Mr. and Ms. Sumara have the following income items: Mr. Sumara's Schedule C net profit Ms. Sumara's Schedule C net loss Ms. Sumara's taxable

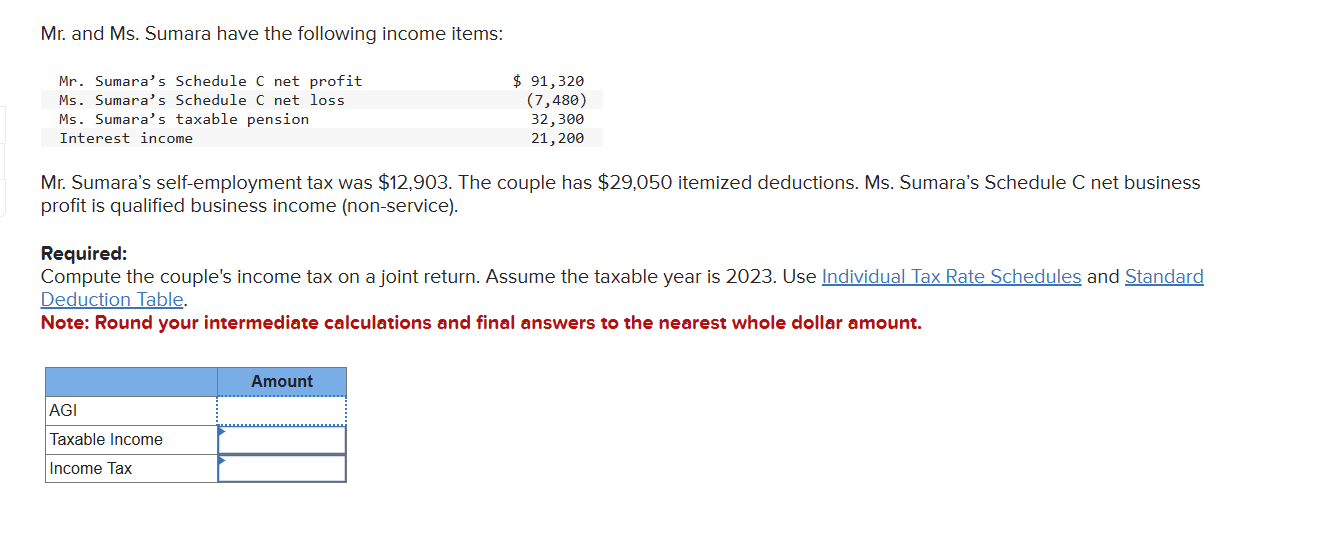

Mr. and Ms. Sumara have the following income items: Mr. Sumara's Schedule C net profit Ms. Sumara's Schedule C net loss Ms. Sumara's taxable pension Interest income $ 91,320 (7,480) 32,300 21,200 Mr. Sumara's self-employment tax was $12,903. The couple has $29,050 itemized deductions. Ms. Sumara's Schedule C net business profit is qualified business income (non-service). Required: Compute the couple's income tax on a joint return. Assume the taxable year is 2023. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. AGI Taxable Income Income Tax Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute Mr and Ms Sumaras income tax on a joint return for 2023 we will follow these steps 1 Calc...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started