Question

Return to question Item4 Item 4 10 points Karla Tanner opened a web consulting business called Linkworks and recorded the following transactions in its first

Return to question

Item4

Item 4 10 points

Karla Tanner opened a web consulting business called Linkworks and recorded the following transactions in its first month of operations.

| Apr. | 1 | Tanner invests $80,000 cash along with office equipment valued at $26,000 in the company in exchange for common stock. | ||

| Apr. | 2 | The company prepaid $9,000 cash for twelve months rent for office space. The company's policy is record prepaid expenses in balance sheet accounts. | ||

| Apr. | 3 | The company made credit purchases for $8,000 in office equipment and $3,600 in office supplies. Payment is due within 10 days. | ||

| Apr. | 6 | The company completed services for a client and immediately received $4,000 cash. | ||

| Apr. | 9 | The company completed a $6,000 project for a client, who must pay within 30 days. | ||

| Apr. | 13 | The company paid $11,600 cash to settle the account payable created on April 3. | ||

| Apr. | 19 | The company paid $2,400 cash for the premium on a 12-month insurance policy. The company's policy is record prepaid expenses in balance sheet accounts. | ||

| Apr. | 22 | The company received $4,400 cash as partial payment for the work completed on April 9. | ||

| Apr. | 25 | The company completed work for another client for $2,890 on credit. | ||

| Apr. | 28 | The company paid $5,500 cash in dividends. | ||

| Apr. | 29 | The company purchased $600 of additional office supplies on credit. | ||

| Apr. | 30 | The company paid $435 cash for this months utility bill. |

Descriptions of items that require adjusting entries on April 30, 2017, follow.

-

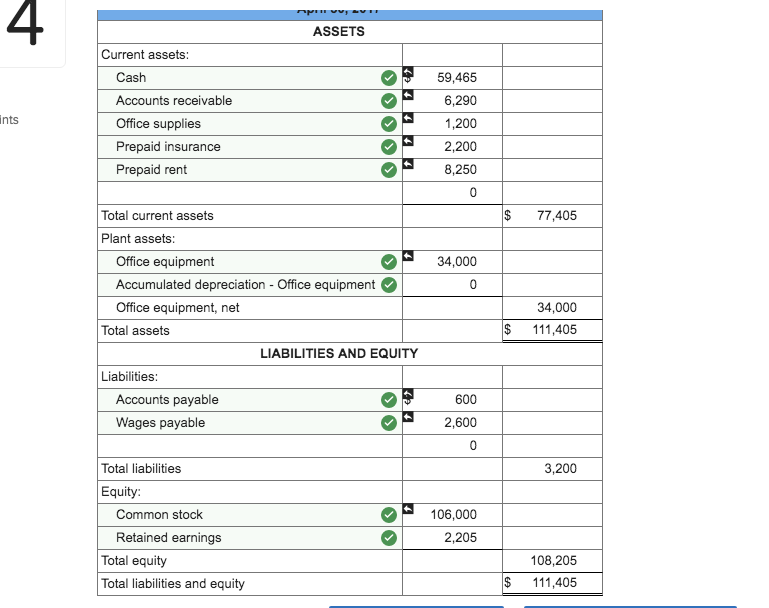

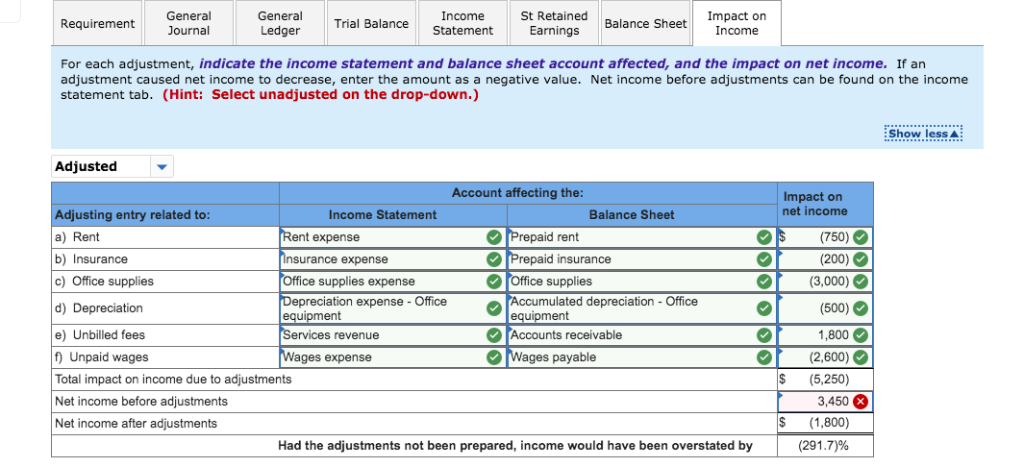

a) On April 2, the company prepaid $9,000 cash for twelve months' rent for office space.

-

b) The balance in Prepaid insurance represents the premium paid for a 12-month insurance policy the policy's coverage began on April 1.

-

c) Office supplies on hand as of April 30 total $1,200.

-

d) Straight-line depreciation of office equipment, based on a 5-year life and a $4,000 salvage value, is $500 per month.

-

e) The company has completed work for a client, but has not yet billed the $1,800 fee.

-

f) Wages due to employees, but not yet paid, as of April 30 total $2,600.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started