Answered step by step

Verified Expert Solution

Question

1 Approved Answer

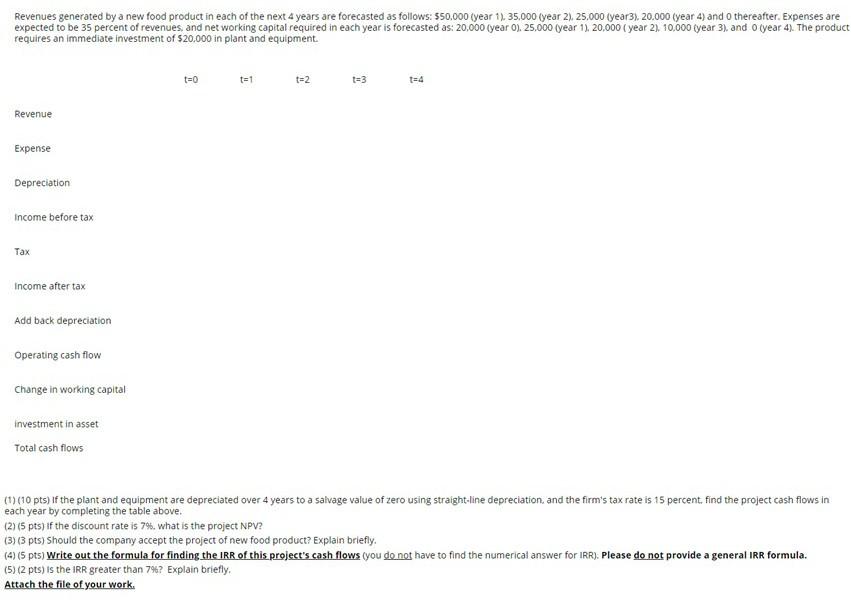

Revenues generated by a new food product in each of the next 4 years are forecasted as follows: 550.000 (year 1), 35,000 (year 2) 25.000

Revenues generated by a new food product in each of the next 4 years are forecasted as follows: 550.000 (year 1), 35,000 (year 2) 25.000 (year3), 20.000 (year 4) and thereafter. Expenses are expected to be 35 percent of revenues, and net working capital required in each year is forecasted as: 20,000 (year O). 25,000 (year 1), 20,000 (year 2) 10.000 (year 3), and (year 4). The product requires an immediate investment of $20.000 in plant and equipment t=0 t=1 t=2 t=3 t=4 Revenue Expense Depreciation Income before tax Tax Income after tax Add back depreciation Operating cash flow Change in working capital investment in asset Total cash flows (1)(10 pts) If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm's tax rate is 15 percent, find the project cash flows in each year by completing the table above. (2)(5 pts) if the discount rate is 79. what is the project NPV? (3) (3 pts) should the company accept the project of new food product? Explain briefly. (4) (5 pts) Write out the formula for finding the IRR of this project's cash flows you do not have to find the numerical answer for IRR). Please do not provide a general IRR formula. (5) (2 pts) is the IRR greater than 7%? Explain briefly, Attach the file of your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started