Answered step by step

Verified Expert Solution

Question

1 Approved Answer

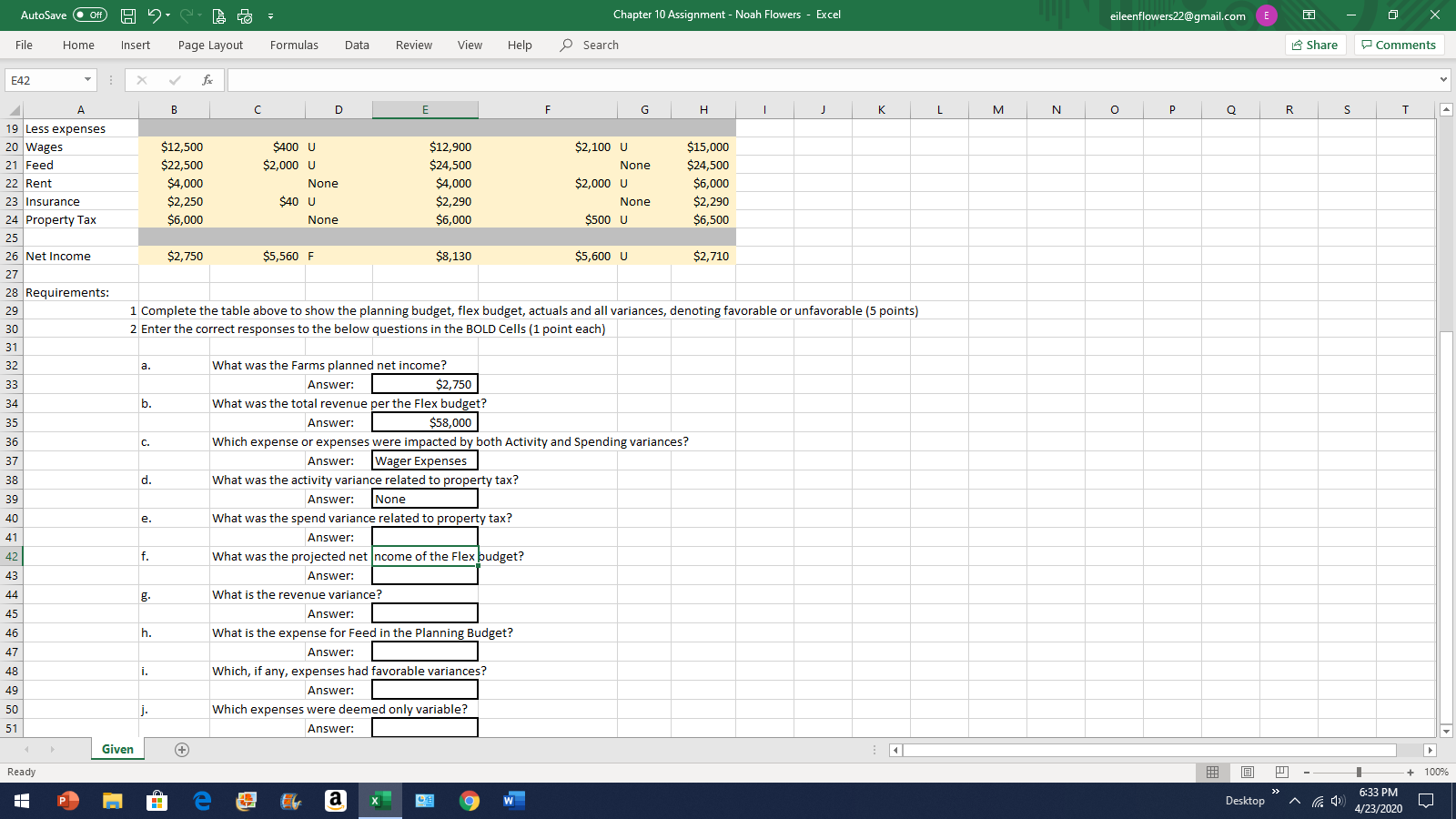

Revenue is Net income which is listed. The type if budget is a flexible budget. AutoSave Of Ho f Chapter 10 Assignment - Noah Flowers

Revenue is "Net income" which is listed. The type if budget is a flexible budget.

AutoSave Of Ho f Chapter 10 Assignment - Noah Flowers - Excel eileenflowers22@gmail.com E 0 - 0 File Home Insert Page Layout Formulas Data Review View Help Search Share Comments B C D E F G H I J K L M N O P Q R S T A A 19 Less expenses 20 Wages 21 Feed 22 Rent 23 Insurance 24 Property Tax $12,500 $22,500 $4,000 $2,250 $6,000 $400 U $2,000 u None $40 U None $12,900 $24,500 $4,000 $2,290 $6,000 $2,100 U None $2,000 U None $500 U $15,000 $24,500 $6,000 $2,290 $6,500 26 Net Income $2,750 $5,560 F $8,130 $5,600 U $2,710 28 Requirements: 1 Complete the table above to show the planning budget, flex budget, actuals and all variances, denoting favorable or unfavorable (5 points) 2 Enter the correct responses to the below questions in the BOLD Cells (1 point each) What was the Farms planned net income? Answer: $2,750 What was the total revenue per the Flex budget? Answer: $58,000 Which expense or expenses were impacted by both Activity and Spending variances? Answer: Wager Expenses What was the activity variance related to property tax? Answer: None What was the spend variance related to property tax? Answer: What was the projected net Income of the Flex budget? Answer: What is the revenue variance? Answer: What is the expense for Feed in the Planning Budget? Answer: Which, if any, expenses had favorable variances? Answer: Which expenses were deemed only variable? Answer: Given Ready J + 100% Desktop -- - A) 6:33 PM AutoSave Of Ho f Chapter 10 Assignment - Noah Flowers - Excel eileenflowers22@gmail.com E 0 - 0 File Home Insert Page Layout Formulas Data Review View Help Search Share Comments B C D E F G H I J K L M N O P Q R S T A A 19 Less expenses 20 Wages 21 Feed 22 Rent 23 Insurance 24 Property Tax $12,500 $22,500 $4,000 $2,250 $6,000 $400 U $2,000 u None $40 U None $12,900 $24,500 $4,000 $2,290 $6,000 $2,100 U None $2,000 U None $500 U $15,000 $24,500 $6,000 $2,290 $6,500 26 Net Income $2,750 $5,560 F $8,130 $5,600 U $2,710 28 Requirements: 1 Complete the table above to show the planning budget, flex budget, actuals and all variances, denoting favorable or unfavorable (5 points) 2 Enter the correct responses to the below questions in the BOLD Cells (1 point each) What was the Farms planned net income? Answer: $2,750 What was the total revenue per the Flex budget? Answer: $58,000 Which expense or expenses were impacted by both Activity and Spending variances? Answer: Wager Expenses What was the activity variance related to property tax? Answer: None What was the spend variance related to property tax? Answer: What was the projected net Income of the Flex budget? Answer: What is the revenue variance? Answer: What is the expense for Feed in the Planning Budget? Answer: Which, if any, expenses had favorable variances? Answer: Which expenses were deemed only variable? Answer: Given Ready J + 100% Desktop -- - A) 6:33 PM Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started