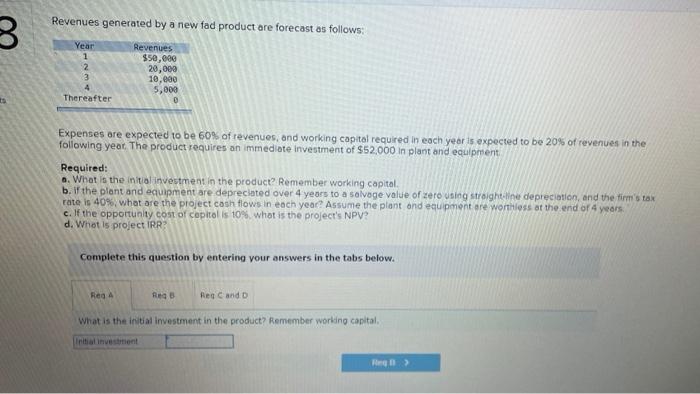

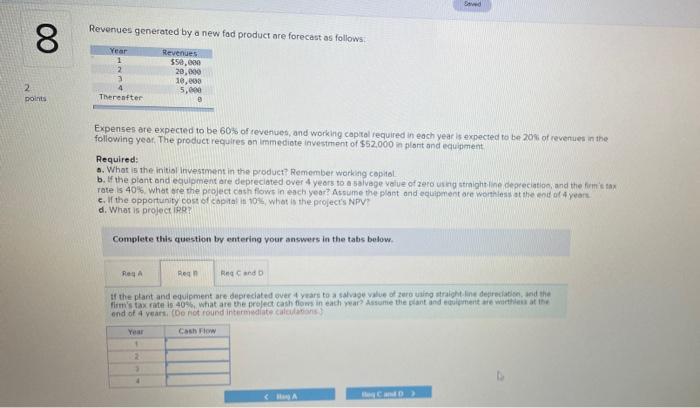

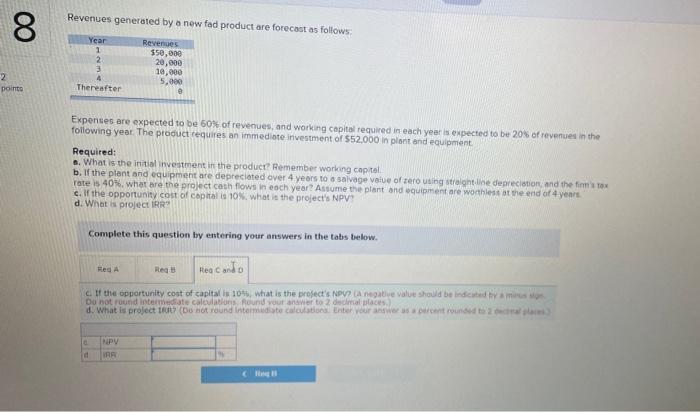

Revenues generated by a new fad product are forecast as follows: Year 1 2 3 Revenues $50,000 20,000 10,000 5,000 0 Thereafter Expenses are expected to be 60% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $52,000 in plant and equipment Required: a. What is the initial investment in the product? Remember working capital b. fthe plant and equipment are depreciated over 4 years to a salvege value of zero using straight line depreciation, and the firm's tox rate is 40% what are the project cash flows in each year? Assume the plant and equipment are worthless at the end or 4 years c. If the opportunity cost of capital is 10% what is the project's NPV? d. What is project IRR? Complete this question by entering your answers in the tabs below. Reg Re Reg Cand D What is the initial investment in the product? Remember working capital. Swed Revenues generated by a new fad product are forecast as follows. 8 Year 1 2 Revenues 550.000 20,000 10,000 5,600 B 3 2 points Thereafter Expenses are expected to be 60% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate Investment of $52.000 in plant and equipment Required: 6. What is the initial investment in the product? Remember working capital b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight line depreciation and the forma Totes 40% what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of years c. If the opportunity cost of capital 10%, what is the project's NPV d. What is project IRRY Complete this question by entering vour answers in the tabs below RA Red Recando If the plant and equipment are depreciated over 4 years to a salvage value of sure using straight line degradation, and the firm's tax rate is 40% what are the project cash flows in each year Assume the plant and ment are worth end of 4 var. (Do not found intermediate calea Year Cash Flow Revenues generated by a new fod product are forecast as follows: 8 Year 1 2 3 Revenues $50,000 20,000 10,000 5.000 4 2 points Thereafter Expenses are expected to be 60% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $52,000 in plant and equipment Required: 2. What is the initial investment in the product? Remember working capital b. If the plant and equipment are depreciated over 4 years to a salvage value of tero using straight line depreciation and the firm's tox rate is 40%. what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years c. the opportunity cost of capital is 10%, what is the project's NPV d. What is project IRR? Complete this question by entering your answers in the tabs below. Red A Reg Rea cando c. If the opportunity cost of capital is 104, what is the project's NPV? A negative value should be indicated by menos Do not round intermediate calculation Round your answer to 2 decimal places d. What is project TRULY (Do not round Intermediate calculations Enter your answers are rounded to MPV VAR