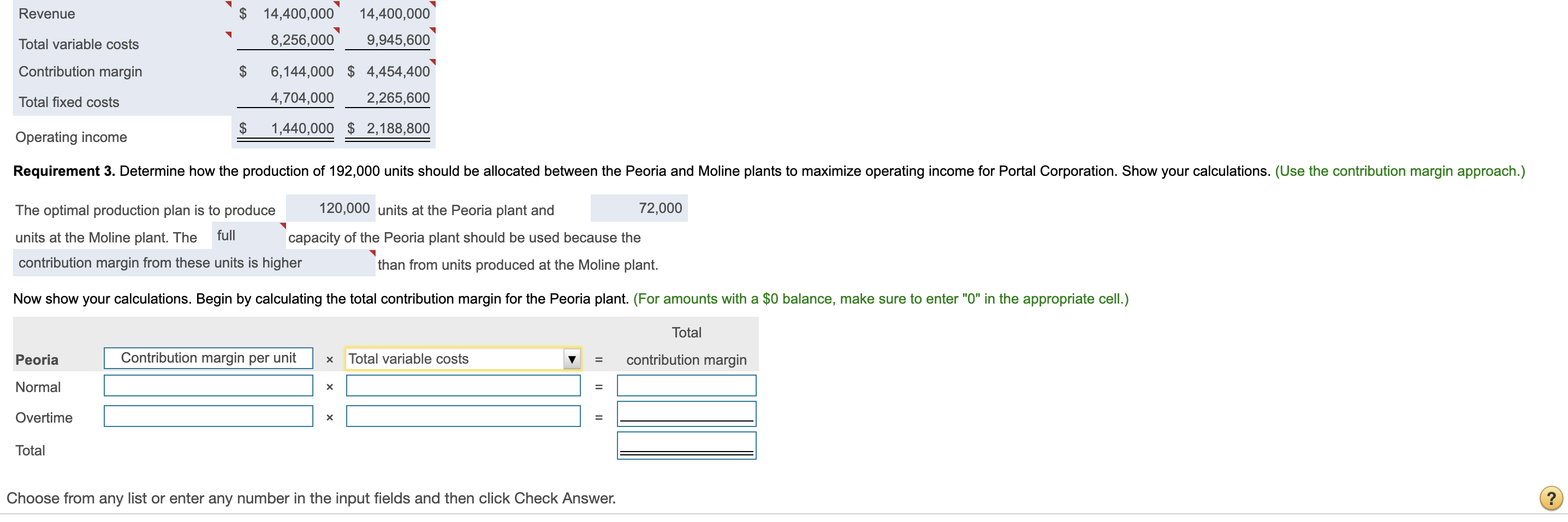

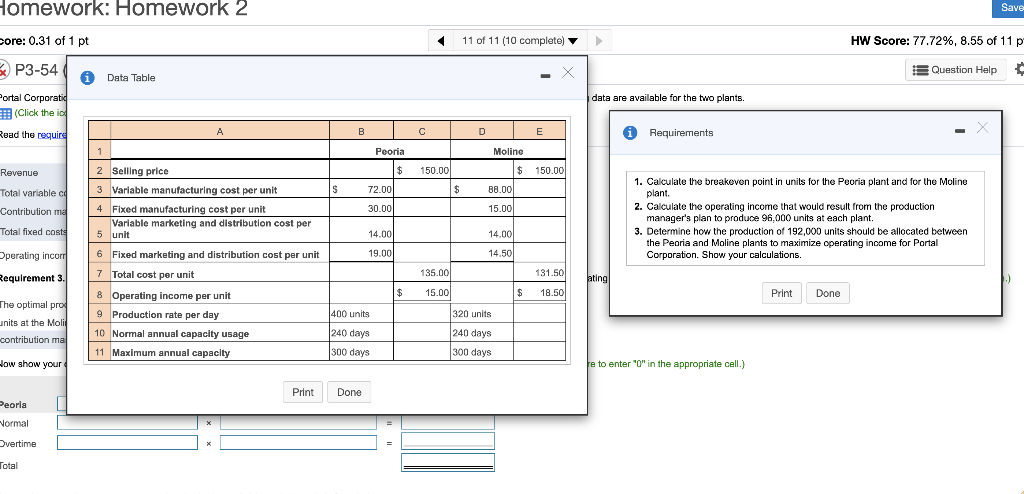

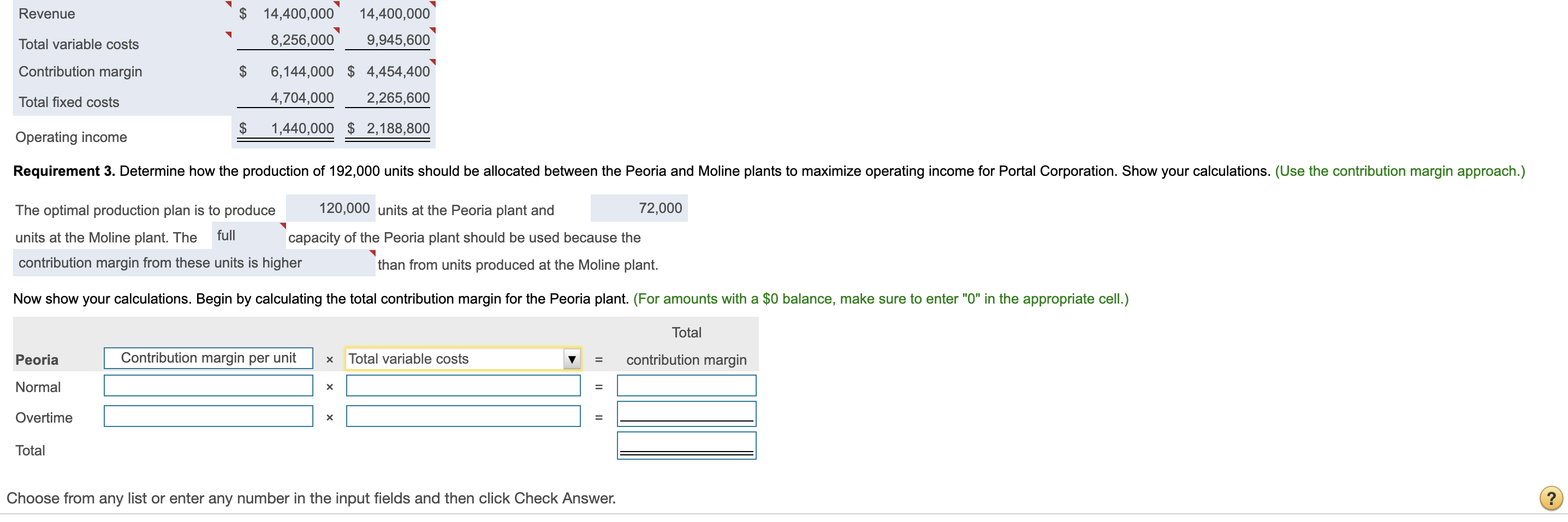

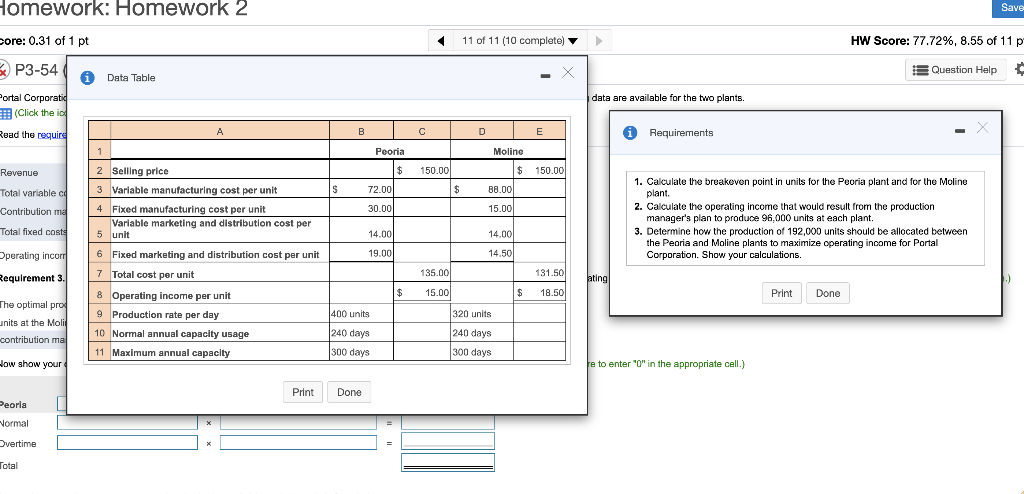

Revenue 14,400,000 8,256,000 14,400,000 9,945,600 Total variable costs Contribution margin $ 6,144,000 $ 4,454,400 4,704,000 2,265,600 Total fixed costs $ 1,440,000 $ 2,188,800 Operating income Requirement 3. Determine how the production of 192,000 units should be allocated between the Peoria and Moline plants to maximize operating income for Portal Corporation. Show your calculations. (Use the contribution margin approach.) The optimal production plan is to produce 120,000 units at the Peoria plant and 72,000 units at the Moline plant. The full capacity of the Peoria plant should be used because the contribution margin from these units is higher than from units produced at the Moline plant. Now show your calculations. Begin by calculating the total contribution margin for the Peoria plant. (For amounts with a $0 balance, make sure to enter "O" in the appropriate cell.) Total Peoria Contribution margin per unit x Total variable costs = contribution margin Normal x Overtime X II Total Choose from any list or enter any number in the input fields and then click Check Answer. ? Homework: Homework 2 Save 11 of 11 (10 complete) HW Score: 77.72%, 8.55 of 11 p core: 0.31 of 1 pt P3-54 Question Help Data Table data are available for the two plants. Portal Corporatio (Click the ice Read the require B D E i Requirements 1 Pooria Moline Revenue $ 150.00 $ 150.00 S 72.00 $ Total variable cd 88.00 2 Selling price 3 Variable manufacturing cost per unit 4 Fixed manufacturing cost per unit Variable marketing and distribution cost per 5 unit Contribution me 30.00 15.00 1. Calculate the breakeven point in unils for the Peoria plant and for the Moline plant. 2. Calculate the operating income that would result from the production manager's plan to produce 96,000 units at each plant. 3. Determine how the production of 192,000 units should be allocated between the Peoria and Moline plants to maximize operating income for Portal Corporation. Show your calculations. Total fixed costs 14.00 14.00 Operating incorr 6 Fixed marketing and distribution cost per unit 19.00 14.501 Requirement 3. 7 Total cost per unit 135.00 131.50 ating $ 15.00 $ 18.50 Print Done 400 units 320 units The optimal pro units at the Moli contribution mal 8 Operating income per unit 9 Production rate per day 9 10 Normal annual capacity usage 11 Maximum annual capacity 240 days 240 days 300 days 300 days How show your e to enter "0" in the appropriate cell.) Print Done Peoria Normal Overtime Total