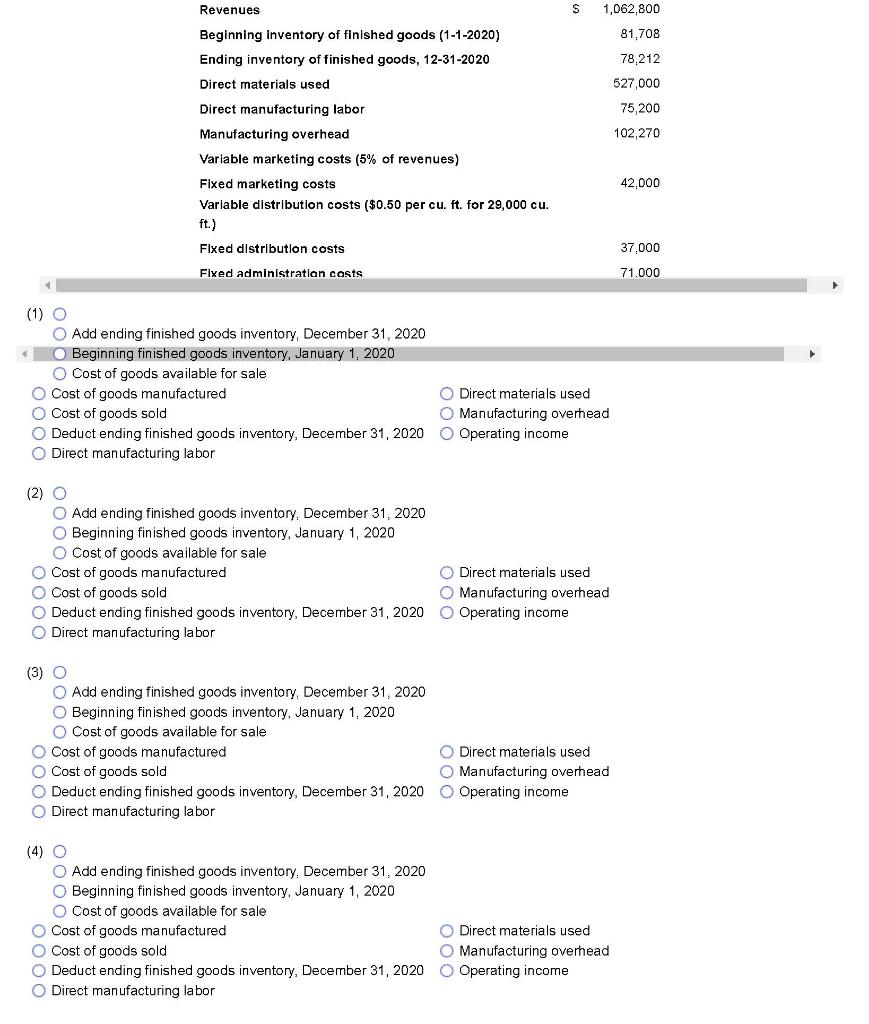

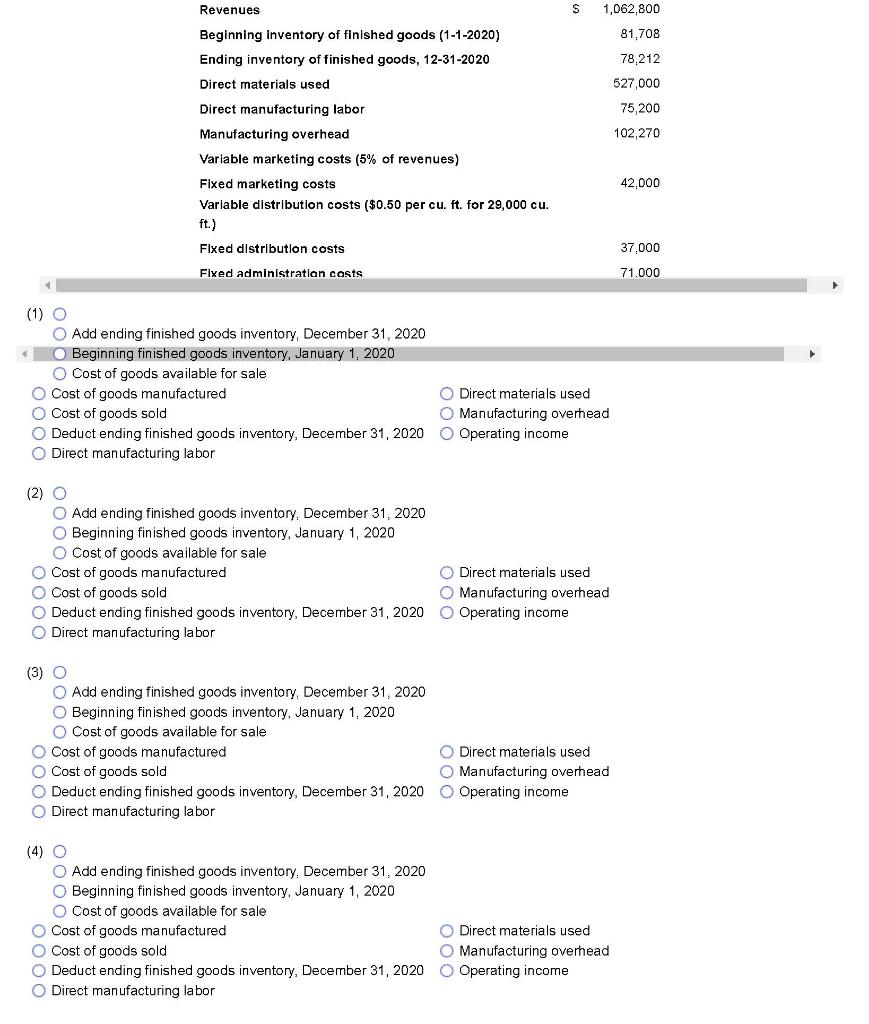

Revenues: 1,062,800

Fixed administration costs: 71,000

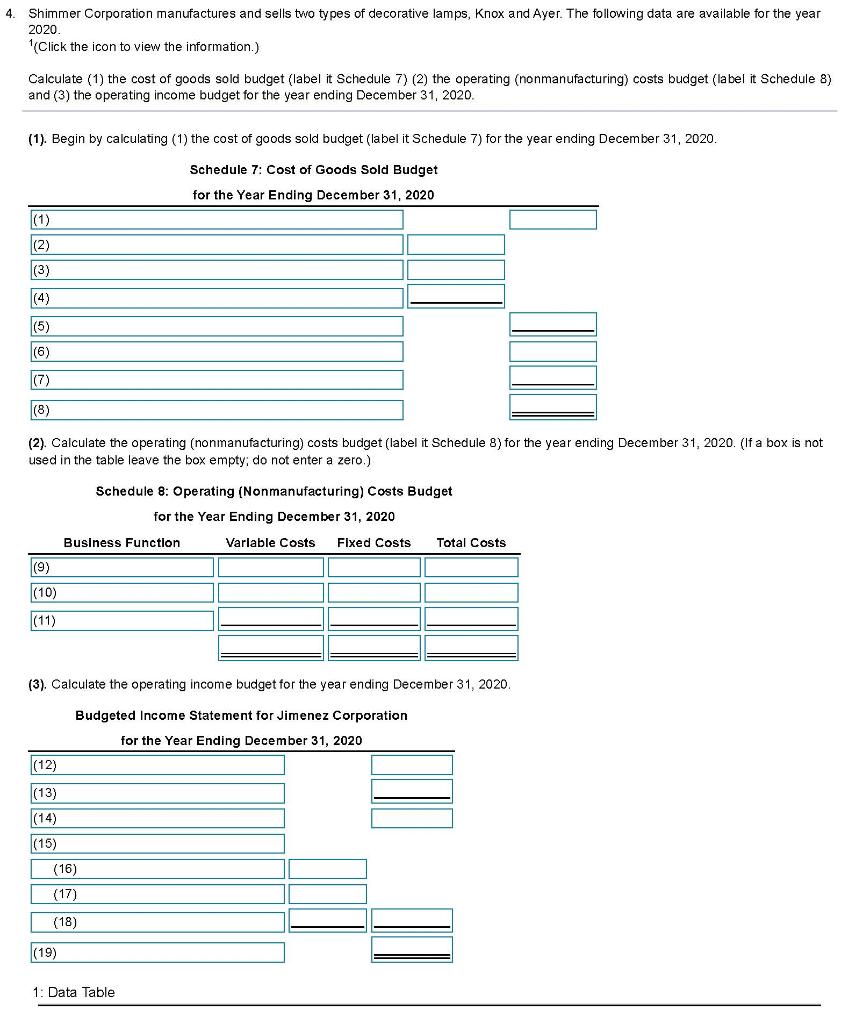

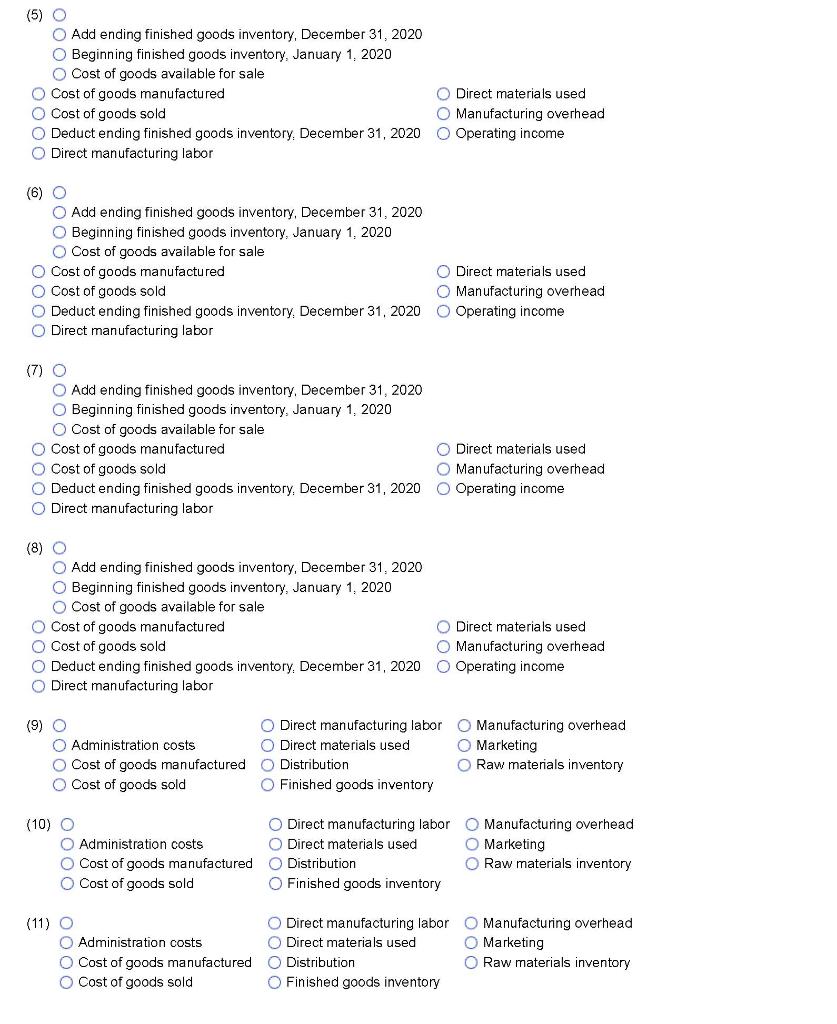

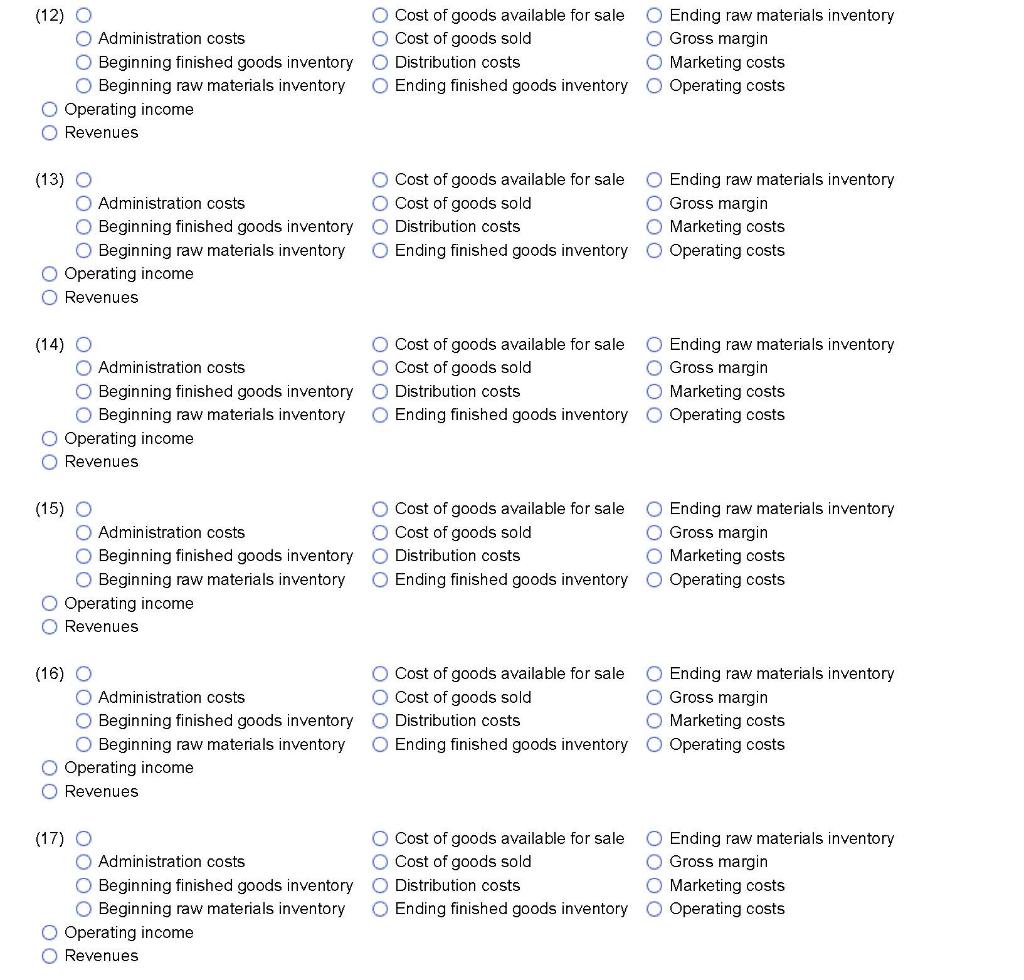

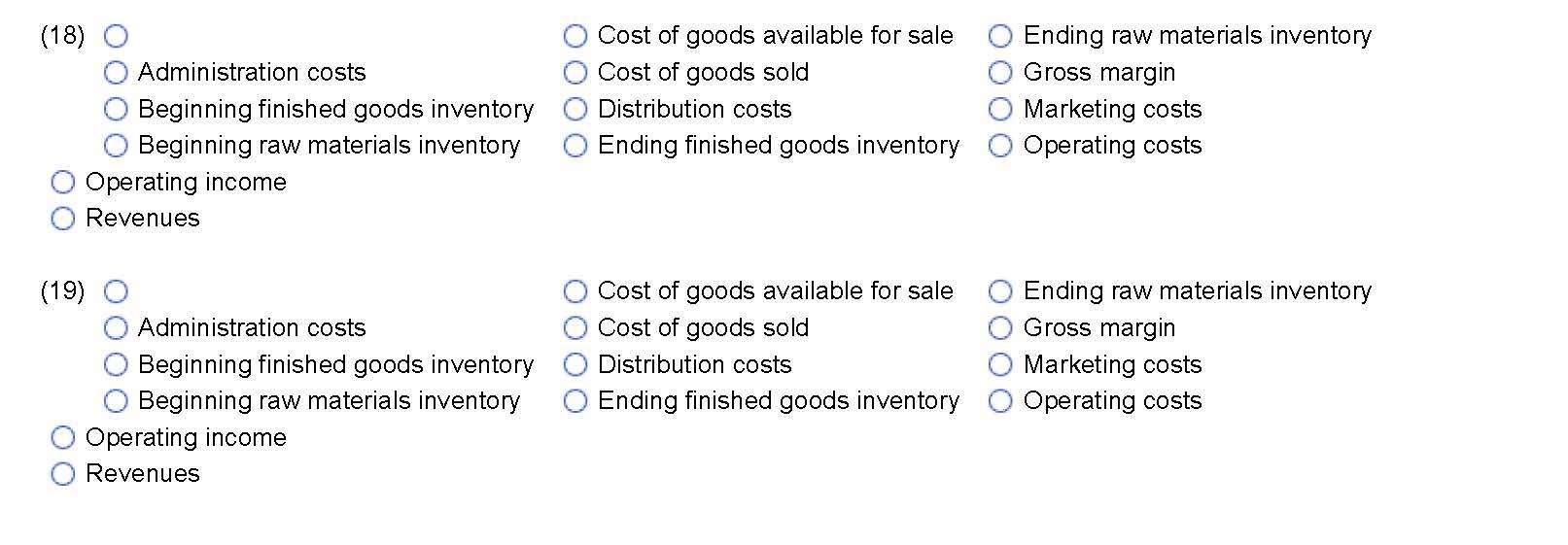

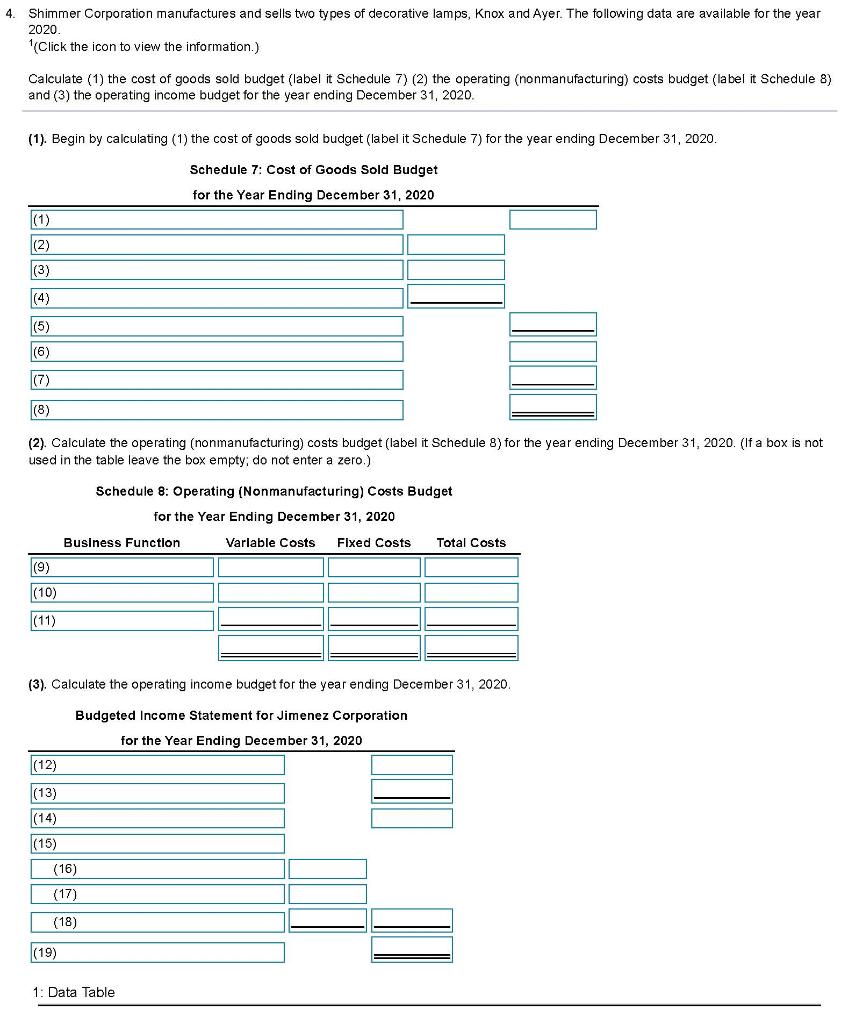

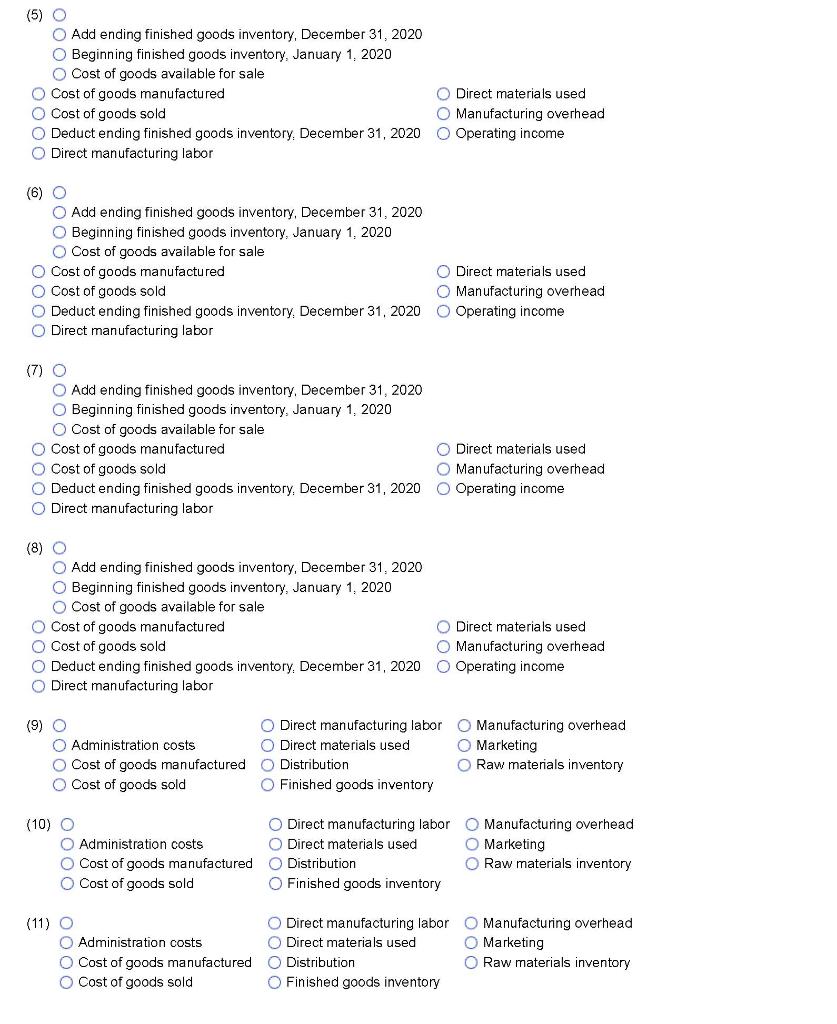

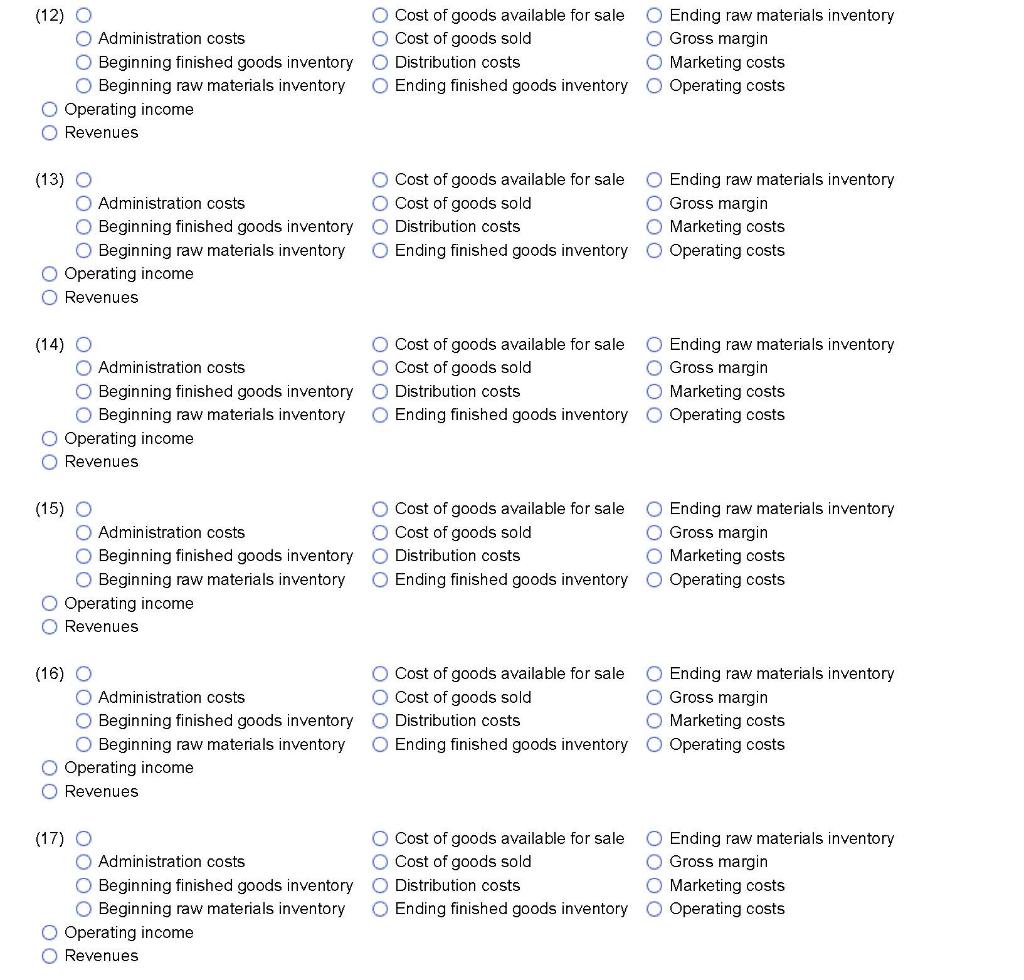

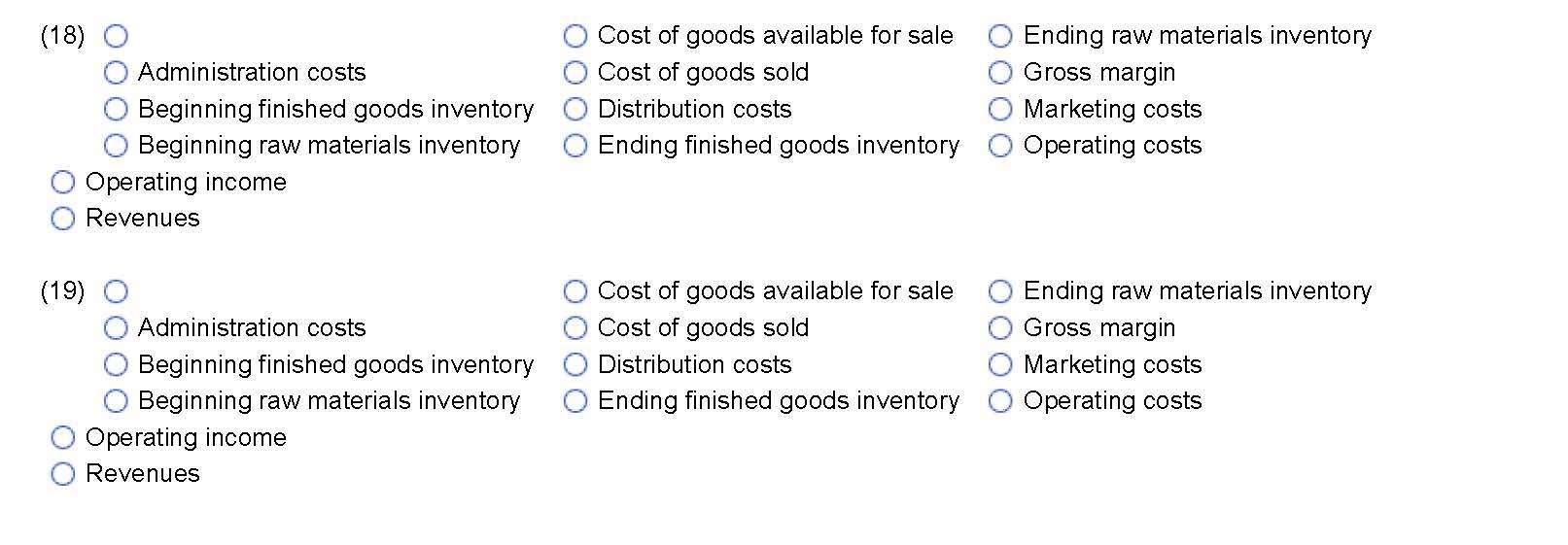

4. Shimmer Corporation manufactures and sells two types of decorative lamps, Knox and Ayer. The following data are available for the year 2020. 1 (Click the icon to view the information.) Calculate (1) the cost of goods sold budget (label it Schedule 7) (2) the operating (nonmanufacturing) costs budget (label it Schedule 8) and (3) the operating income budget for the year ending December 31,2020. (1). Begin by calculating (1) the cost of goods sold budget (label it Schedule 7) for the year ending December 31, 2020. (2). Calculate the operating (nonmanufacturing) costs budget (label it Schedule 8) for the year ending December 31,2020 . (If a box is not used in the table leave the box empty; do not enter a zero.) Schedule 8: Operating (Nonmanufacturing) Costs Budget for the Year Ending December 31, 2020 (3). Calculate the operating income budget for the year ending December 31,2020. (2) Add ending finished goods inventory, December 31, 2020 Beginning finished goods inventory, January 1,2020 Cost of goods available for sale Cost of goods manufactured Direct materials used Cost of goods sold Manufacturing overhead Deduct ending finished goods inventory, December 31, 2020 Operating income Direct manufacturing labor (3) Add ending finished goods inventory. December 31, 2020 Beginning finished goods inventory, January 1, 2020 Cost of goods available for sale Cost of goods manufactured Direct materials used Cost of goods sold Manufacturing overhead Deduct ending finished goods inventory, December 31,2020 Operating income Direct manufacturing labor (4) Add ending finished goods inventory, December 31, 2020 Beginning finished goods inventory, January 1, 2020 Cost of goods available for sale Cost of goods manufactured Direct materials used Cost of goods sold Manufacturing overhead Deduct ending finished goods inventory, December 31, 2020 Operating income Direct manufacturing labor (5) Add ending finished goods inventory, December 31,2020 Beginning finished goods inventory, January 1, 2020 Cost of goods available for sale Cost of goods manufactured Direct materials used Cost of goods sold Manufacturing overhead Deduct ending finished goods inventory. December 31, 2020 Operating income Direct manufacturing labor (6) Add ending finished goods inventory, December 31, 2020 Beginning finished goods inventory, January 1, 2020 Cost of goods available for sale Cost of goods manufactured Direct materials used Cost of goods sold Manufacturing overhead Deduct ending finished goods inventory. December 31, 2020 Operating income Direct manufacturing labor (7) Add ending finished goods inventory. December 31, 2020 Beginning finished goods inventory, January 1, 2020 Cost of goods available for sale Cost of goods manufactured Direct materials used Cost of goods sold Manufacturing overhead Deduct ending finished goods inventory. December 31, 2020 Operating income Direct manufacturing labor (8) Add ending finished goods inventory, December 31, 2020 Beginning finished goods inventory, January 1,2020 Cost of goods available for sale Cost of goods manufactured Direct materials used Cost of goods sold Manufacturing overhead Deduct ending finished goods inventory. December 31, 2020 Operating income Direct manufacturing labor (9) (12) AdministrationcostsBeginningfinishedgoodsinventoryBeginningrawmaterialsinventoryCostofgoodsavailableforsaleCostofgoodssoldDistributioncostsEndingfinishedgoodsinventoryEndingrawmaterialsinventoryGrossmarginMarketingcostsOperatingcosts Operating income Revenues (13) AdministrationcostsBeginningfinishedgoodsinventoryBeginningrawmaterialsinventoryPeratingincomeevenuesCostofgoodsavailableforsaleCostofgoodssoldDistributioncostsEndingfinishedgoodsinventoryEndingrawmaterialsinventoryGrossmarginMarketingcostsOperatingcosts (14) AdministrationcostsBeginningfinishedgoodsinventoryBeginningrawmaterialsinventoryCostofgoodsavailableforsaleCostofgoodssoldDistributioncostsEndingfinishedgoodsinventoryEndingrawmaterialsinventoryGrossmarginMarketingcostsOperatingcosts Operating income Revenues (15) AdministrationcostsBeginningfinishedgoodsinventoryBeginningrawmaterialsinventoryeratingincomevenuesCostofgoodsavailableforsaleCostofgoodssoldDistributioncostsEndingfinishedgoodsinventoryEndingrawmaterialsinventoryGrossmarginMarketingcostsOperatingcosts (16) AdministrationcostsBeginningfinishedgoodsinventoryBeginningrawmaterialsinventoryCostofgoodsavailableforsaleCostofgoodssoldDistributioncostsEndingfinishedgoodsinventoryEndingrawmaterialsinventoryGrossmarginMarketingcostsOperatingcosts Operating income Revenues (17) AdministrationcostsBeginningfinishedgoodsinventoryBeginningrawmaterialsinventoryperatingincomeCostofgoodsavailableforsaleCostofgoodssoldDistributioncostsEndingfinishedgoodsinventoryEndingrawmaterialsinventoryGrossmarginMarketingcostsOperatingcosts (18) Cost of goods available for sale Ending raw materials inventory AdministrationcostsBeginningfinishedgoodsinventoryBeginningrawmaterialsinventoryCostofgoodssoldDistributioncostsEndingfinishedgoodsinventoryGrossmarginMarketingcostsOperatingcosts Operating income Revenues (19) AdministrationcostsBeginningfinishedgoodsinventoryBeginningrawmaterialsinventoryCostofgoodsavailableforsaleCostofgoodssoldDistributioncostsEndingfinishedgoodsinventoryEndingrawmaterialsinventoryGrossmarginMarketingcostsOperatingcosts Operating income Revenues