Answered step by step

Verified Expert Solution

Question

1 Approved Answer

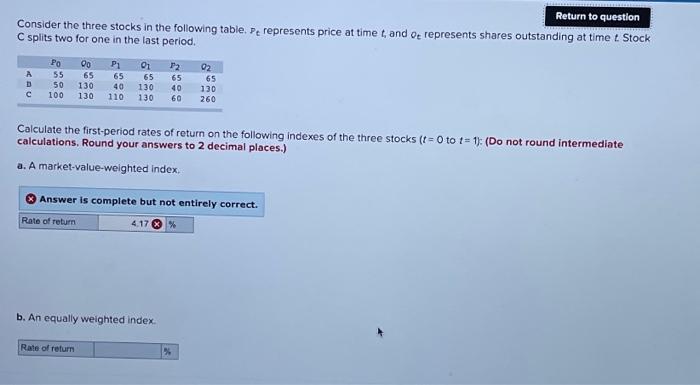

Return to question Consider the three stocks in the following table. Pt represents price at time t, and ot represents shares outstanding at time t.

Return to question Consider the three stocks in the following table. Pt represents price at time t, and ot represents shares outstanding at time t. Stock C splits two for one in the last period. A B C Po 55 65 50 130 100 130 20 Rate of return P1 21 65 65 40 110 130 130 Rate of return P2 65 40 60 Calculate the first-period rates of return on the following indexes of the three stocks (t = 0 to t= 1): (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A market-value-weighted index. b. An equally weighted index. Answer is complete but not entirely correct. 4.17 X % 02 65 130 260 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started