Question

Revenue Recognition Over a Period of Time : This time, well assume Bailey has determined that this project does satisfy the third criterion of the

Revenue Recognition Over a Period of Time:

Revenue Recognition Over a Period of Time:

This time, well assume Bailey has determined that this project does satisfy the third criterion of the three identified in ASU 2014-09 for recognizing revenue over a period of time:

The customer consumes the benefit of the sellers work as it is performed

The customer controls the asset as it is created

The seller is creating an asset that has no alternative use to the seller, and the seller has the legal right to receive payment for progress to date

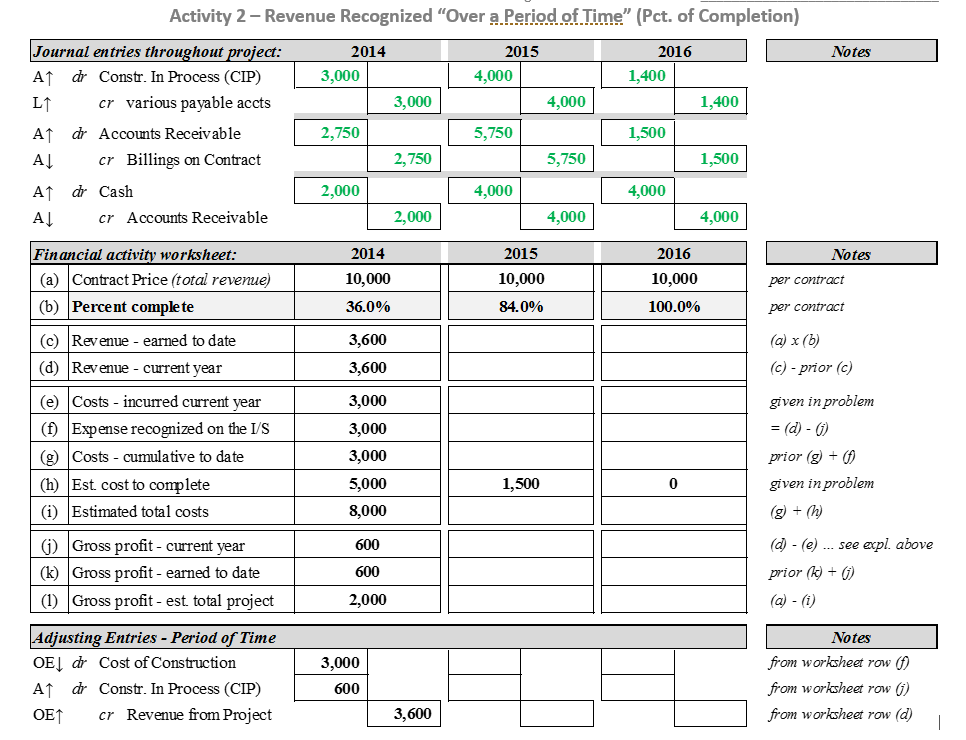

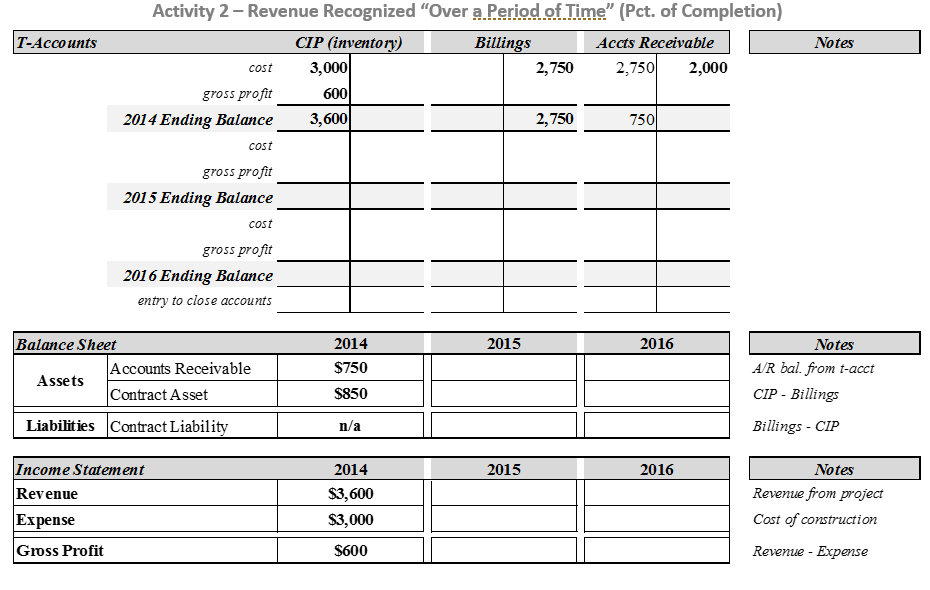

This means that revenue should be recognized over a period of time, based on the percentage of completion method. As long as reasonably reliable cost estimates are available for the project, we recognize a percentage of the revenue, expenses, and the resulting gross profit during each period as the project progresses, using the output-based progress measures identified in the contract. Note: construction costs, billing activities, and cash collection during the construction project are still tracked in balance sheet accounts (CIP, Billings, and A/R) described earlier.

Requirement:

Attached is a worksheet, with the first year of the project (2014) already completed using the Period-of-Time (percentage of completion) approach. Complete the 2nd and 3rd years for the project.

Note: the formulas along the right side of the worksheet will be helpful, but be sure to think carefully about what you are doing and why it makes sense because these formulas will not be provided on homework and examsin fact, you may not be provided with a worksheet at all.

Activity 2 - Revenue Recognized "Over a Period.of Time" (Pct. of Completion) Journal entries throughout project: 2014 2015 2016 Notes A ar Constr. In Process (CIP) 3,000 4,000 1,400 cr various payable accts 3,000 4,000 1,400 5,750 A d, Accounts Receivable A cr Billings on Contract A d. Cash A cr Accounts Receivable Fin ancial activity worksheet 2,750 2,750 5,750 2,000 4,000 4,000 2,000 4,000 4,000 2014 10,000 36.0% 3,600 3,600 3,000 3,000 3,000 5,000 8,000 600 600 2,000 2015 10,000 84.0% 2016 10,000 100.0% Notes (a) Contract Price (total revenue) (b) Percent comple te (c) Revenue earned to date per contract per contract Revenue - current vear c) -prior (c) (e) Costs - incurred current year given inproblem (0 Expense recognized on the I/s (g) Costs - cumulative to date (h) Est cost to complete (i) Estimated total costs (j) Gross profit - current year (k) Gross profit - earned to date (1) Gross profit - est total project djusting Entries - Period of Time or 1,500 0 given inproblem (a) - (e) see expl above prior (k) + (j) Notes Cost of Construction Constr. In Process (CIP) cr Revenue from Project 3,000 600 from worksheet row ( from worksheet row G from worksheet row (a OEL dr A OET ar 3,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started