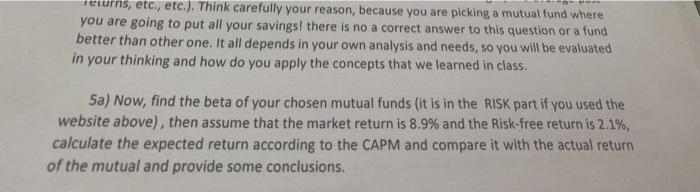

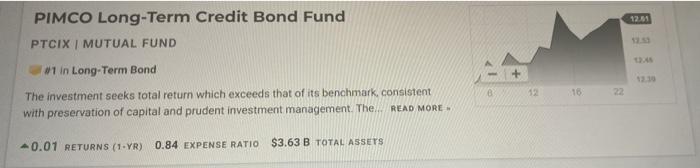

returns, etc., etc.). Think carefully your reason, because you are picking a mutual fund where you are going to put all your savingsl there is no a correct answer to this question or a fund better than other one. It all depends in your own analysis and needs, so you will be evaluated in your thinking and how do you apply the concepts that we learned in class. 5a) Now, find the beta of your chosen mutual funds (it is in the RISK part if you used the website above), then assume that the market return is 8.9% and the Risk-free return is 2.1%, calculate the expected return according to the CAPM and compare it with the actual return of the mutual and provide some conclusions. PIMCO Long-Term Credit Bond Fund 12.31 PTCIX MUTUAL FUND #1 in Long-Term Bond The investment seeks total return which exceeds that of its benchmark consistent with preservation of capital and prudent investment management. The... READ MORE B 16 22 0.01 RETURNS (1-YR) 0.84 EXPENSE RATIO $3.63 B TOTAL ASSETS About PTCIX The investment seeks total return which exceeds that of its benchmark, consistent with preservation of capital and prudent investment management. The fund normally invests at least 80% of its assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts or swap agreements. It invests primarily in investment grade debt securities, but may invest up to 20% of its total assets in junk bonds that are rated B or higher by Moody's, or equivalently rated by S&P or Fitch, or, if unrated, determined by PIMCO to be of comparable quality. returns, etc., etc.). Think carefully your reason, because you are picking a mutual fund where you are going to put all your savingsl there is no a correct answer to this question or a fund better than other one. It all depends in your own analysis and needs, so you will be evaluated in your thinking and how do you apply the concepts that we learned in class. 5a) Now, find the beta of your chosen mutual funds (it is in the RISK part if you used the website above), then assume that the market return is 8.9% and the Risk-free return is 2.1%, calculate the expected return according to the CAPM and compare it with the actual return of the mutual and provide some conclusions. PIMCO Long-Term Credit Bond Fund 12.31 PTCIX MUTUAL FUND #1 in Long-Term Bond The investment seeks total return which exceeds that of its benchmark consistent with preservation of capital and prudent investment management. The... READ MORE B 16 22 0.01 RETURNS (1-YR) 0.84 EXPENSE RATIO $3.63 B TOTAL ASSETS About PTCIX The investment seeks total return which exceeds that of its benchmark, consistent with preservation of capital and prudent investment management. The fund normally invests at least 80% of its assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts or swap agreements. It invests primarily in investment grade debt securities, but may invest up to 20% of its total assets in junk bonds that are rated B or higher by Moody's, or equivalently rated by S&P or Fitch, or, if unrated, determined by PIMCO to be of comparable quality