Answered step by step

Verified Expert Solution

Question

1 Approved Answer

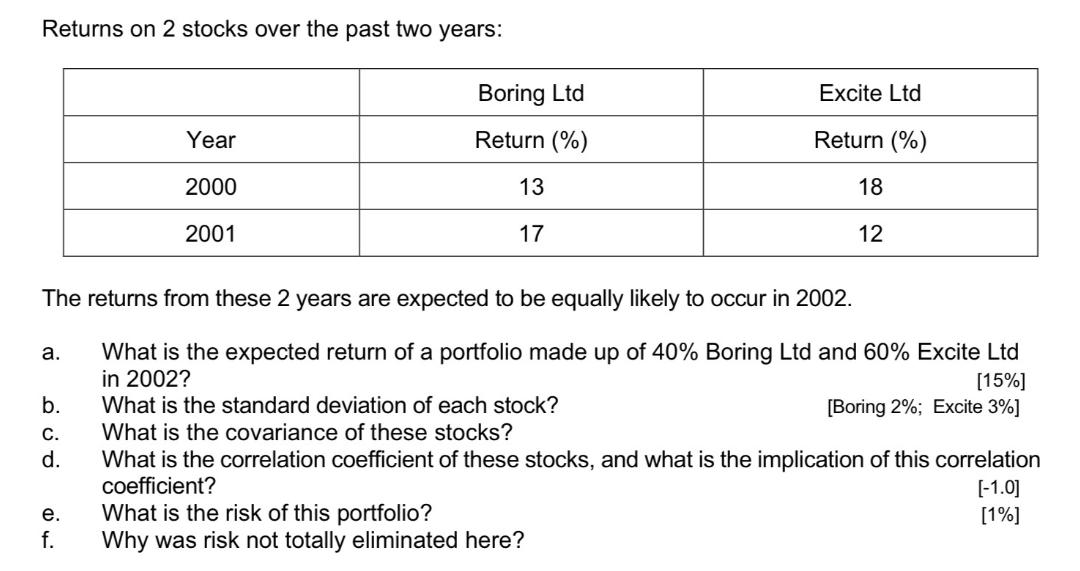

Returns on 2 stocks over the past two years: a. b. C. d. Year 2000 2001 e. f. Boring Ltd Return (%) The returns

Returns on 2 stocks over the past two years: a. b. C. d. Year 2000 2001 e. f. Boring Ltd Return (%) The returns from these 2 years are expected to be equally likely to occur in 2002. What is the expected return of a portfolio made up of 40% Boring Ltd and 60% Excite Ltd in 2002? [15%] [Boring 2%; Excite 3%] 13 17 What is the standard deviation of each stock? What is the covariance of these stocks? Excite Ltd Return (%) 18 12 What is the correlation coefficient of these stocks, and what is the implication of this correlation coefficient? What is the risk of this portfolio? Why was risk not totally eliminated here? [-1.0] [1%]

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each part of this problem step by step a To find the expected return of the portfolio made up of 40 Boring Ltd and 60 Excite Ltd in 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started