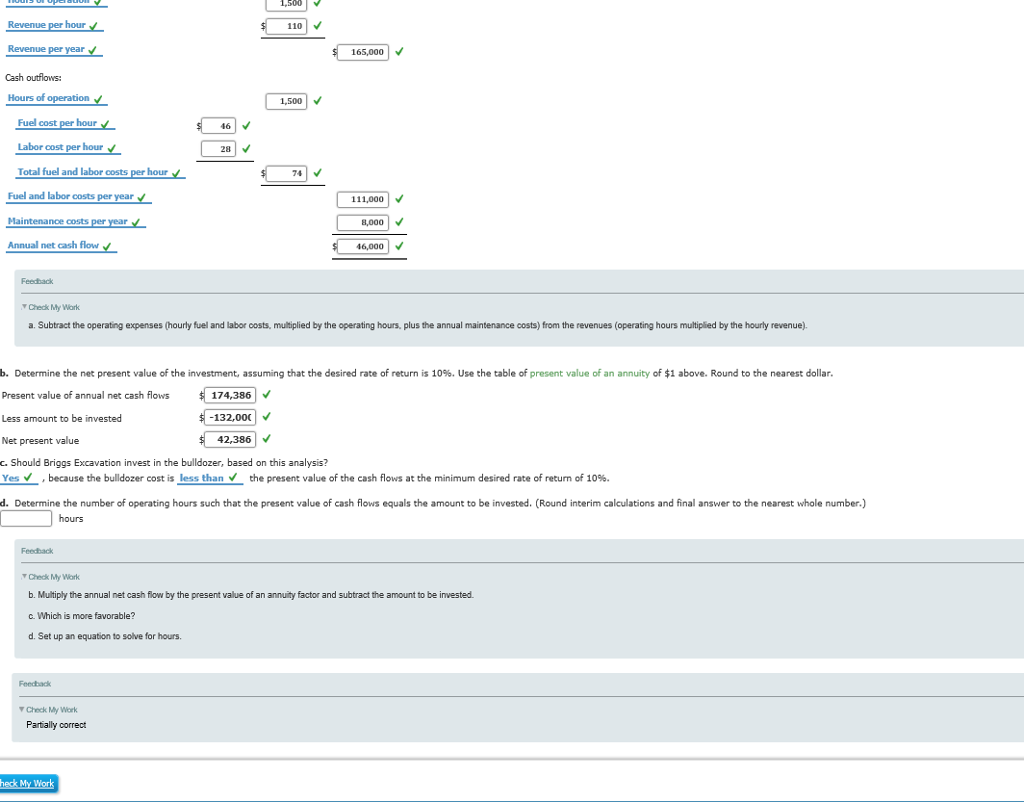

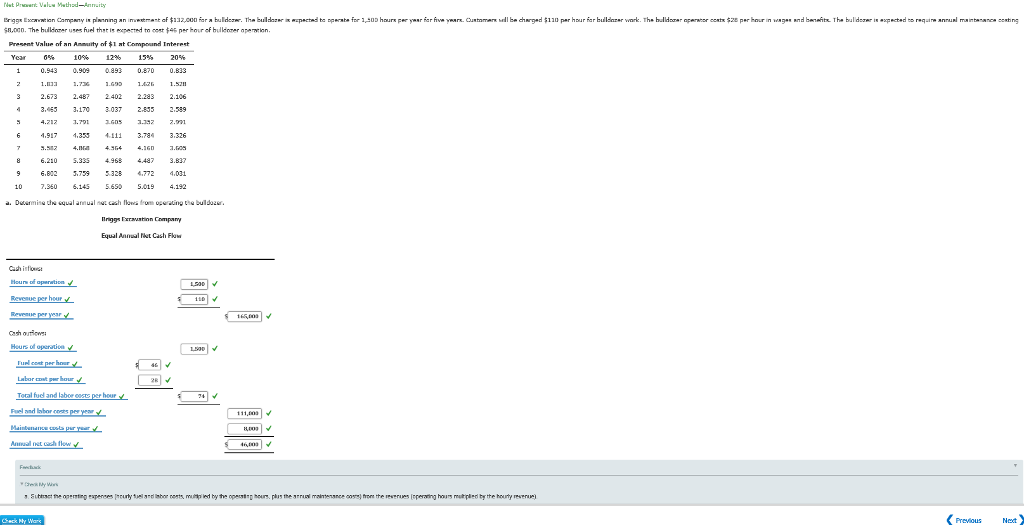

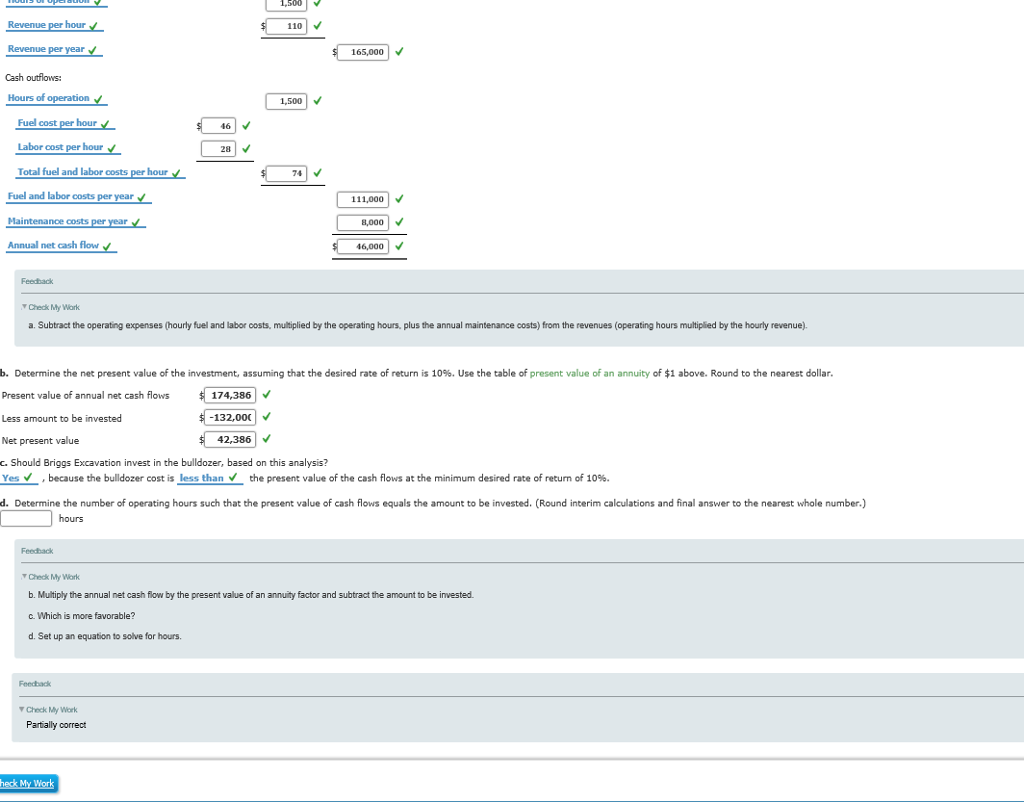

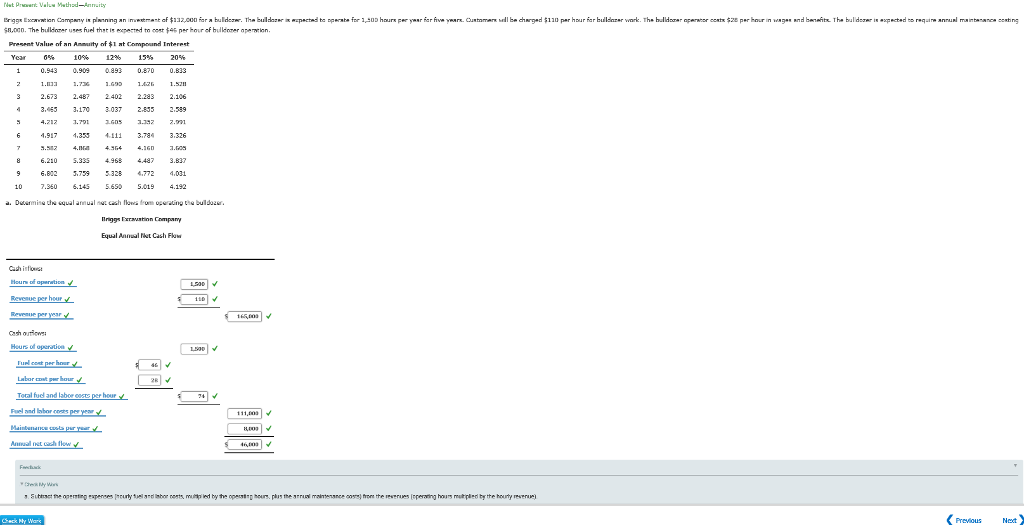

Revenue per hour Revenue per year Cash outflows: Hours of operation 110 65,000 1,500 Fuel cost per hour Labor cost per hour Total fuel and labor costs per hour 46 28 74 Fuel and labor costs per year 111,000 8,000 46,000 Maintenance costs Annual net cash flow Feedback a. Subtract the operating expenses (hourly fuel and labor costs, multiplied by the operating hours, plus the annual maintenance costs) from the revenues (operating hours multiplied by the hourly revenue). b. Determine the net present value of the investment, assuming that the desired rate of return is 10%. Use the table of present value of an annuity of $1 above. Round to the nearest dollar. Present value of annual net cash flows Less amount to be invested Net present value c. Should Briggs Excavation invest in the bulldozer, based on this analysis? Yes-, because the bulldozer cost is less than-the present value of the cash flows at the minimum desired rate of return of 10%. alue of annual net cash fows174.386 132,000V 42,386 d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested. (Round interim calculations and final answer to the nearest whole number.) hours Feedback Check My Work b. Multiply the annual net cash flow by the present value of an annuity factor and subtract the amount to be invested. c. Which is more favorable? d. Set up an equation to solve for hours. Feecbach Check My Work Partially correct A.OOn.The huldnzer uses fuel thst is epected to cot per hour of bullenmer aperrion. Present Value of an Anmuity of$1 at Compound Interest 1 0.943 0.9090893 0870 0.833 3 2.673 2.487 2402 2.283 2.106 3.455 3103037 2835 2,589 6 4917 3534111 3.784 3.326 6.210 5335 496 3.83 9 6.825,79 328.772 4.031 7.950 6145 555.019 4.192 Equal Anml et Cash Fluw 1500 Teal fud and labor osts per hour Revenue per hour Revenue per year Cash outflows: Hours of operation 110 65,000 1,500 Fuel cost per hour Labor cost per hour Total fuel and labor costs per hour 46 28 74 Fuel and labor costs per year 111,000 8,000 46,000 Maintenance costs Annual net cash flow Feedback a. Subtract the operating expenses (hourly fuel and labor costs, multiplied by the operating hours, plus the annual maintenance costs) from the revenues (operating hours multiplied by the hourly revenue). b. Determine the net present value of the investment, assuming that the desired rate of return is 10%. Use the table of present value of an annuity of $1 above. Round to the nearest dollar. Present value of annual net cash flows Less amount to be invested Net present value c. Should Briggs Excavation invest in the bulldozer, based on this analysis? Yes-, because the bulldozer cost is less than-the present value of the cash flows at the minimum desired rate of return of 10%. alue of annual net cash fows174.386 132,000V 42,386 d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested. (Round interim calculations and final answer to the nearest whole number.) hours Feedback Check My Work b. Multiply the annual net cash flow by the present value of an annuity factor and subtract the amount to be invested. c. Which is more favorable? d. Set up an equation to solve for hours. Feecbach Check My Work Partially correct A.OOn.The huldnzer uses fuel thst is epected to cot per hour of bullenmer aperrion. Present Value of an Anmuity of$1 at Compound Interest 1 0.943 0.9090893 0870 0.833 3 2.673 2.487 2402 2.283 2.106 3.455 3103037 2835 2,589 6 4917 3534111 3.784 3.326 6.210 5335 496 3.83 9 6.825,79 328.772 4.031 7.950 6145 555.019 4.192 Equal Anml et Cash Fluw 1500 Teal fud and labor osts per hour