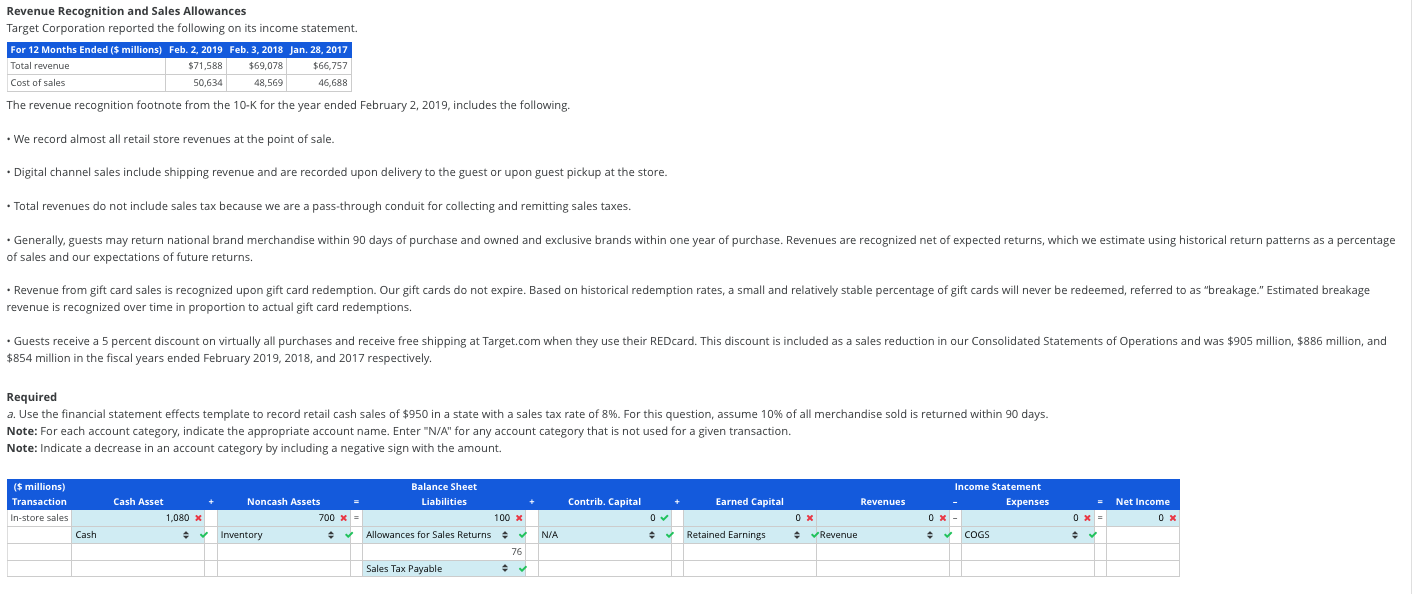

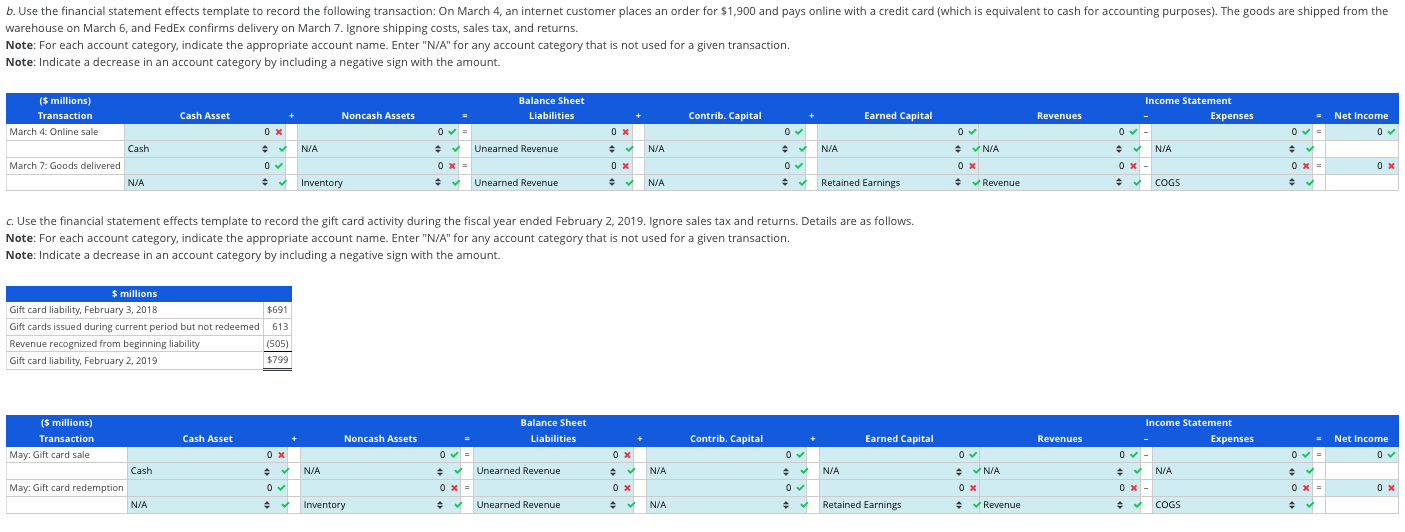

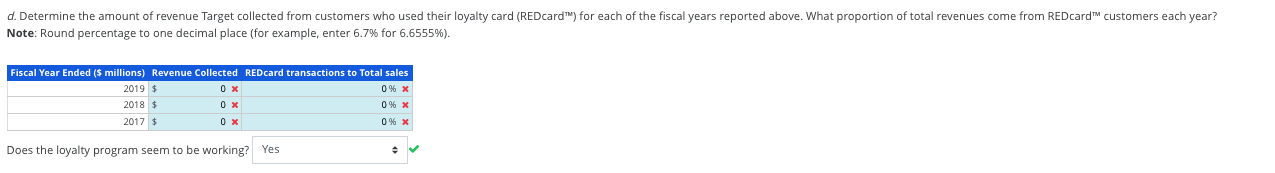

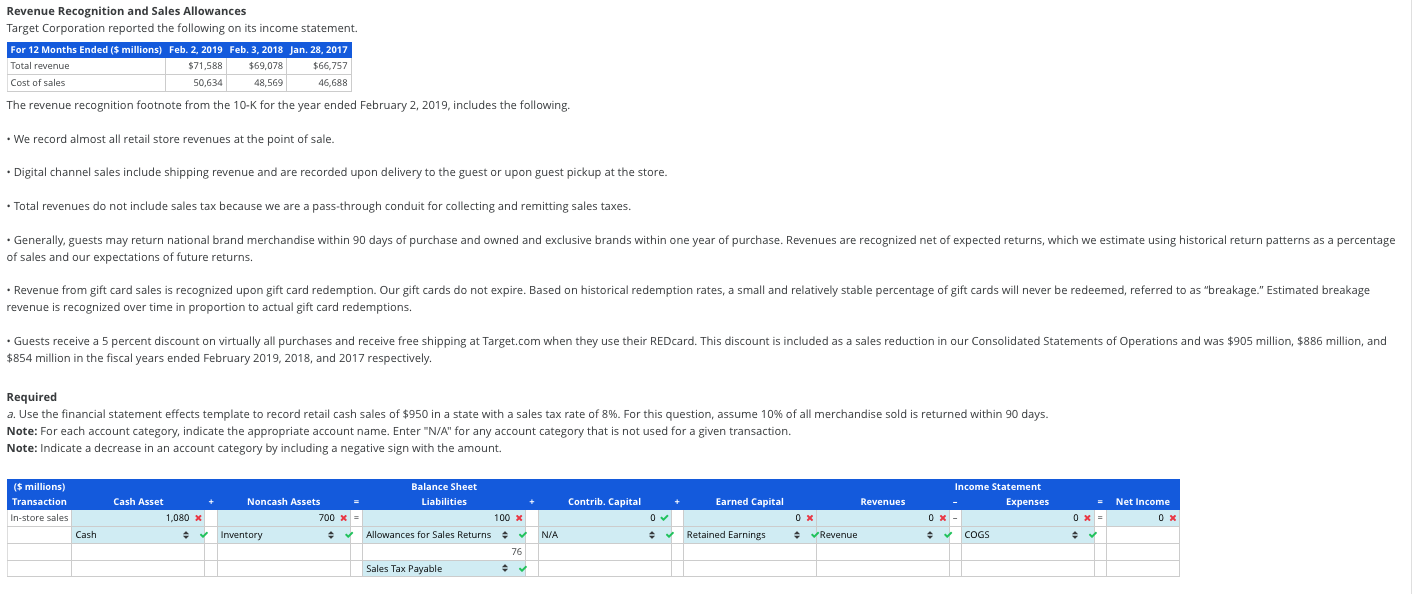

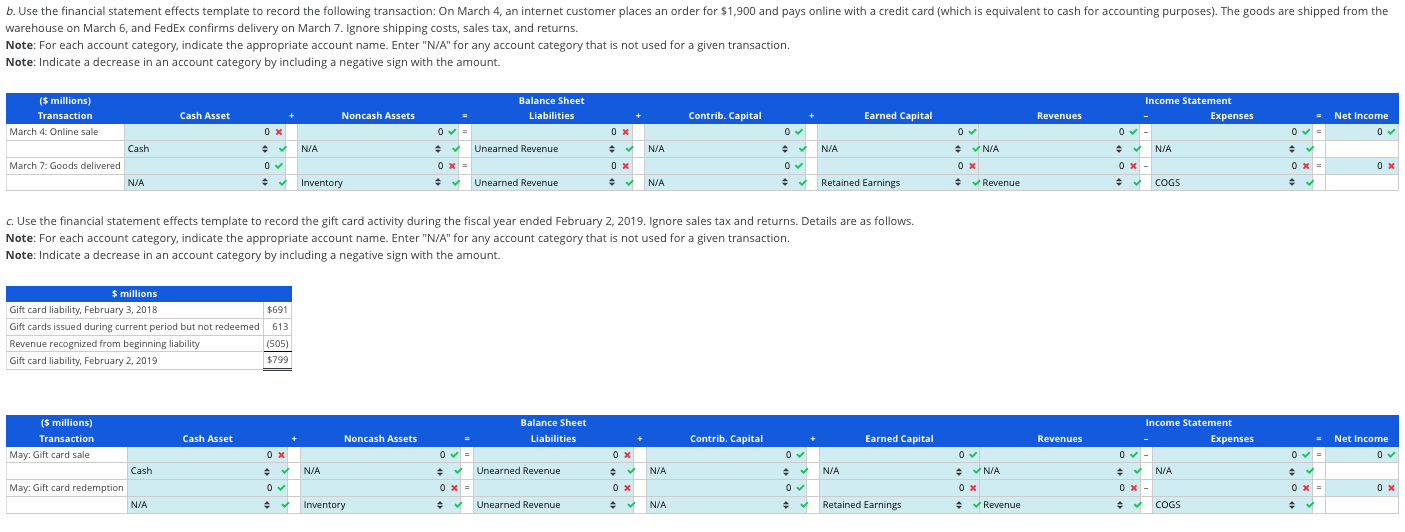

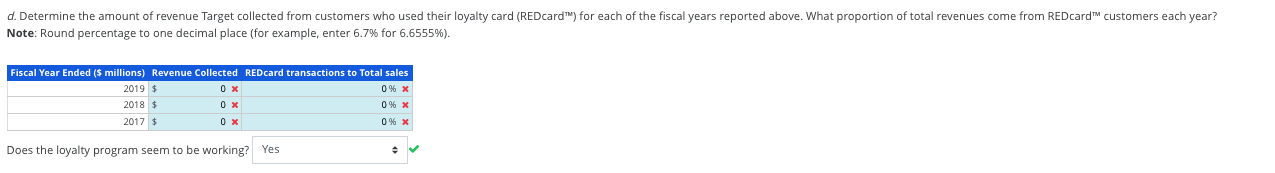

Revenue Recognition and Sales Allowances Target Corporation reported the following on its income statement. The revenue recognition footnote from the 10-K for the year ended February 2, 2019, includes the following. - We record almost all retail store revenues at the point of sale. - Digital channel sales include shipping revenue and are recorded upon delivery to the guest or upon guest pickup at the store. - Total revenues do not include sales tax because we are a pass-through conduit for collecting and remitting sales taxes. of sales and our expectations of future returns. revenue is recognized over time in proportion to actual gift card redemptions. $854 million in the fiscal years ended February 2019, 2018, and 2017 respectively. Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. larehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipping costs, sales tax, and returns. Jote: Indicate a decrease in an account category by including a negative sign with the amount. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2,2019 . Ignore sales tax and returns. Details are as follows. lote: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. lote: Indicate a decrease in an account category by including a negative sign with the amount. Note: Round percentage to one decimal place (for example, enter 6.7% for 6.6555% ). Does the loyalty program seem to be working? Revenue Recognition and Sales Allowances Target Corporation reported the following on its income statement. The revenue recognition footnote from the 10-K for the year ended February 2, 2019, includes the following. - We record almost all retail store revenues at the point of sale. - Digital channel sales include shipping revenue and are recorded upon delivery to the guest or upon guest pickup at the store. - Total revenues do not include sales tax because we are a pass-through conduit for collecting and remitting sales taxes. of sales and our expectations of future returns. revenue is recognized over time in proportion to actual gift card redemptions. $854 million in the fiscal years ended February 2019, 2018, and 2017 respectively. Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. larehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipping costs, sales tax, and returns. Jote: Indicate a decrease in an account category by including a negative sign with the amount. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2,2019 . Ignore sales tax and returns. Details are as follows. lote: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. lote: Indicate a decrease in an account category by including a negative sign with the amount. Note: Round percentage to one decimal place (for example, enter 6.7% for 6.6555% ). Does the loyalty program seem to be working