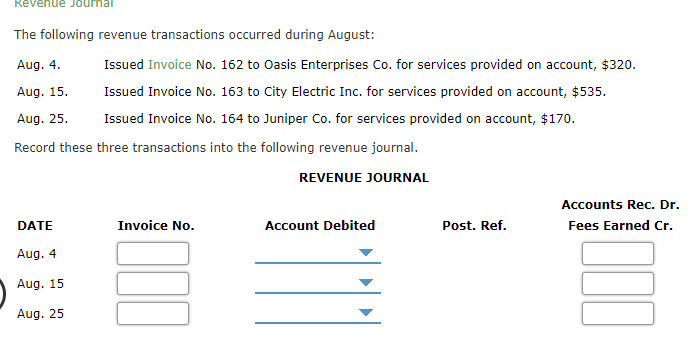

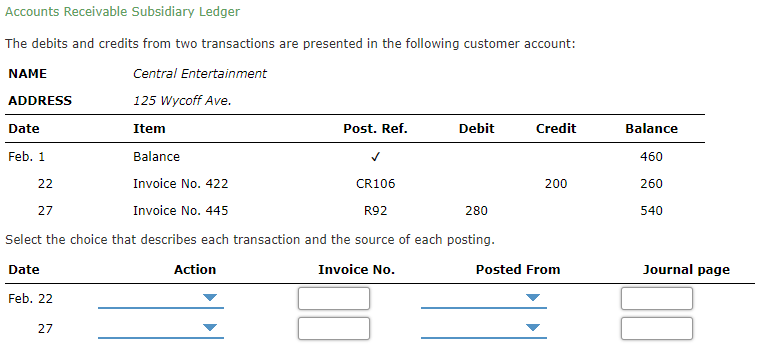

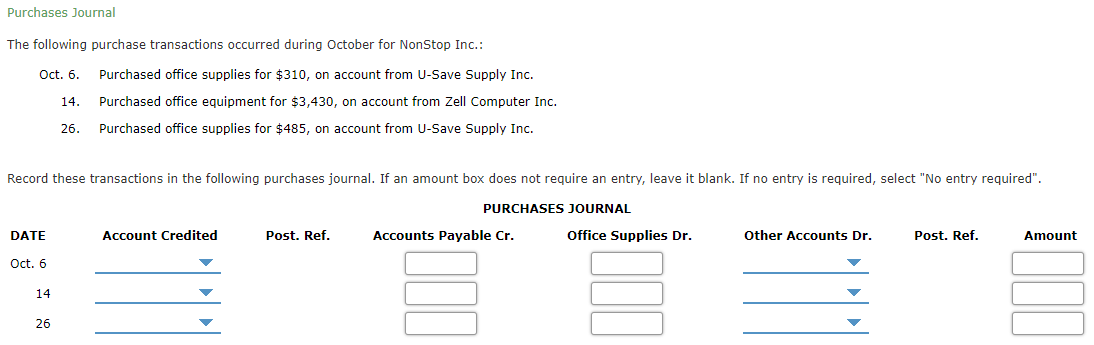

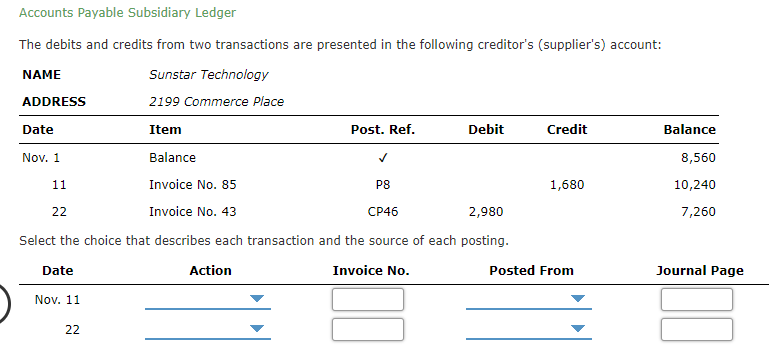

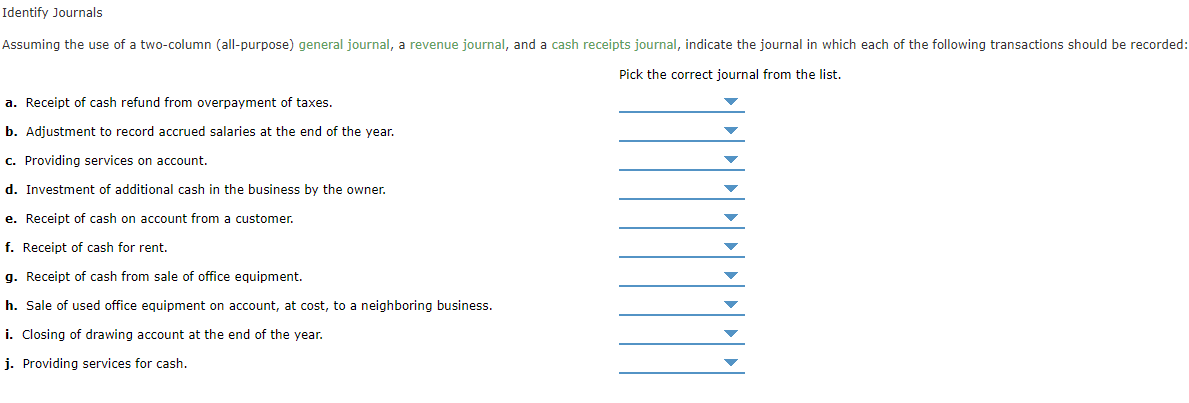

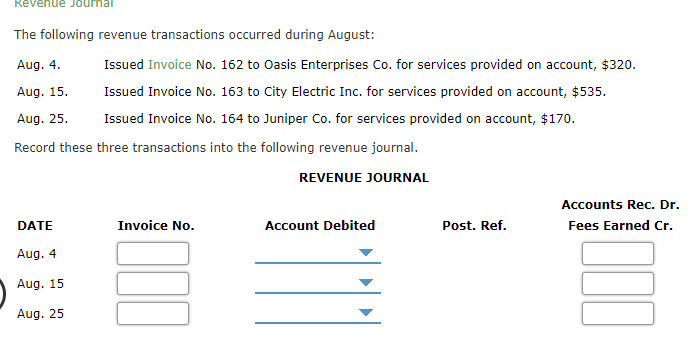

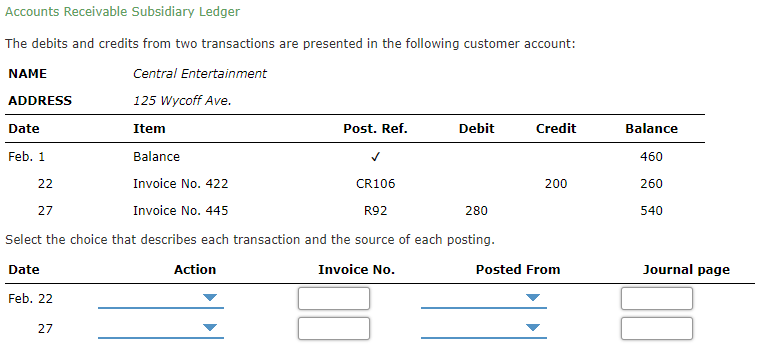

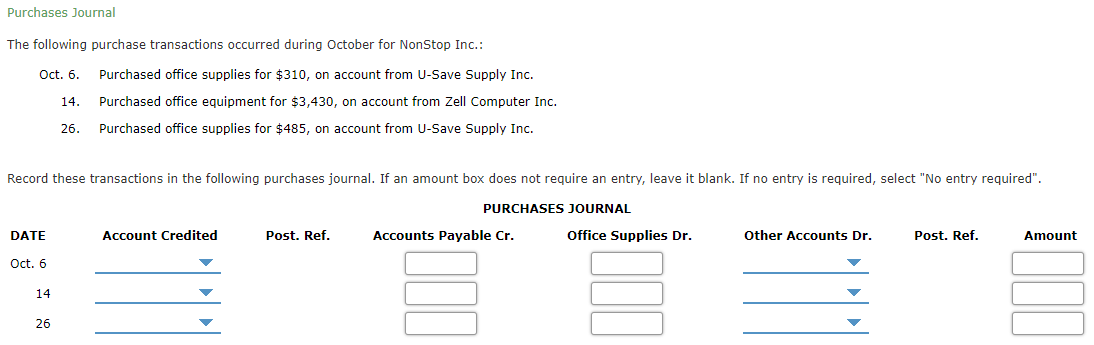

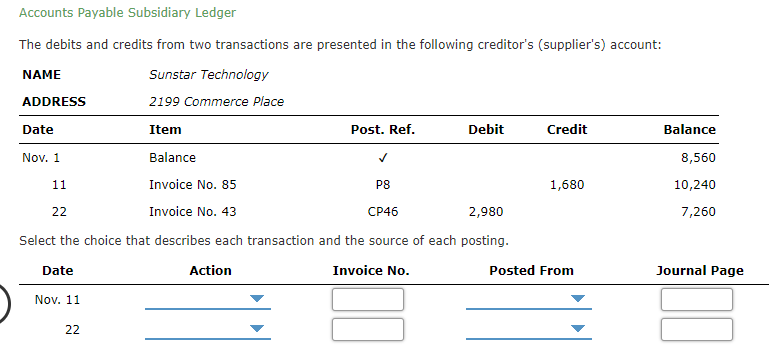

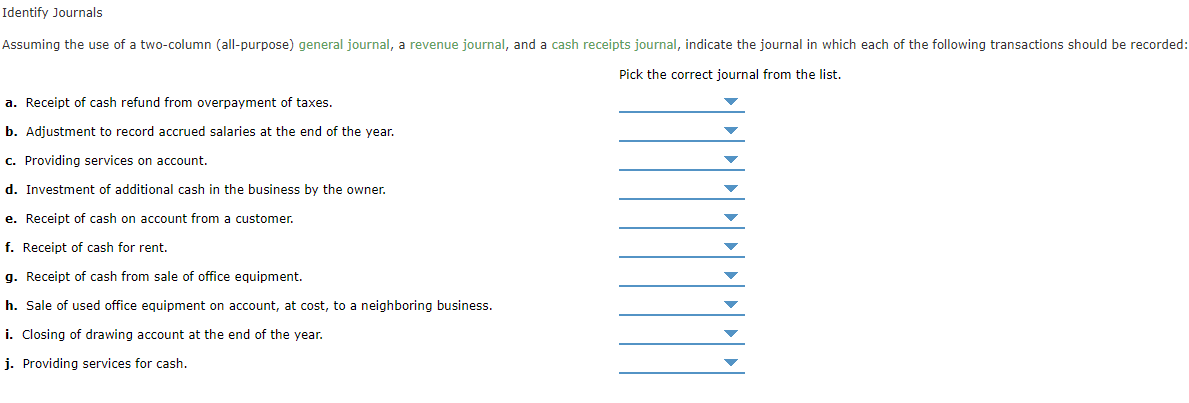

Revenue Journal The following revenue transactions occurred during August: Aug. 4. Issued Invoice No. 162 to Oasis Enterprises Co. for services provided on account, $320. Aug. 15. Issued Invoice No. 163 to City Electric Inc. for services provided on account, $535. Aug. 25. Issued Invoice No. 164 to Juniper Co. for services provided on account, $170. Record these three transactions into the following revenue journal. REVENUE JOURNAL Accounts Rec. Dr. DATE Invoice No. Account Debited Post. Ref. Fees Earned Cr. Aug. 4 Aug. 15 Aug. 25 Accounts Receivable Subsidiary Ledger Balance The debits and credits from two transactions are presented in the following customer account: NAME Central Entertainment ADDRESS 125 Wycoff Ave. Date Item Post. Ref. Debit Credit Feb. 1 Balance 22 Invoice No. 422 CR106 200 27 Invoice No. 445 R92 280 Select the choice that describes each transaction and the source of each posting. Date Action Invoice No. Posted From 460 260 540 Journal page Feb. 22 27 Purchases Journal The following purchase transactions occurred during October for NonStop Inc.: Oct. 6. 14. Purchased office supplies for $310, on account from U-Save Supply Inc. Purchased office equipment for $3,430, on account from Zell Computer Inc. Purchased office supplies for $485, on account from U-Save Supply Inc. 26. Record these transactions in the following purchases journal. If an amount box does not require an entry, leave it blank. If no entry is required, select "No entry required". PURCHASES JOURNAL DATE Account Credited Post. Ref. Accounts Payable Cr. Office Supplies Dr. Other Accounts Dr. Post. Ref. Amount Oct. 6 14 26 Accounts Payable Subsidiary Ledger The debits and credits from two transactions are presented in the following creditor's (supplier's) account: NAME Sunstar Technology 2199 Commerce Place ADDRESS Date Item Post. Ref. Debit Credit Balance 8,560 10,240 Nov. 1 Balance 11 Invoice No. 85 P8 1,680 22 Invoice No. 43 CP46 2,980 Select the choice that describes each transaction and the source of each posting. Date Action Invoice No. Posted From 7,260 Journal Page Nov. 11 22 Identify Journals Assuming the use of a two-column (all-purpose) general journal, a revenue journal, and a cash receipts journal, indicate the journal in which each of the following transactions should be recorded: Pick the correct journal from the list. a. Receipt of cash refund from overpayment of taxes. b. Adjustment to record accrued salaries at the end of the year. C. Providing services on account. d. Investment of additional cash in the business by the owner. e. Receipt of cash on account from a customer. f. Receipt of cash for rent. g. Receipt of cash from sale of office equipment. h. Sale of used office equipment on account, at cost, to a neighboring business. i. Closing of drawing account at the end of the year. j. Providing services for cash