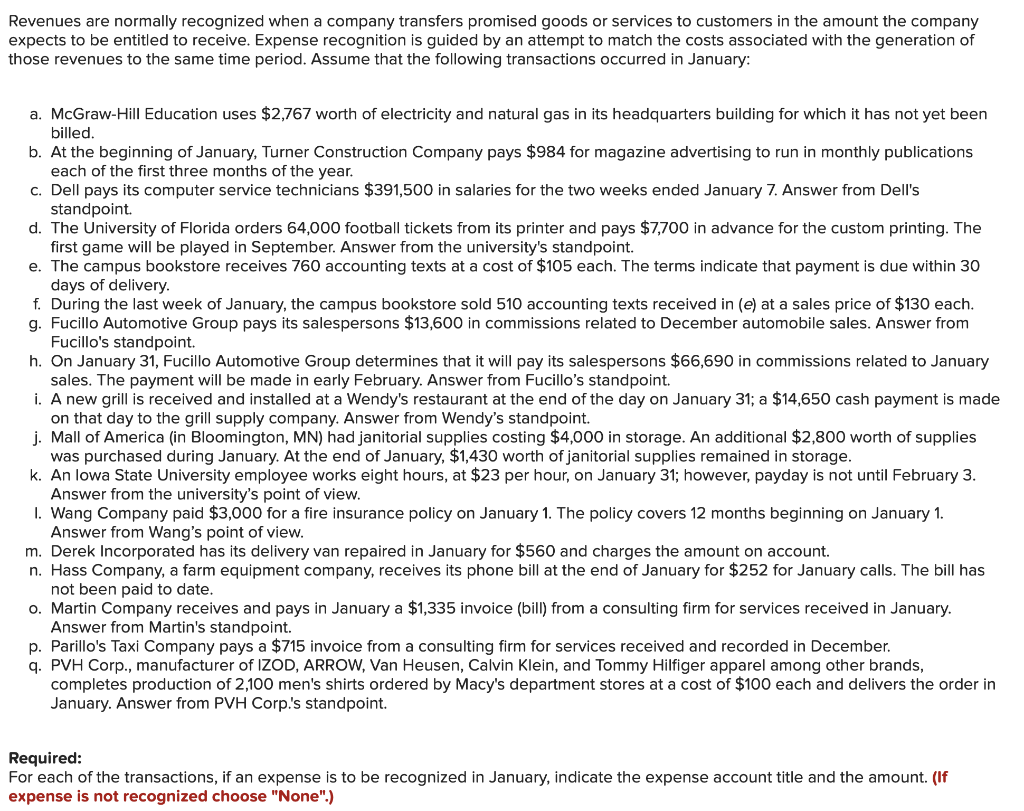

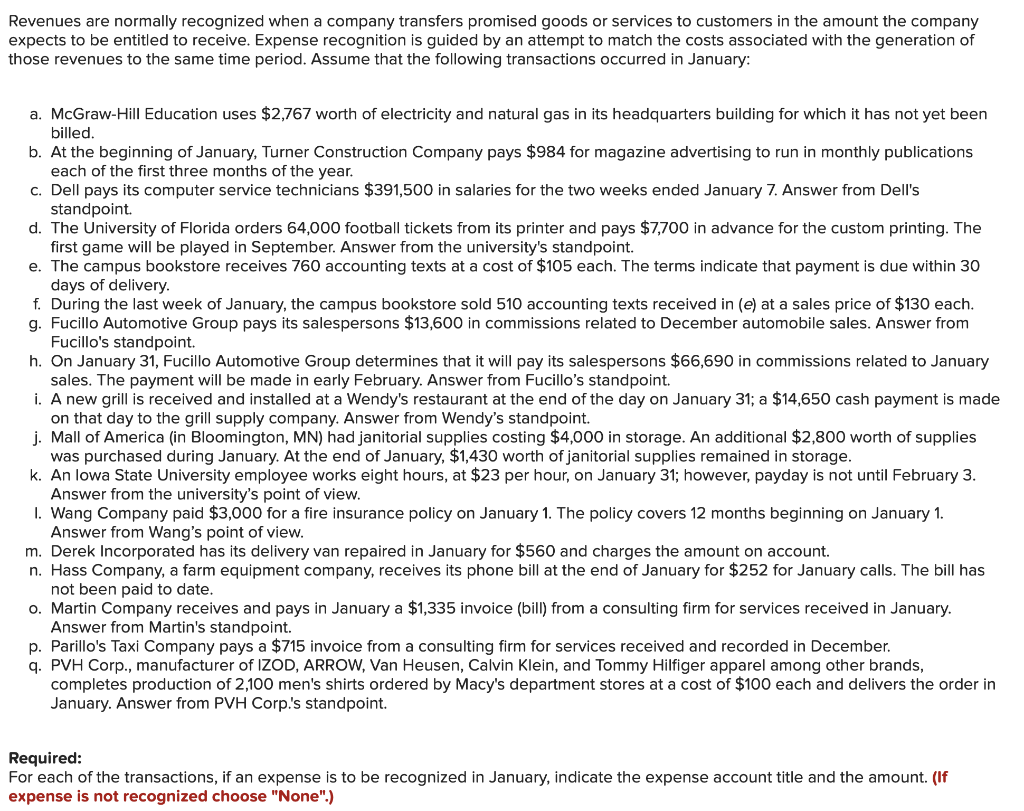

Revenues are normally recognized when a company transfers promised goods or services to customers in the amount the company expects to be entitled to receive. Expense recognition is guided by an attempt to match the costs associated with the generation of those revenues to the same time period. Assume that the following transactions occurred in January: a. McGraw-Hill Education uses $2,767 worth of electricity and natural gas in its headquarters building for which it has not yet been billed. b. At the beginning of January, Turner Construction Company pays $984 for magazine advertising to run in monthly publications each of the first three months of the year. c. Dell pays its computer service technicians $391,500 in salaries for the two weeks ended January 7. Answer from Dell's standpoint d. The University of Florida orders 64,000 football tickets from its printer and pays $7,700 in advance for the custom printing. The first game will be played in September. Answer from the university's standpoint. e. The campus bookstore receives 760 accounting texts at a cost of $105 each. The terms indicate that payment is due within 30 days of delivery. f. During the last week of January, the campus bookstore sold 510 accounting texts received in (e) at a sales price of $130 each. g. Fucillo Automotive Group pays its salespersons $13,600 in commissions related to December automobile sales. Answer from Fucillo's standpoint. h. On January 31, Fucillo Automotive Group determines that it will pay its salespersons $66,690 in commissions related to January sales. The payment will be made in early February. Answer from Fucillo's standpoint. i. A new grill is received and installed at a Wendy's restaurant at the end of the day on January 31; a $14,650 cash payment is made on that day to the grill supply company. Answer from Wendy's standpoint. j. Mall of America (in Bloomington, MN) had janitorial supplies costing $4,000 in storage. An additional $2,800 worth of supplies was purchased during January. At the end of January, $1,430 worth of janitorial supplies remained in storage. k. An lowa State University employee works eight hours, at $23 per hour, on January 31; however, payday is not until February 3. Answer from the university's point of view. 1. Wang Company paid $3,000 for a fire insurance policy on January 1. The policy covers 12 months beginning on January 1. Answer from Wang's point of view. m. Derek Incorporated has its delivery van repaired in January for $560 and charges the amount on account. n. Hass Company, a farm equipment company, receives its phone bill at the end of January for $252 for January calls. The bill has not been paid to date. o. Martin Company receives and pays in January a $1,335 invoice (bill) from a consulting firm for services received in January. Answer from Martin's standpoint. p. Parillo's Taxi Company pays a $715 invoice from a consulting firm for services received and recorded in December. q. PVH Corp., manufacturer of IZOD, ARROW, Van Heusen, Calvin Klein, and Tommy Hilfiger apparel among other brands, completes production of 2,100 men's shirts ordered by Macy's department stores at a cost of $100 each and delivers the order in January. Answer from PVH Corp.'s standpoint. Required: For each of the transactions, if an expense is to be recognized in January, indicate the expense account title and the amount. (If expense is not recognized choose "None".)