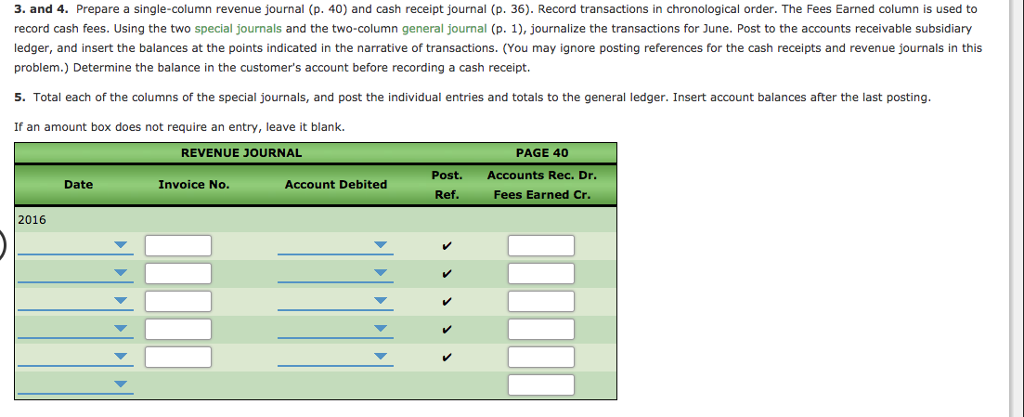

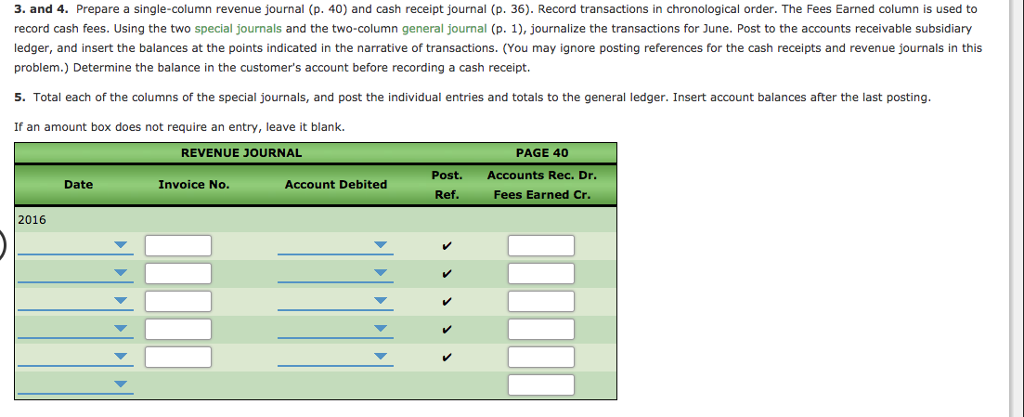

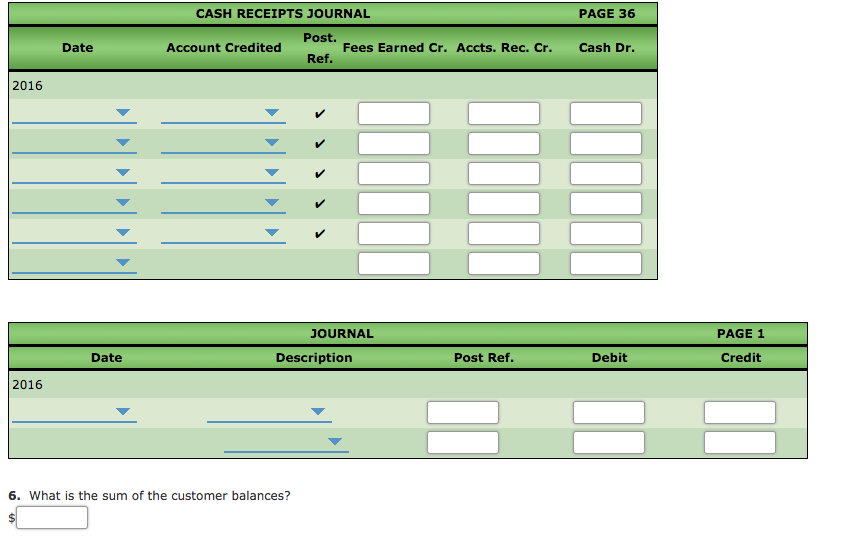

Revenue Journal and Cash Receipts Journal; Accounts Receivable subsidiary and General Ledgers Transactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 2-30, 2016, are as follows: June 2 Issued Invoice No. 717 to Yee Co., $1,430 June 3 Received cash from Auto-Flex Co. for the balance owed on its account. June 7 Issued Invoice No. 718 to Cooper Development Co., $670. June 10 Issued Invoice No. 719 to Ridge Communities, $2,840. Post revenue and collections to the accounts receivable subsidiary ledger. June 14 Received cash from Cooper Development Co. for the balance owed on June 1. June 16 Issued Invoice No. 720 to Cooper Development Co., $400 Post revenue and collections to the accounts receivable subsidiary ledger. June 18 Received cash from Yee Co. for the balance due on invoice of June 2 June 20 Received cash from Cooper Development Co. for invoice of June 7. June 23 Issued Invoice No. 721 to Auto-Flex Co., $860. June 30 Recorded cash fees earned, $4,520 June 30 Received office equipment of $1,800 in partial settlement of balance due on the Ridge Communities account. Post revenue and collections to the accounts receivable subsidiary ledger. Revenue Journal and Cash Receipts Journal; Accounts Receivable subsidiary and General Ledgers Transactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 2-30, 2016, are as follows: June 2 Issued Invoice No. 717 to Yee Co., $1,430 June 3 Received cash from Auto-Flex Co. for the balance owed on its account. June 7 Issued Invoice No. 718 to Cooper Development Co., $670. June 10 Issued Invoice No. 719 to Ridge Communities, $2,840. Post revenue and collections to the accounts receivable subsidiary ledger. June 14 Received cash from Cooper Development Co. for the balance owed on June 1. June 16 Issued Invoice No. 720 to Cooper Development Co., $400 Post revenue and collections to the accounts receivable subsidiary ledger. June 18 Received cash from Yee Co. for the balance due on invoice of June 2 June 20 Received cash from Cooper Development Co. for invoice of June 7. June 23 Issued Invoice No. 721 to Auto-Flex Co., $860. June 30 Recorded cash fees earned, $4,520 June 30 Received office equipment of $1,800 in partial settlement of balance due on the Ridge Communities account. Post revenue and collections to the accounts receivable subsidiary ledger