Answered step by step

Verified Expert Solution

Question

1 Approved Answer

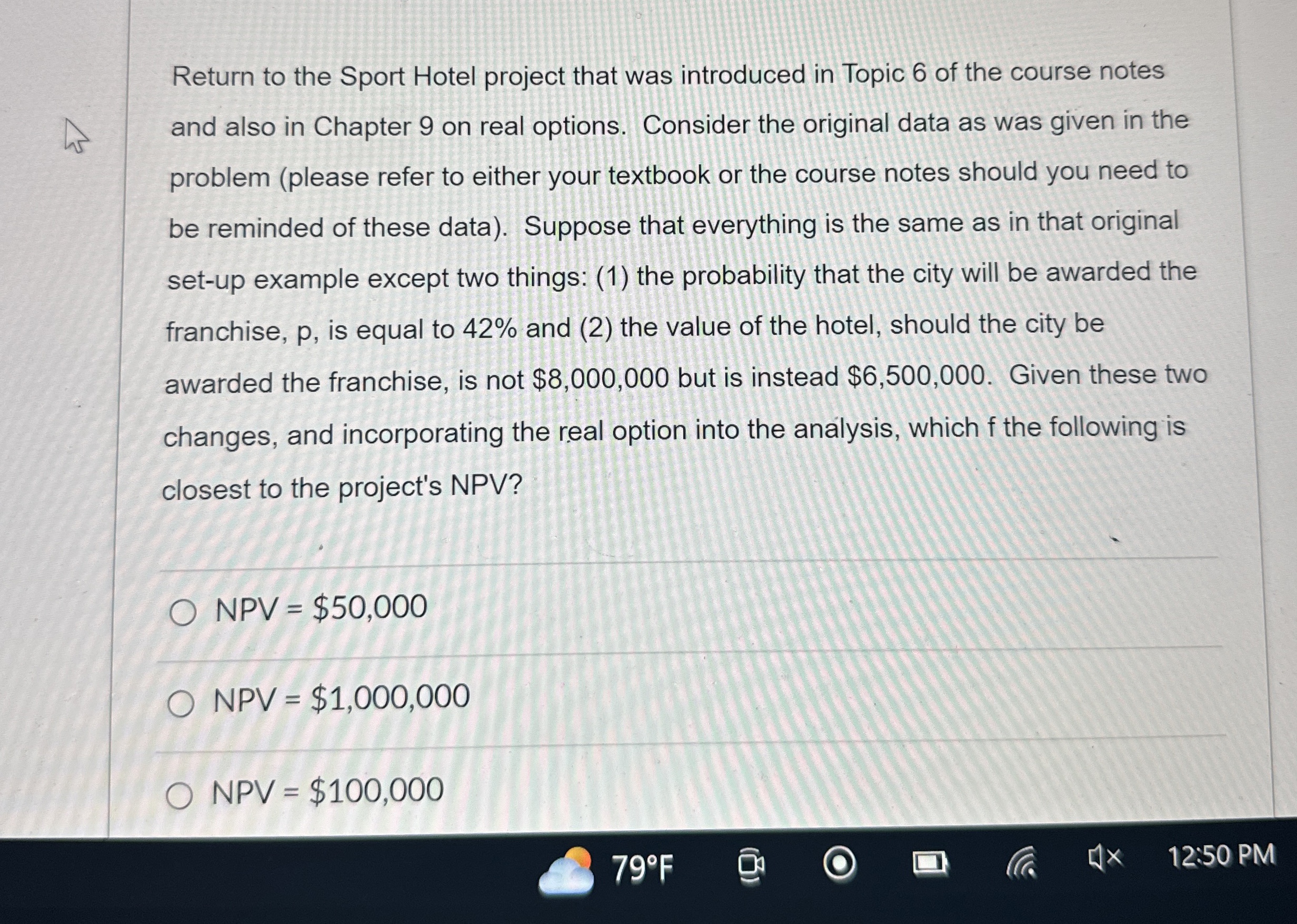

Return to the Sport Hotel project that was introduced in Topic 6 of the course notes and also in Chapter 9 on real options. Consider

Return to the Sport Hotel project that was introduced in Topic of the course notes and also in Chapter on real options. Consider the original data as was given in the problem please refer to either your textbook or the course notes should you need to be reminded of these data Suppose that everything is the same as in that original setup example except two things: the probability that the city will be awarded the franchise, is equal to and the value of the hotel, should the city be awarded the franchise, is not $ but is instead $ Given these two changes, and incorporating the real option into the analysis, which the following is closest to the project's NPV

$

$

NPV $return to the sport hotel pro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started