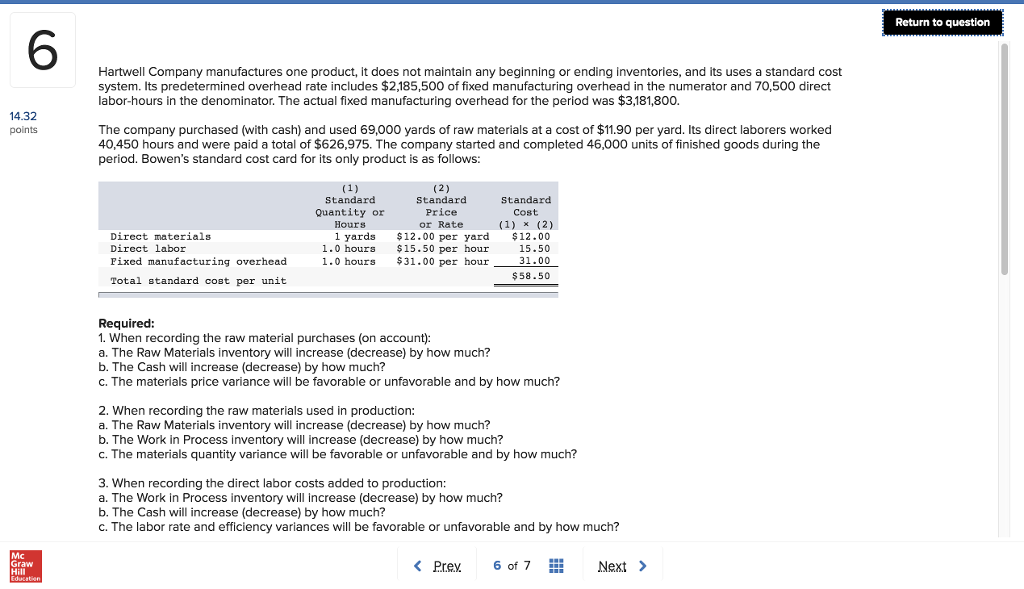

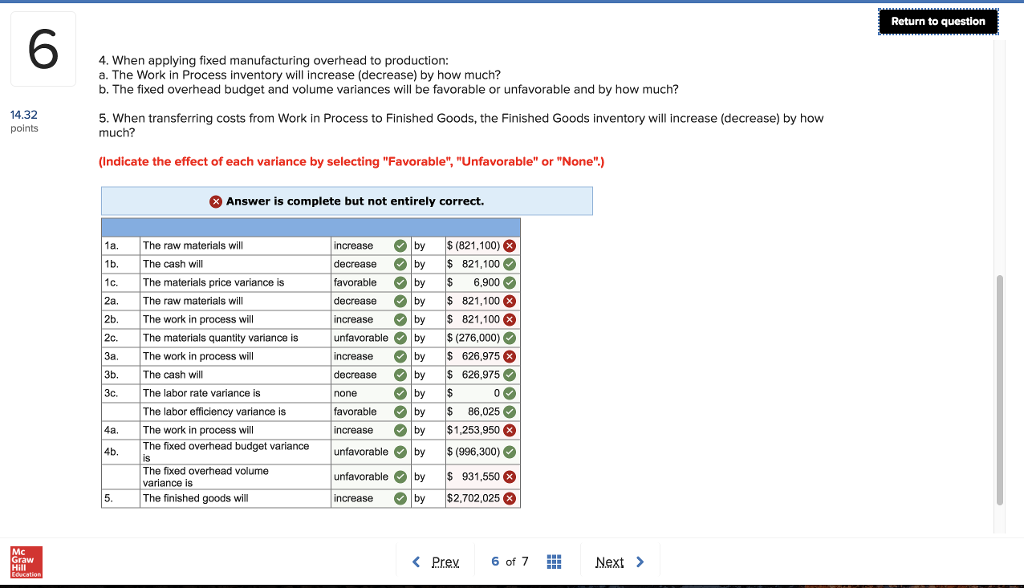

Return to question 6 Hartwell Company manufactures one product, it does not maintain any beginning or ending inventories, and its uses a standard cost system. Its predetermined overhead rate includes $2,185,500 of fixed manufacturing overhead in the numerator and 70,500 direct labor-hours in the denominator. The actual fixed manufacturing overhead for the period was $3,181,800. 14.32 ts The company purchased (with cash) and used 69,000 yards of raw materials at a cost of $11.90 per yard. Its direct laborers worked 40,450 hours and were paid a total of $626,975. The company started and completed 46,000 units of finished goods during the period. Bowen's standard cost card for its only product is as follows: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials Direct labor Pixed manufacturing overhead Total standard cost per unit 1 yards $12.00 per yard$12.00 15.50 31.00 $58.50 1.0 hours 1.0 hours $15.50 per hour $31.00 per hour Required: 1. When recording the raw material purchases (on account) a. The Raw Materials inventory will increase (decrease) by how much? b. The Cash will increase (decrease) by how much? C. The materials price variance will be favorable or unfavorable and by how much? 2. When recording the raw materials used in production: a. The Raw Materials inventory will increase (decrease) by how much? b. The Work in Process inventory will increase (decrease) by how much? c. The materials quantity variance will be favorable or unfavorable and by how much? 3. When recording the direct labor costs added to production: a. The Work in Process inventory will increase (decrease) by how much? b. The Cash will increase (decrease) by how much? C. The labor rate and efficiency variances will be favorable or unfavorable and by how much? Mc Graw Hill Prex 6 of 7 Next > Return to question 6 Hartwell Company manufactures one product, it does not maintain any beginning or ending inventories, and its uses a standard cost system. Its predetermined overhead rate includes $2,185,500 of fixed manufacturing overhead in the numerator and 70,500 direct labor-hours in the denominator. The actual fixed manufacturing overhead for the period was $3,181,800. 14.32 ts The company purchased (with cash) and used 69,000 yards of raw materials at a cost of $11.90 per yard. Its direct laborers worked 40,450 hours and were paid a total of $626,975. The company started and completed 46,000 units of finished goods during the period. Bowen's standard cost card for its only product is as follows: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials Direct labor Pixed manufacturing overhead Total standard cost per unit 1 yards $12.00 per yard$12.00 15.50 31.00 $58.50 1.0 hours 1.0 hours $15.50 per hour $31.00 per hour Required: 1. When recording the raw material purchases (on account) a. The Raw Materials inventory will increase (decrease) by how much? b. The Cash will increase (decrease) by how much? C. The materials price variance will be favorable or unfavorable and by how much? 2. When recording the raw materials used in production: a. The Raw Materials inventory will increase (decrease) by how much? b. The Work in Process inventory will increase (decrease) by how much? c. The materials quantity variance will be favorable or unfavorable and by how much? 3. When recording the direct labor costs added to production: a. The Work in Process inventory will increase (decrease) by how much? b. The Cash will increase (decrease) by how much? C. The labor rate and efficiency variances will be favorable or unfavorable and by how much? Mc Graw Hill Prex 6 of 7 Next >