Revenue, Costs of Goods Sold, Gross Profit,

Inventory, Furnishings, Accumulated Depreciation,

Common Stock are the required fields

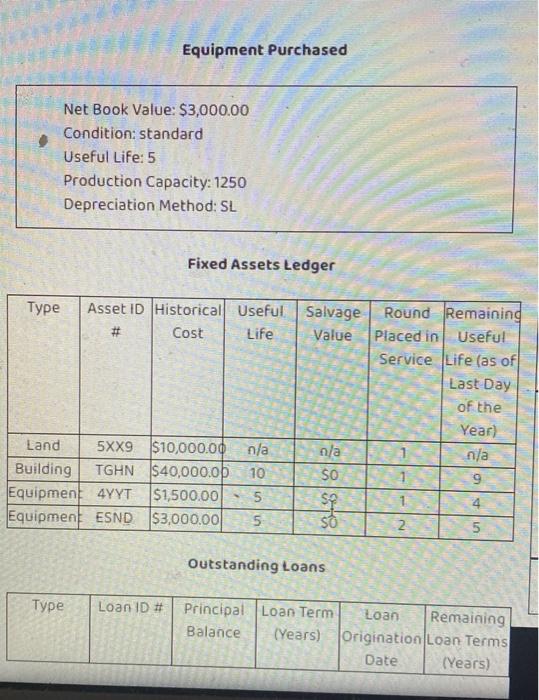

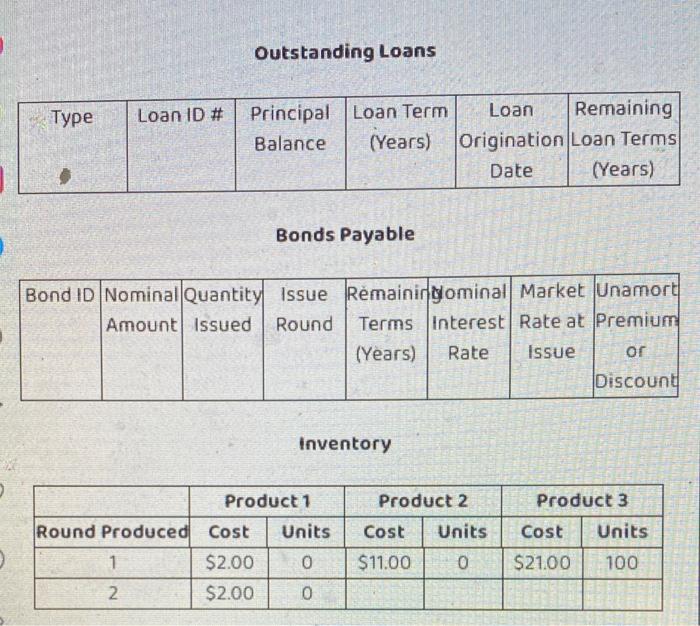

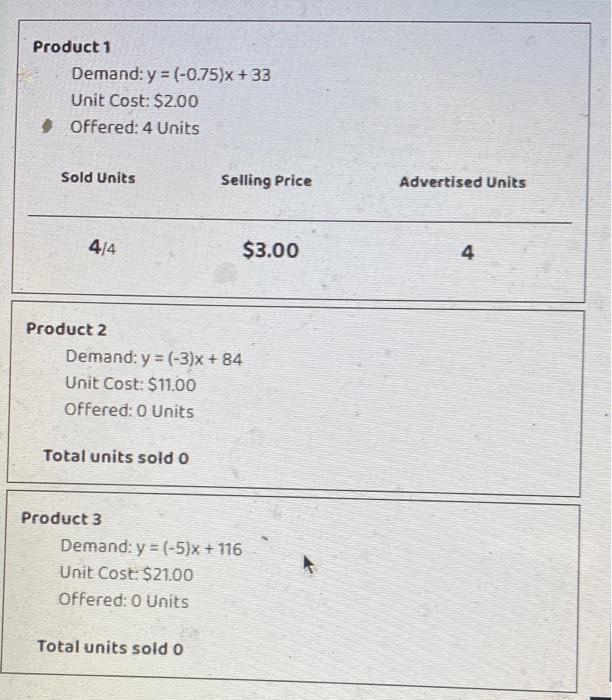

Equipment Purchased Net Book Value: $3,000.00 Condition: standard Useful Life: 5 Production Capacity: 1250 Depreciation Method: SL Fixed Assets Ledger Type Asset ID Historical Useful # Cost Life Salvage Value Round Remaining Placed in Useful Service Life (as of Last Day of the Year) nila 9 Land 5XX9 $10,000.00 n/a Building TGHN $40,000.00 10 Equipment 4YYT $1,500.00 Equipment ESND $3,000.00 5 o in n/a SO $2 so 2. 5 Outstanding Loans Type Loan ID # Principal Loan Term Loan Remaining Balance (Years) Origination Loan Terms Date (Years) Outstanding Loans Type Loan ID # Principal Loan Term Loan Remaining Balance (Years) Origination Loan Terms Date (Years) Bonds Payable Bond ID Nominal Quantity issue Remainingominal Market Unamort Amount issued Round Terms Interest Rate at Premium (Years) Rate Issue or Discount Inventory Product 2 Cost Units Product 1 Round Produced Cost Units 1 $2.00 0 2. $2.00 0 Product 3 Cost Units $21.00 100 $11.00 0 Product 1 Demand: y = (-0.75)x +33 Unit Cost: $2.00 Offered: 4 Units Sold Units Selling Price Advertised Units 414 $3.00 4 Product 2 Demand: y = (-3)X + 84 Unit Cost: $11.00 Offered: 0 Units Total units sold o Product 3 Demand: y = (-5)X + 116 Unit Cost: $21.00 Offered: 0 Units Total units sold o Equipment Purchased Net Book Value: $3,000.00 Condition: standard Useful Life: 5 Production Capacity: 1250 Depreciation Method: SL Fixed Assets Ledger Type Asset ID Historical Useful # Cost Life Salvage Value Round Remaining Placed in Useful Service Life (as of Last Day of the Year) nila 9 Land 5XX9 $10,000.00 n/a Building TGHN $40,000.00 10 Equipment 4YYT $1,500.00 Equipment ESND $3,000.00 5 o in n/a SO $2 so 2. 5 Outstanding Loans Type Loan ID # Principal Loan Term Loan Remaining Balance (Years) Origination Loan Terms Date (Years) Outstanding Loans Type Loan ID # Principal Loan Term Loan Remaining Balance (Years) Origination Loan Terms Date (Years) Bonds Payable Bond ID Nominal Quantity issue Remainingominal Market Unamort Amount issued Round Terms Interest Rate at Premium (Years) Rate Issue or Discount Inventory Product 2 Cost Units Product 1 Round Produced Cost Units 1 $2.00 0 2. $2.00 0 Product 3 Cost Units $21.00 100 $11.00 0 Product 1 Demand: y = (-0.75)x +33 Unit Cost: $2.00 Offered: 4 Units Sold Units Selling Price Advertised Units 414 $3.00 4 Product 2 Demand: y = (-3)X + 84 Unit Cost: $11.00 Offered: 0 Units Total units sold o Product 3 Demand: y = (-5)X + 116 Unit Cost: $21.00 Offered: 0 Units Total units sold o